Last updated: July 27, 2025

Introduction

Doxycycline, a broad-spectrum tetracycline antibiotic, has a longstanding presence in the pharmaceutical market, primarily prescribed for bacterial infections, malaria prophylaxis, and various dermatological conditions. Its significance surged during the COVID-19 pandemic, given preliminary hypotheses about its anti-inflammatory properties, though its primary uses remain within antimicrobial therapies. This analysis offers a comprehensive overview of doxycycline's current market landscape, key drivers, competitive dynamics, regulatory environment, and future price projections, enabling stakeholders to make informed strategic decisions.

Market Overview

Market Size and Revenue

As of 2022, the global doxycycline market is valued at approximately USD 950 million, with steady growth projected at a compound annual growth rate (CAGR) of 3.5% through 2030. The trajectory reflects sustained demand from both human health sectors and animal health markets, where doxycycline is used extensively in veterinary medicine and aquaculture.

Applications and Indications

Doxycycline's principal indications include respiratory tract infections, sexually transmitted infections, Lyme disease, cholera, and malaria prophylaxis. Its wide application spectrum sustains consistent demand in developed markets, especially in North America and Europe, where antibiotic stewardship programs promote the use of targeted therapies to combat antimicrobial resistance.

In emerging markets, doxycycline's cost-effectiveness and broad application continue to foster high consumption, especially in Africa, Asia, and Latin America, where infectious disease burdens remain high.

Market Dynamics and Drivers

Clinical Efficacy and Safety Profile

Doxycycline maintains a favorable efficacy and safety profile, bolstering its steady utilization. Its once-daily dosing, oral bioavailability, and broad antimicrobial coverage underpin its ongoing clinical relevance.

Regulatory and Patent Landscape

Commercial duration varies by region—many formulations are off-patent, with generic options dominating the market, which exerts downward pressure on prices. Nonetheless, pharmaceutical companies develop new formulations, combination therapies, and extended-release versions to extend market exclusivity.

Antimicrobial Resistance (AMR) Impact

Rising AMR poses a dual challenge—while it constrains doxycycline's utility for some indications, it also catalyzes pharmaceutical efforts to develop novel derivatives or combination products to re-invigorate its market potential.

COVID-19 Pandemic and Off-Label Use

Early in the pandemic, doxycycline's off-label use for COVID-19-related pneumonia and inflammatory responses temporarily increased demand. However, subsequent clinical trials tempered these expectations, leading to stabilization in consumption patterns.

Competitive Landscape

Major pharmaceutical players include Pfizer, Teva Pharmaceuticals, Sun Pharmaceutical Industries, and Mylan (now part of Viatris), among others. The off-patent nature of doxycycline results in a highly competitive market with numerous generics, leading to price erosion but also broad availability.

Market Entry and Innovation

Innovation tends to revolve around improving formulations—such as delayed-release tablets and combination therapies—aimed at enhancing patient compliance and expanding indications.

Regulatory and Reimbursement Environment

Most markets have regulations favoring the approval and reimbursement of generic doxycycline formulations due to its off-patent status. Nevertheless, pricing negotiations and formulary inclusion decisions vary regionally, influenced by local healthcare policies and AMR considerations.

Price Trends and Projections

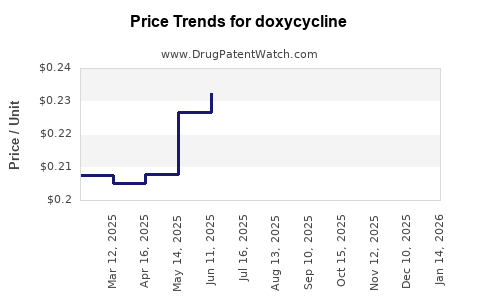

Current Pricing Dynamics

The average retail price of doxycycline tablets in the United States has declined by approximately 24% over the last five years, predominantly due to generic competition. As of 2022, a 100 mg doxycycline capsule costs between USD 0.10 and USD 0.20 per tablet wholesale, with retail prices often higher due to markups.

Forecasted Price Trajectory (2023–2030)

Based on historical declines and market factors:

-

Short-term (1–3 years): Prices are expected to stabilize or slightly decrease, driven by continued generic competition and procurement efficiencies in healthcare systems.

-

Medium-term (3–6 years): Minor price reductions are anticipated, but innovation-driven formulations may command premium pricing.

-

Long-term (6–10 years): Price erosion will likely plateau, maintaining average prices within the USD 0.08–USD 0.12 range per tablet, with regional variations.

Influencing Factors

- Patent and regulatory exclusivity: Limited to no new patents are expected, constraining pricing power.

- Antimicrobial stewardship initiatives: May impose restrictions on doxycycline's use, affecting volume and pricing policies.

- Demand from emerging markets: Growing demands may sustain or slightly increase bulk procurement, affecting pricing stability.

- Manufacturing costs: Stable or decreasing due to economies of scale in generics production.

Future Market Opportunities and Risks

Opportunities

- Development of combination therapies targeting resistant bacteria.

- Expansion into emerging markets with increasing infectious disease burdens.

- Integration into veterinary and aquaculture sectors, which are less regulated.

Risks

- Accelerating antimicrobial resistance may limit doxycycline’s clinical utility.

- Regulatory pressures aimed at reducing antibiotic overuse.

- Competition from alternative antibiotics and emerging therapies.

Conclusion

The doxycycline market is characterized by maturity, intense generic competition, and regional demand variations. While overall price declines are expected to persist, innovation in formulations and increasing usage in untapped markets present growth opportunities. Stakeholders should focus on optimizing procurement strategies, monitoring resistance trends, and exploring new indications to remain competitive.

Key Takeaways

- Doxycycline's global market is stable, with a valuation nearing USD 1 billion.

- Generic competition significantly constrains pricing, leading to a downward trend.

- Future prices will likely hover around USD 0.08–USD 0.12 per tablet with minor fluctuations.

- Opportunities exist in emerging markets and veterinary applications, whereas antimicrobial resistance poses ongoing challenges.

- Strategic innovation in formulations and expanded indications can help sustain profitability.

FAQs

-

What factors most influence doxycycline pricing?

Generic availability, regional healthcare policies, antimicrobial resistance trends, and procurement volumes predominantly drive doxycycline prices.

-

How has the COVID-19 pandemic affected doxycycline market demand?

Early in the pandemic, off-label use temporarily increased demand; however, subsequent clinical guidance tempered usage, leading to market stabilization.

-

Are there opportunities for innovative doxycycline formulations?

Yes. Extended-release formulations and combination therapies can command higher prices and extend market exclusivity.

-

What is the outlook for doxycycline in antimicrobial resistance management?

As resistance rises, doxycycline’s clinical role may diminish in some indications, potentially impacting demand unless new formulations or indications emerge.

-

How do regulatory policies impact doxycycline pricing worldwide?

Regulatory frameworks encouraging generic manufacturing and price controls generally lower prices, whereas restrictions on off-label use or restrictions on antibiotic prescriptions can limit market growth.

References

- Market research reports and industry analyses (e.g., MarketsandMarkets, Grand View Research).

- Public health and antimicrobial resistance data from CDC, WHO.

- Pharmaceutical price tracking databases and reports.