Last updated: July 27, 2025

Introduction

Entacapone is a selective peripheral catechol-O-methyltransferase (COMT) inhibitor primarily prescribed to manage symptoms in Parkinson’s disease (PD) patients. It works synergistically with levodopa by preventing its peripheral breakdown, thereby increasing central nervous system availability. As the global prevalence of Parkinson’s disease rises—projected to affect over 12 million individuals worldwide by 2040—the market landscape for PD medications, including entacapone, faces substantial growth and strategic considerations. This analysis explores current market dynamics, competitive positioning, regulatory landscape, and price projections for entacapone over the next five years.

Market Overview

Global Market Size

The Parkinson’s disease therapeutics market was valued at approximately USD 4.1 billion in 2022, with central nervous system (CNS) drugs comprising a significant share. Entacapone, marketed mainly under the brand name Comtan by Novartis and available as generics globally, accounted for a considerable segment within PD adjunct therapy. Its sales are influenced by increasing diagnosis rates, advances in symptomatic treatment, and evolving clinical guidelines favoring combination therapy involving levodopa.

Key Market Drivers

- Rising Incidence and Prevalence of PD: Demographics indicate aging populations as a primary driver. The WHO estimates that PD affects about 1% of individuals over 60, with prevalence increasing globally.

- Advancements in Treatment Regimens: Combination therapies incorporating entacapone enhance motor function while reducing off-periods, reinforcing its importance.

- Generic Drug Market Expansion: Patent expirations of branded entacapone formulations have led to wider availability of affordable generics, boosting market penetration.

Regional Market Dynamics

- North America: Dominated by high healthcare expenditure, established regulatory pathways, and widespread awareness, North America remains the largest market segment for entacapone.

- Europe: Similar dynamics as North America, with robust outpatient treatment frameworks.

- Asia-Pacific: Exhibiting the fastest growth due to expanding healthcare infrastructure, increased PD diagnosis, and rising healthcare spending, especially in countries like China and India.

- Latin America and Middle East: Growing markets with increasing accessibility to PD therapies.

Competitive Landscape

Major Players

- Novartis AG: Original patent holder; currently the primary provider of branded entacapone.

- Teva Pharmaceuticals: Prominent in generic formulations, offering cost-effective options.

- Mylan (now part of Viatris): Significant producer of generic entacapone.

- Other generics: Several regional competitors expanding presence due to patent cliffs.

Product Differentiation & Market Competition

Price, supply chain reliability, and regulatory approvals influence market share more than product differentiation. The growing pipeline of combination therapies, including extended-release formulations and fixed-dose combinations, introduces potential competition but also expands therapeutic options.

Regulatory Environment

Global approval status is stable, with entacapone approved in major markets (FDA, EMA, PMDA). Regulatory trends favor expedited pathways for generic approvals, intensifying price competition. Additionally, evolving guidelines recommend increased use of COMT inhibitors for certain PD subpopulations, marginally influencing demand.

Pricing Trends and Projections

Current Pricing Landscape

- Brand-Name (Comtan): In the United States, the retail price hovers around USD 200-300 per 200 mg tablet.

- Generics: Prices tend to be 40-70% lower, with regional variation. In emerging markets, generic prices can dip below USD 50 per month of therapy, significantly improving accessibility.

Factors Influencing Prices

- Patent Expirations: Led to increased generic competition, driving down prices.

- Market Entry of Biosimilars/Generics: Accelerated cost reductions.

- Manufacturing Costs: Lowered by technological advancements in synthesis and scale-up.

- Regulatory Price Controls: Particularly in Europe and some Asian markets, influence maximum allowable prices.

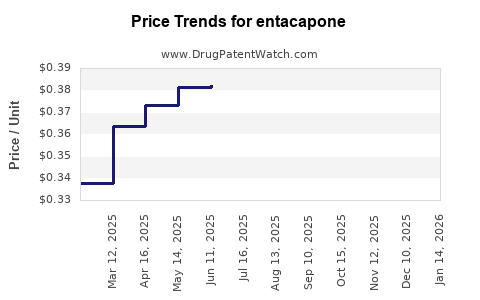

Price Projection 2023-2028

The global trend towards cost containment and increased generic penetration suggests a continued decline in prices over the next five years. Specific projections include:

- United States: Achievable reductions of 20-30% in average prices for branded formulations, with generics stabilizing around USD 50-80 per month.

- Europe: Similar trends with potential stabilization due to regulatory controls.

- Emerging Markets: More substantial reductions, with prices potentially dropping by 40-60%, enhancing access but impacting revenue margins for originators.

Influencing Factors for Future Prices

- Potential patent challenges or extensions: Could temporarily hinder price declines.

- Introduction of novel formulations: Extended-release or combination products may command higher prices initially, slowing aggregate price decreases.

- Market Consolidation: Increased generic manufacturer competition could further depress prices.

Market Opportunities and Challenges

Opportunities

- Growing PD Population: Sustains demand for adjunct therapies like entacapone.

- Generic Market Expansion: Presents avenues for volume growth in emerging markets.

- Combination Therapies: The development of fixed-dose combinations (FDCs) with levodopa can enhance therapeutic adherence, stimulating demand.

Challenges

- Price Erosion: Intense generic competition threatens profit margins.

- Regulatory Hurdles: Stringent approval processes, especially in new markets, can delay sales.

- Market Saturation: Matures markets may see stagnant growth, necessitating expansion into new regions or indications.

Future Outlook

The global entacapone market is poised for moderate expansion driven by demographic trends and increased PD awareness. Price reductions are anticipated due to widespread generic availability; however, strategic differentiation through formulation innovations may sustain premium pricing for certain segments. Bright prospects exist for manufacturers willing to invest in pipeline innovations, such as extended-release formulations or combination therapies.

Key Takeaways

- The global Parkinson’s disease therapeutics market is expanding, with entacapone positioned as a critical adjunct therapy.

- Patent expirations and generic competition have sharply reduced prices, making entacapone more accessible but compressing profit margins for original manufacturers.

- Regional variations influence price dynamics, with emerging markets experiencing more pronounced declines.

- Future price stability or correction hinges on innovations, regulatory settings, and market penetration strategies.

- Companies should explore formulation improvements and combination therapies to sustain growth amid price pressures.

FAQs

-

What are the primary factors influencing entacapone’s pricing in different markets?

Price variations are driven by patent status, regional regulatory policies, manufacturing costs, market competition, and healthcare system negotiation power.

-

How does the patent landscape affect entacapone’s market opportunities?

Patent expirations have facilitated generic entry, lowering prices and expanding access, especially in emerging markets. Conversely, new patents or exclusivity can temporarily sustain higher prices.

-

What is the outlook for entacapone’s demand over the next five years?

Demand is expected to grow moderately, fueled by rising PD prevalence, aging populations, and increased utilization of combination therapies, although market saturation and pricing pressures may temper growth.

-

Are there ongoing innovations that could impact entacapone’s market?

Yes. The development of extended-release formulations, fixed-dose combinations, and novel COMT inhibitors could influence market dynamics and pricing strategies.

-

What strategies should pharmaceutical companies consider to maximize revenue from entacapone?

Focusing on formulation innovation, exploring opportunities in emerging markets, and developing combination therapies while managing competitive pricing pressures are key strategies.

Sources

- GlobalData, Parkinson’s Disease Therapeutics Market Analysis. (2022)

- IQVIA, Pharmaceutical Price Trends and Market Access Reports. (2022)

- World Health Organization, Parkinson’s Disease Prevalence and Demographics. (2021)

- Novartis Annual Report 2022.

- European Medicines Agency, Drug Approvals and Regulatory Guidelines. (2022)