Last updated: July 27, 2025

Introduction

Furosemide, a widely used loop diuretic, has been a staple in treating edema associated with heart failure, liver cirrhosis, and renal disease since its discovery in the 1960s. Its pharmacological efficacy, low cost, and broad therapeutic application have sustained demand over decades. This report provides an in-depth market analysis and price projection for furosemide, considering current market dynamics, manufacturing trends, patent landscape, regulatory factors, and emerging economic influences.

Market Overview

Current Market Size and Key Markets

Furosemide's global market was valued at approximately USD 600 million in 2022, predominantly driven by North America, Europe, and Asia-Pacific regions. North America accounts for nearly 40% of the market due to high prevalence of cardiovascular and renal diseases and well-established healthcare systems. Europe follows closely, with increasing demand influenced by aging populations. The Asia-Pacific region exhibits rapid growth potential, attributable to expanding healthcare infrastructure and rising disease burden [1].

Leading Manufacturers and Market Share

Major manufacturers include Teva Pharmaceuticals, Sandoz (Novartis), Mylan, and Fresenius Kabi, contributing predominantly to the generics market segment. Patent expirations in various formulations have facilitated an influx of generic competition, intensifying price sensitivity yet expanding overall access. Brand-name products, such as Lasix (Sanofi), maintain a niche within specialized markets but hold a minor fraction of total sales.

Distribution Channels

Distribution primarily flows through hospital pharmacies, retail pharmacies, and clinics. The healthcare system's structure influences the speed of adoption, with hospitals being primary consumers for IV formulations used acutely and retail pharmacies for oral tablets in outpatient care.

Market Dynamics

Drivers

-

Growing Burden of Chronic Diseases: Increased prevalence of congestive heart failure and liver cirrhosis fuels demand. The WHO estimates approximately 64 million people suffer from heart failure worldwide [2].

-

Cost-effectiveness: Furosemide’s low manufacturing cost and affordability enhance its continued use, especially in resource-constrained environments.

-

Regulatory Approvals and Generic Entry: Expiration of patents and regulatory pathways for generics facilitate market penetration and price competition.

Restraints

-

Availability of Alternatives: Newer diuretics (e.g., torsemide, bumetanide) with improved pharmacokinetic profiles may reduce reliance on furosemide in certain indications.

-

Drug Resistance and Clinical Guidelines: Adaptive prescribing patterns driven by evolving clinical evidence influence demand.

-

Regulatory and Reimbursement Changes: Policies aiming to contain healthcare costs can impact market size and product pricing.

Price Trends and Forecast

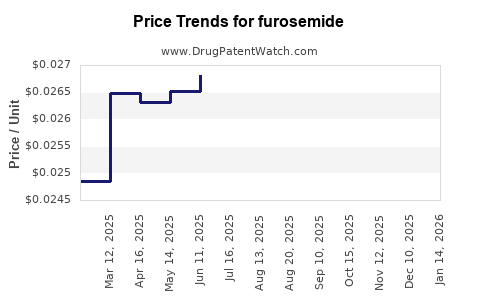

Historical Pricing

Oral furosemide tablets have historically been priced between USD 0.02 and USD 0.05 per tablet in the U.S., with IV formulations priced higher depending on the formulation and supplier. Dynamic generic competition post-patent expiry has driven prices downward; for instance, in the U.S., the price per tablet declined by approximately 50% over the past decade [3].

Current Pricing Factors

-

Formulation and Packaging: Packaged in 20, 40, and 80 mg tablets; IV forms are more costly, often priced around USD 2–3 per vial.

-

Region-specific Pricing: Prices vary widely due to healthcare policies, procurement systems, and market competition.

Forecasted Price Trends (2023-2030)

Given increasing generic penetration, prices are projected to stabilize or decline marginally in mature markets. The average oral tablet price in the U.S. is expected to remain around USD 0.02–0.03 per unit, with minimal fluctuations. However, IV formulations may experience slight price erosion owing to increased manufacturing efficiency and supply chain optimization.

Emerging markets could see prices decline further, driven by intensified competition and government-led price controls. Conversely, supply chain disruptions (e.g., raw material shortages, geopolitical instability) could cause short-term price volatility.

Regulatory Landscape Impact

The regulatory environment significantly influences market dynamics. The FDA's process for abbreviated new drug applications (ANDAs) simplifies generic approval, promoting price competition. Conversely, stringent quality standards and import-export regulations impact supply and, consequently, market prices. Future regulatory initiatives aimed at reducing healthcare costs will likely perpetuate price pressures in the generics sector.

Emerging Trends and Their Impact

Innovations and Reformulations

While no significant reformulations of furosemide are anticipated shortly, innovations that improve delivery or bioavailability could influence market share and pricing. Nevertheless, the drug’s established status and affordability limit the impact of such innovations on overall market dynamics.

Market Expansion in Developing Countries

An aging population and rising disease burden in developing countries open new markets. The affordability of furosemide makes it a preferred choice in these regions, stimulating growth.

Supply Chain and Raw Materials

Dependence on active pharmaceutical ingredients (APIs) sourced from China and India exposes the market to geopolitical and economic risks. Price fluctuations of raw materials could influence production costs and subsequent pricing.

Competitive Landscape and Future Outlook

The market is highly commoditized, with price competition reigning supreme. Small improvements in manufacturing efficiency and supply chain management could further reduce costs. Patent expirations favor an ongoing influx of generics, maintaining price elasticity and broad access.

Expected future market growth will hinge on:

- The increasing burden of chronic cardiovascular and renal diseases.

- Evolving clinical guidelines favoring diuretic use.

- Regulatory and healthcare policy influences aiming for affordability.

Overall, the furosemide market is mature, characterized by consistent demand and downward price pressure.

Key Takeaways

- The global furosemide market was valued at around USD 600 million in 2022, with North America and Europe as dominant regions.

- Generic competition has driven prices downward, stabilizing oral tablet costs at USD 0.02–0.05 per unit.

- Market growth is expected to remain stable or slow, primarily driven by increasing disease prevalence in emerging economies.

- Supply chain stability and raw material costs significantly influence production and pricing.

- Regulatory policies supporting generic drug approval and cost containment will continue to shape the market landscape.

Conclusion

Furosemide remains a low-cost, essential medication with steady demand. While the market faces price pressures from generics and healthcare policies, sustained growth prospects exist in developing markets driven by demographic shifts. Providers and manufacturers must monitor supply chain dynamics, regulatory changes, and clinical guidelines to navigate the evolving landscape effectively.

FAQs

-

What factors primarily influence furosemide pricing globally?

The key factors include generic competition, manufacturing costs, supply chain stability, regional regulatory policies, and healthcare reimbursement structures.

-

How does patent expiry affect furosemide market dynamics?

Patent expiration facilitates entry of generics, leading to increased competition, price reductions, and expanded access.

-

Are there any recent advancements in furosemide formulations?

Currently, no groundbreaking reformulations are expected soon. The focus remains on generic manufacturing efficiencies and supply chain optimization.

-

Which regions are expected to see the highest growth in furosemide demand?

Developing nations in Asia-Pacific and Latin America will likely experience increased demand due to rising cardiovascular disease prevalence and expanding healthcare access.

-

What are the main risks to the future price stability of furosemide?

Supply chain disruptions, raw material cost volatility, regulatory challenges, and the emergence of alternative therapies could impact prices.

References

- Statista. (2022). Global Diuretic Market Size.

- World Health Organization. (2021). Cardiovascular Diseases Fact Sheet.

- IQVIA. (2022). U.S. Prescription Drug Price Trends Report.