Last updated: July 28, 2025

Introduction

Fluorometholone is a topical corticosteroid primarily used to treat inflammatory and allergic conditions of the eye. Approved in various markets for ophthalmic indications, its competitive landscape, market potential, and pricing dynamics are evolving due to changes in clinical practice, regulatory environments, and technological advancements. This analysis examines the current market landscape, forecasted trends, and pricing projections for Fluorometholone over the next five years.

Market Overview

Indications and Therapeutic Class

Fluorometholone hierarchically belongs to the corticosteroid class, indicated for management of conjunctivitis, keratitis, uveitis, and allergic eye conditions. It offers an anti-inflammatory effect with a relatively favorable safety profile compared to potent steroids, making it suitable for long-term use in chronic ocular inflammation.

Market Size and Revenue

The global ophthalmic corticosteroids market was valued at approximately USD 1.2 billion in 2022. Fluorometholone dominates the topical corticosteroid segment due to its established efficacy and tolerability, with a significant share in North America and Europe, driven by high prevalence rates of ocular inflammatory diseases and advanced ophthalmological healthcare infrastructure.

Key Market Drivers

- Rising Prevalence of Ocular Conditions: An aging population and increased incidence of allergic conjunctivitis, dry eye syndrome, and uveitis expand the patient pool.

- Advancements in Ophthalmic Pharmacology: Development of optimized formulations enhances patient compliance and outcomes.

- Increased Adoption of Generic Versions: Patent expirations and generic entry lower prices, expanding access.

- Growing Awareness and Diagnostic Capabilities: Improved diagnostic modalities promote earlier intervention.

Market Challenges

- Price Competition: Entry of generics suppresses prices and margins.

- Regulatory Hurdles: Variations in approval processes and regulatory requirements across regions.

- Limited Differentiation: Generic concurrency reduces brand loyalty.

- Potential side effects: Elevated intraocular pressure and cataract formation necessitate cautious prescribing, impacting market volume.

Competitive Landscape

Major Players

- Allergan (AbbVie): Traditionally held significant market share with their branded formulations.

- Sandoz (Novartis): Focuses on generic Fluorometholone formulations, offering cost-effective options.

- Teva, Mylan: Active players providing generic formulations.

- Emerging Biosimilar Manufacturers: Entering markets with lower-priced options.

Product Differentiation

Most formulations are similar in active ingredient concentration, with variations primarily in excipients, drop formulations, and preservative use. No major biological or biosimilar competition exists, keeping prices relatively stable unless disrupted by new entrants.

Market Trends and Future Outlook

Regulatory Trends

- Stricter regulations around preservative use and delivery systems aim to improve patient safety.

- Increasing approvals for preservative-free formulations could impact demand for traditional preserved drops.

Technological Developments

- Liposomal and nanoparticle-based formulations might increase bioavailability and reduce systemic side effects.

- Sustained-release ocular implants under development could reshape treatment modalities but are currently in early stages.

Market Penetration of Generics and Biosimilars

- Expanding availability of generics is expected to significantly reduce prices, especially in emerging markets and regions with robust healthcare policies favoring cost-effective treatments.

Geographical Market Dynamics

- North America will continue to dominate the market due to advanced healthcare infrastructure and high ophthalmic disease prevalence.

- Asia-Pacific registers the highest growth potential owing to increased healthcare investments and rising ocular disease burden.

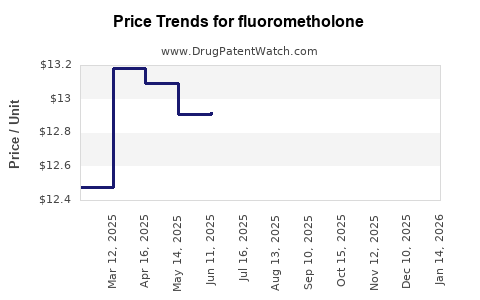

Price Projections for Fluorometholone (2023–2028)

Current Pricing Landscape

- Brand-Name Formulations: Retail prices typically range from USD 20-40 per bottle (e.g., 0.1% solutions).

- Generic Products: Prices have decreased to USD 5-15 per bottle, representing a ~50-70% decline following patent expirations.

Projected Price Trends

- Short-Term (1–2 years): Prices for generic Fluorometholone are expected to stabilize or decline marginally as market saturation occurs.

- Mid to Long Term (3–5 years): Entry of biosimilars and technological advances could further depress average prices by 20–30%, especially in emerging markets.

- Premium and Specialty Formulations: Preservative-free or sustained-release variants could command premium pricing, maintaining higher margins in niche segments.

| Year |

Average Price (USD) |

Notes |

| 2023 |

8-15 |

Dominance of generics, slight price decrease |

| 2024 |

7-13 |

Increasing biosimilar presence, further discounts |

| 2025 |

6-12 |

Market consolidation, technological innovations |

| 2026 |

6-11 |

Potential regulatory impact, new formulations |

| 2027 |

5-10 |

Price stabilizes at lower levels, regional variability |

| 2028 |

5-10 |

Emergence of premium formulations in niche markets |

Strategic Implications for Stakeholders

Pharmaceutical Companies

- Focus on developing preservative-free, targeted delivery systems to command premium prices.

- Invest in biosimilar development to expand market share in cost-sensitive regions.

- Optimize manufacturing efficiencies to sustain margins amidst declining prices.

Healthcare Providers

- Prioritize prescribing cost-effective generic formulations where appropriate.

- Stay updated on emerging formulations that could improve patient outcomes.

Regulators and Payers

- Encourage transparent pricing and support policies that facilitate access to affordable corticosteroids.

- Promote the adoption of biosimilars to reduce healthcare expenses.

Key Takeaways

- Market Dominance of Generics: Post-patent expiry, Fluorometholone's market is heavily influenced by generics, leading to significant price reductions.

- Price Decrease Trajectory: Expect a steady decline in prices over the next five years, especially in emerging markets, driven by biosimilar entries and technological advances.

- Growth in Niche Segments: Premium formulations such as preservative-free or sustained-release drugs will sustain higher margins but at limited volumes.

- Regional Variability: North America and Europe will experience mature, price-stable markets, whereas Asia-Pacific and Latin America will see rapid growth and more significant price drops.

- Regulatory and Innovation Impact: Advances in delivery systems and regulatory frameworks may alter the competitive landscape, impacting prices and market share.

FAQs

1. How does patent expiry influence Fluorometholone pricing?

Patent expiry typically leads to the entry of generic competitors, causing a substantial price decline—usually between 50-70%—due to increased competition and price sensitivity.

2. Are biosimilars a factor for Fluorometholone?

Currently, biosimilars are uncommon for topical corticosteroids like Fluorometholone; most competition arises from generics. However, biosimilar development may become relevant if new formulations or delivery systems are introduced.

3. What market regions will see the fastest price reductions?

Emerging markets in Asia-Pacific and Latin America are poised for the most significant price decreases due to higher generic adoption driven by cost-containment policies.

4. Will technological innovations impact Fluorometholone prices?

Yes. The introduction of preservative-free, sustained-release, or nanoparticle formulations can command higher prices initially but may eventually lead to price adjustments as technologies mature and competition increases.

5. How will regulatory changes affect Fluorometholone market dynamics?

Stringent regulations on preservative use and approval standards can increase costs or delay product launches, influencing prices and market penetration strategies.

References

- MarketWatch. Ophthalmic Corticosteroids Market Size & Trends. 2022.

- Grand View Research. Topical Ophthalmic Drugs Market Insights. 2023.

- FDA Database. Product Approvals and Regulatory Status for Ophthalmic Drugs.

- IQVIA. Global Pharmaceutical Pricing & Market Trends Report. 2022.

- Transparency Market Research. Biosimilars Landscape in Ophthalmology. 2023.