Last updated: July 28, 2025

Introduction

Fenofibric acid, the active metabolite of fenofibrate, is an essential pharmaceutical for managing hyperlipidemia, particularly elevated triglycerides and low HDL cholesterol. Its role in cardiovascular risk reduction has only heightened global demand, positioning it as a key product in the lipid-lowering drug segment. This analysis evaluates current market trends, competitive landscape, regulatory influences, and price projections for fenofibric acid over the next five years.

Market Overview

Global Market Size and Growth Drivers

The global market for fenofibric acid and related fibrates was valued at approximately $3.5 billion in 2022, with a compound annual growth rate (CAGR) of around 4.2% projected until 2028. The steady expansion reflects increased awareness of cardiovascular risk factors, higher prevalence of dyslipidemia, and broader adoption of lipid management guidelines emphasizing fibrates as adjunct therapy.

Key growth drivers include:

-

Rising Prevalence of Cardiovascular Disease (CVD): CVD remains the leading cause of mortality worldwide, prompting extensive usage of lipid-lowering therapies [1].

-

Expanding Screening and Diagnosis: Improved diagnostic capabilities enable earlier intervention with fenofibric acid.

-

Enhanced Formulations and Patent Expiry of Competitors: Innovations such as extended-release formulations and generic availability influence supply and demand dynamics.

Regional Market Dynamics

-

North America: Dominates due to established healthcare infrastructure, high prescription rates, and strong clinical guideline support. The U.S. accounts for roughly 45% of the global market.

-

Europe: Significant growth driven by increased awareness and aging populations, with growth rates paralleling North America.

-

Asia-Pacific: Rapid expansion, especially in China and India, driven by urbanization, rising healthcare expenditure, and expanding pharmaceutical markets.

Competitive Landscape

Market Players

-

AbbVie (formerly Abbott): Pioneers with branded Tricor and generic formulations.

-

Teva Pharmaceuticals: Major generic competitor, leveraging cost advantages.

-

Mylan (now part of Viatris): Robust presence in generics.

-

Other regional manufacturers: Increasingly contributing to the supply chain at lower price points.

Patent Expiry & Generic Penetration

The original patents expired between 2011 and 2015, ushering in a wave of generics that dramatically lowered prices. Despite this, branded fenofibrate formulations maintain premium positioning in certain regions due to clinical familiarity and brand loyalty.

Innovation and New Formulations

Recent developments include novel extended-release formulations that improve bioavailability and adherence. These innovations are likely to support premium pricing in specific segments.

Regulatory and Reimbursement Environment

Regulatory agencies like the FDA and EMA have maintained rigorous standards for lipid-lowering agents, influencing drug approval and market access. Reimbursement policies increasingly favor generic options, pressuring prices downward but expanding volume sales.

In some markets, government initiatives incentivize the use of cost-effective therapies, further intensifying price competition. However, specialty formulations or combination therapies commanding higher prices are emerging niches.

Price Trends and Projections

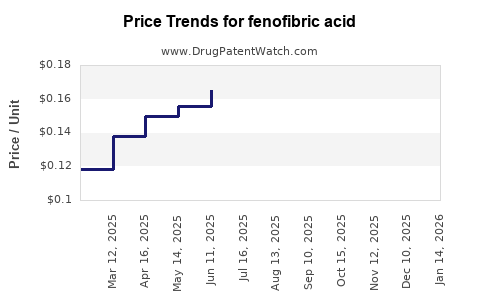

Historical Price Trends

Post-patent expiry, fenofibric acid prices experienced a sharp decline — in some markets by up to 70% for generic versions between 2012 and 2017. Despite this, branded formulations have sustained higher prices, often 20-30% above generics, due to perceived quality and physician preference.

Current Pricing Landscape

-

Generic Fenofibrate: retail prices range from $0.20 to $0.50 per capsule, with notable regional variations.

-

Branded Formulations: typically priced around $1.20 to $2.00 per capsule in the U.S.

Price Projection (2023-2028)

-

Short-term (2023-2025): Prices are expected to stabilize or decline marginally due to increased generic competition, with a CAGR of approximately -2% to -3%. In mature markets, generic prices may further decrease by 5-10%, driven by competitive pressure.

-

Medium-term (2025-2028): Prices for innovative formulations or combination products could see modest increases (~1-2% annually) driven by technological improvements and brand differentiation.

-

Premium Positioning: Niche markets for patented, extended-release formulations may see price premiums of 20-30% sustained through 2028.

Factors Influencing Future Pricing

-

Patent Landscape: The expiration or extension of patents influences generics' market share and pricing.

-

Manufacturing Costs: Advancements in synthesis and scale efficiencies are likely to exert downward pressure on prices.

-

Clinical Evidence & Guidelines: Consensus on efficacy influences physician prescribing patterns, indirectly affecting pricing strategies.

-

Regulatory Changes: Cost containment policies and formulary policies may further restrict prices in certain regions.

-

Market Entry of Biosimilars and Alternatives: Although biosimilars are less relevant for small molecules like fenofibrate, innovative lipid-lowering agents may influence market share and pricing.

Strategic Implications for Stakeholders

-

Manufacturers: Focus on differentiation through extended-release, combination therapies, and quality assurance to maintain premium prices.

-

Investors: Expect sustained high-volume sales despite declining unit prices, particularly in emerging markets.

-

Healthcare Providers: Preference for cost-efficient generic options will persist, encouraging price compression.

-

Policy Makers: Cost-effectiveness evaluations may limit reimbursement levels, influencing retail prices.

Key Takeaways

-

The global fenofibric acid market is mature but continues to grow steadily, driven by rising cardiovascular disease burdens and expanding diagnosis.

-

Price erosion for generics persists post-patent expiry, with a projected annual decline of approximately 2-3% through 2025.

-

Innovation in drug formulations offers opportunities for price premiums; however, widespread commoditization limits sustained high pricing for traditional formulations.

-

Regional disparities influence pricing strategies, with North America and Europe favoring branded products, while emerging markets champion generics.

-

Future investment should monitor patent landscapes, regulatory shifts, and technological innovations that could reshape pricing models.

FAQs

1. How has patent expiry affected fenofibric acid pricing?

Patent expiry, occurring between 2011 and 2015, led to a surge in generic competition, resulting in substantial price reductions—up to 70% in some markets—encouraging increased volume sales but reducing margins for branded manufacturers.

2. Are branded fenofibric acid formulations expected to regain pricing power?

While innovation-driven formulations may command price premiums of 20-30%, overall branded pricing remains constrained by generic competitiveness and market penetration.

3. What regional factors influence fenofibric acid pricing?

In North America and Europe, high reimbursement levels and brand loyalty support higher prices, whereas cost-driven markets like India and parts of Asia favor low-cost generics, exerting downward pressure.

4. How do regulatory policies impact fenofibric acid pricing?

Stringent reimbursement controls and approval pathways for generics facilitate price reductions, but regulatory incentives for innovative formulations can support premium pricing.

5. What future market shifts could impact fenofibric acid prices?

Emergence of new lipid-lowering agents with superior efficacy, biosimilar competition, and evolving clinical guidelines may further influence pricing dynamics.

References

[1] World Health Organization, “Cardiovascular Diseases (CVDs),” 2021.

[2] MarketWatch, “Global Fibrate Market Report 2022,” 2022.

[3] IQVIA, “Healthcare Trends,” 2021.

[4] U.S. Food and Drug Administration, “Approved Lipid-Lowering Drugs,” 2022.