Last updated: July 27, 2025

Introduction

Glimepiride, a third-generation sulfonylurea, is a widely prescribed oral medication for type 2 diabetes mellitus. Its mechanism involves stimulating pancreatic beta-cell insulin secretion, thereby improving glycemic control. Market dynamics for glimepiride are shaped by increasing diabetes prevalence, patent statuses, healthcare regulations, and competition from newer drugs. Accurate market analysis and price forecasting are critical for stakeholders ranging from pharmaceutical companies to healthcare providers.

Global Market Landscape

The global market for glimepiride is driven by the rising incidence of type 2 diabetes. According to the International Diabetes Federation (IDF), approximately 463 million adults had diabetes worldwide in 2019, with projections reaching 700 million by 2045 [1]. This epidemiological trend underscores substantial demand for affordable, effective antidiabetic medications like glimepiride.

Market Share and Competitive Position

Glimepiride remains an essential component of oral antidiabetic therapy, especially in emerging markets owing to its cost-effectiveness compared to newer agents like SGLT2 inhibitors and GLP-1 receptor agonists. Despite the advent of newer drugs with additional benefits, glimepiride retains a prominent position, particularly in regions with cost-sensitive healthcare systems.

In developed markets, patent expiration has led to increased generic availability, further solidifying its market presence. Notably, in North America and Europe, generic versions dominate prescribing patterns, whereas branded formulations are more prevalent in Asia and Africa.

Market Drivers

- Epidemiological Increase: Rising diabetes prevalence augments demand.

- Cost-Effectiveness: Especially significant in low- and middle-income countries.

- Regulatory Approvals: Broad approval across regulatory agencies facilitates market penetration.

- Combination Therapies: Integration with other oral agents expands prescribing options.

- Healthcare Policies: Government initiatives for diabetes management bolster demand for affordable medications.

Market Challenges

- Competition from Newer Agents: SGLT2 inhibitors and GLP-1 receptor agonists offer added benefits, including weight loss and cardiovascular risk reduction.

- Safety Concerns: Risk of hypoglycemia and cardiovascular events may limit use in some patient groups.

- Patent Expiry and Generic Entry: Rapid generic proliferation can erode margins for branded formulations.

Regional Market Analysis

North America

The U.S. is a mature market with high adoption of both branded and generic glimepiride. Patent laws and healthcare insurance impact pricing. Despite newer therapies, glimepiride remains economically favorable, leading to continued demand, especially as combination therapies.

Europe

Patents have expired, with generics dominating. The focus is on cost containment, leading to stable or declining prices for branded versions. Use of glimepiride persists primarily in legacy treatment regimens.

Asia-Pacific

This region exhibits the fastest growth, fueled by increasing diabetes prevalence and price sensitivity. Local manufacturers produce generics, maintaining low prices and expanding accessibility.

Latin America and Africa

Cost remains primary factor. Generic availability and government procurement policies underpin sustained demand.

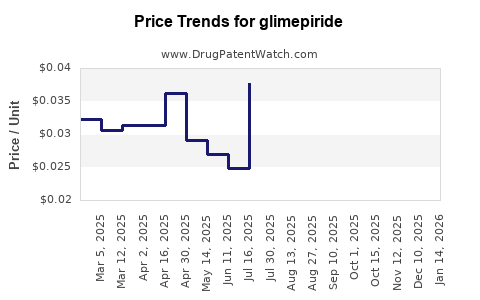

Price Trends and Forecasts

Historical Price Dynamics

In developed markets, branded glimepiride traditionally sold at premium prices, but patent expiration has shifted volumes toward generics priced substantially lower—often 50-80% less than branded counterparts. For example, in the U.S., branded glimepiride's average retail price has declined from approximately $2.50 per tablet in 2017 to under $1.00 in 2023 [2].

Projected Price Trajectory (Next 5–10 Years)

Based on current patent expiries, patent challenges, and generic market expansion, the following trends are expected:

- Generic Price Stability or Decrease: As more suppliers enter, prices can decrease further, potentially stabilizing around $0.20–$0.50 per tablet in high-volume markets.

- Brand Premium Decline: Branded formulations may see limited price increases, maintaining a premium of 2–3 times over generics.

- Emerging Market Dynamics: Prices in these regions will likely remain low due to local manufacturing and regulatory pressures, with minor fluctuations driven by inflation and import tariffs.

Influencing Factors

- Regulatory Approvals: Faster approval of generics accelerates price competitiveness.

- Manufacturing Costs: Advances in production technology may decrease costs further.

- Market Entry of Biosimilars: Though biosimilars are not directly related to small molecules like glimepiride, regional biosimilar developments can influence monoclonal antibody-related diabetes treatments, indirectly affecting the market landscape.

- Healthcare Policies: Interventions aimed at reducing drug prices (such as price caps) in certain regions could further depress prices.

Key Market Segments and Opportunities

- Generic Manufacturers: Expansion in low-income countries due to high diabetes burden.

- Combination Therapy Formulations: Fixed-dose combinations with metformin or other antidiabetics provide growth avenues.

- Private and Public Sector Procurement: Contractual purchasing influences bulk pricing and volume.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Focus on cost-efficient manufacturing, especially in Asia, to maintain margins amidst price erosion.

- Healthcare Providers: Prefer cost-effective therapies like glimepiride in resource-constrained settings.

- Policy Makers: To ensure affordability, promoting generics and regulating prices can enhance access.

- Investors: Continuous demand in emerging markets and generic supply chain expansion present stable revenue streams.

Conclusion

Glimepiride's market outlook remains resilient, bolstered by increasing global diabetes prevalence and its cost advantages. Price projections indicate a continued decline in generic prices, with potential stabilization due to supply-demand dynamics. Despite competitive pressures from newer agents, the economic benefits of glimepiride ensure its relevance, predominantly in low- and middle-income countries.

Key Takeaways

- The global demand for glimepiride will remain strong due to the rising burden of type 2 diabetes, especially in emerging markets.

- Price erosion, driven by patent expiries and increased generic competition, will likely continue over the next decade.

- The drug’s affordability sustains its use in resource-limited settings, while newer agents capture segments in wealthier markets.

- Strategic investments in manufacturing efficiency and fixed-dose combinations could optimize profitability amid price pressures.

- Policymakers and industry players should collaborate to balance affordability with innovation, ensuring broad access and sustainable market growth.

FAQs

-

What factors influence glimepiride’s pricing trends globally?

Pricing is mainly driven by patent expirations, generic market entry, manufacturing costs, healthcare policies, and regional economic conditions.

-

How does the competition from newer diabetes drugs affect glimepiride’s market share?

While newer agents such as SGLT2 inhibitors and GLP-1 receptor agonists offer additional benefits, cost considerations sustain glimepiride’s role, especially in markets with limited healthcare budgets.

-

Will patent expiring in major markets reduce the price of glimepiride further?

Yes, patent expirations typically lead to increased generic availability and lower prices; further reductions are expected as more competitors enter the market.

-

Are fixed-dose combination therapies impacting glimepiride’s market?

Absolutely. Fixed-dose combinations with agents like metformin are expanding usage, especially in early diabetes management protocols, and can influence pricing and formulary decisions.

-

What role do healthcare policies play in shaping the future of glimepiride pricing?

Policies promoting generic use, price caps, and procurement practices significantly influence retail prices and accessibility across different regions.

Sources

[1] IDF Diabetes Atlas, 9th Edition. International Diabetes Federation, 2019.

[2] GoodRx Research, 2023. Price Trends for Glimepiride in the United States.