Last updated: July 27, 2025

Introduction

GABAPENTIN, marketed under the brand name Neurontin among others, is an anticonvulsant medication primarily used for epilepsy, neuropathic pain, and off-label indications such as anxiety and migraine prevention. Since its initial approval in the 1990s, gabapentin has experienced significant market growth driven by expanding indications, off-label usage, and generic competition. This analysis evaluates current market dynamics, assesses key factors influencing pricing trends, and provides future price projections.

Current Market Landscape

1. Market Size and Growth Trends

The global gabapentin market was valued at approximately USD 2.2 billion in 2022, with a Compound Annual Growth Rate (CAGR) estimated at around 4-6% over the past five years. The increase stems from rising prevalence of neuropathic pain, epilepsy, and an expanding patient base for off-label uses.

2. Therapeutic Indications

- Epilepsy: Gabapentin was originally approved for partial seizures; however, its off-label application extends to other seizure disorders.

- Neuropathic Pain: A leading indication, especially diabetic peripheral neuropathy and post-herpetic neuralgia.

- Off-label uses: Anxiety disorders, migraine prophylaxis, and Restless Leg Syndrome (RLS). These off-label uses have significantly increased prescription volumes without corresponding patent protections.

3. Competitive Landscape

Patent exclusivity ended in many regions around 2014-2017, leading to a surge in generic entries. Major pharmaceutical companies like Pfizer, Teva, and Mylan produce generic gabapentin, dramatically reducing prices. Market dominance is now primarily held by generics, with branded formulations capturing only premium segments or specific off-label indications.

4. Regulatory and Patent Considerations

While the original patent expired, recent patent litigations and additional formulations or delivery mechanisms (e.g., extended-release versions) might provide patent extensions or exclusivity in some jurisdictions. However, for most markets, generic competition dominates.

Pricing Dynamics

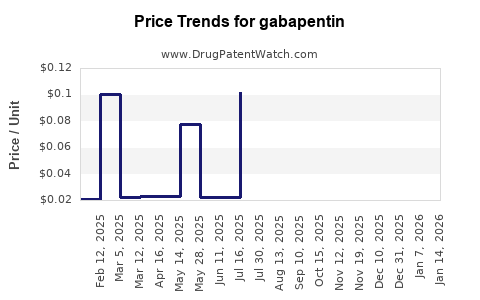

1. Historical Pricing Trends

Pre-generic era, branded gabapentin (Neurontin) commanded prices upwards of USD 8-10 per capsule. Post-genericization, prices plummeted—now, a month's supply of generic gabapentin (300 mg, thrice daily) can cost as little as USD 10-15 in the U.S., depending on pharmacy and insurance coverage.

2. Impact of Generic Competition

Generic entry caused an immediate price erosion, with reductions of up to 80% within the first year. Current retail prices are stabilized at low levels; the price ceiling is largely dominated by manufacturing margins, distribution channels, and regional market policies.

3. Pricing Trends by Region

- United States: Highly competitive, low-cost generics; patient access is primarily influenced by insurance.

- Europe: Prices are regulated; although lower than U.S., discounts are substantial.

- Emerging Markets: Prices can vary significantly; in some developing countries, prices remain higher due to limited generic penetration or regulatory barriers.

Forecasting Future Price Movements

1. Factors Influencing Future Prices

- Patent and Market Exclusivity: Minimal, as patent protections have expired.

- Generic Market Penetration: Still saturated in mature markets; further price declines less likely unless new formulations or delivery systems introduce pricing premiums.

- Regulatory and Policy Changes: Potential for price regulation and reimbursement policies to influence net prices.

- Innovative and Extended-Release Formulations: These could command premium pricing but are likely to face competition soon after launch.

- Insurer and Pharmacy Benefit Manager (PBM) Negotiations: Pooling power may suppress prices further.

2. Price Projections (Next 5 Years)

Given current market saturation:

- Stable Low Prices: For standard immediate-release formulations, prices are likely to remain at current levels or slightly decline, assuming competitive pressures persist.

- Premium Segment: Limited growth potential; new formulations may temporarily command higher prices but will face swift generic copies.

- Regional Variance: In developing markets, prices may remain higher due to slower generic adoption; in contrast, mature markets will see negligible price increases.

3. Potential Disruptive Factors

- Emerging innovations such as novel delivery mechanisms.

- Changes in prescribing guidelines or insurance reimbursement policies.

- Legislative actions influencing drug pricing transparency.

Overall, gabapentin prices are expected to stabilize at or near current low levels in established markets, with slight fluctuations driven by regional policies and new formulation launches.

Market Opportunities and Challenges

Opportunities:

- Developing combination therapies incorporating gabapentin for enhanced analgesic effects.

- Entering emerging markets with tailored cost-effective formulations.

- Developing proprietary extended-release formulations to differentiate offerings.

Challenges:

- Over-saturation of the generic market suppresses profit margins.

- Low-cost generics limit the ability to price premium formulations.

- Legal challenges and patent expiries in multiple jurisdictions further constrain pricing.

Conclusion and Strategic Recommendations

The gabapentin market faces limited growth opportunities for established formulations due to widespread generic equivalence and price suppression. Companies aiming to capitalize on this space should focus on innovation-driven differentiation—such as new delivery systems, combination products, or indications—rather than traditional formulations. Policy surveillance remains critical, as regulatory and reimbursement environments fluctuate and influence pricing trajectories.

Key Takeaways

- The global gabapentin market is mature, with prices predominantly driven by generic competition.

- Current prices for standard formulations hover around USD 10-15 per month in developed markets, with slight variations regionally.

- Future prices are expected to stabilize, with minimal upward movement unless new formulations or indications emerge.

- Market entry strategies should focus on innovation, regional differentiation, or niche indications.

- Ongoing regulatory developments and healthcare policies will significantly influence pricing and market share dynamics.

Frequently Asked Questions

1. Will the price of gabapentin increase with new patent protections?

Unlikely. The expiration of patents and patent challenges have paved the way for generic dominance. Unless a novel formulation with patent protection is introduced, prices are expected to remain stable or decline.

2. Can regional regulatory policies significantly affect gabapentin prices?

Yes. Countries with strict price controls or reimbursement policies may see further price reductions, while markets with less regulation could maintain slightly higher prices.

3. Are there opportunities for brand-name gabapentin in the current market?

Limited. Brand-name versions may command premium prices for specific off-label indications or in regions with low generic penetration; however, the overall market favors generics due to cost advantages.

4. How might emerging formulations impact future pricing?

Innovative formulations, such as extended-release or combination therapies, could command higher prices initially. However, these are likely to face rapid generic competition, limiting long-term pricing premiums.

5. What strategic moves should pharmaceutical companies consider regarding gabapentin?

Focus on niche indications, develop value-added formulations, or explore combination therapies. Monitoring regulatory policies and regional market trends remains essential.

References

[1] Market Research Future. "Global Gabapentin Market Analysis & Forecast 2023-2030."

[2] Grand View Research. "Gabapentin Market Size, Share & Trends."

[3] U.S. FDA. "Gabapentin (Neurontin) Data and Approval Details."

[4] IQVIA. "Pharmaceutical Market Reports and Price Trends."

[5] GlobalData. "Therapeutic Area Insights: Neuropathic Pain and Epilepsy."