Last updated: November 7, 2025

Introduction

Diclofenac potassium, a prominent nonsteroidal anti-inflammatory drug (NSAID), addresses acute pain, inflammation, and postoperative discomfort. Widely utilized in both prescription and over-the-counter formulations, it is a crucial player in the global pain management market. As healthcare systems evolve, understanding market dynamics and price trajectories for diclofenac potassium becomes vital for pharmaceutical companies, investors, and healthcare providers aiming to optimize supply chains, pricing strategies, and R&D investments.

Market Overview

Global Market Size and Growth Trends

The global NSAID market, valued at approximately USD 8 billion in 2022, is projected to expand at a CAGR of 4.5% through 2030 (Fortune Business Insights). Diclofenac potassium comprises about 20-25% of this market, reflecting its widespread acceptance for acute pain and inflammatory indications. The demand remains buoyant due to the rising prevalence of arthritis, osteoarthritis, and postoperative pain conditions, particularly in aging populations across North America, Europe, and Asia.

Regional Dynamics

- North America: The largest market, driven by high prevalence of musculoskeletal disorders, extensive healthcare infrastructure, and aggressive marketing. The U.S. accounts for roughly 40% of the global NSAID market.

- Europe: Moderate growth, with stringent regulatory environments influencing drug approval and pricing.

- Asia-Pacific: The fastest growth, driven by increasing healthcare expenditures, urbanization, and a burgeoning middle class. Countries like China and India are witnessing significant demand for cost-effective NSAID formulations, including diclofenac potassium.

Competitive Landscape

Key players include Novartis (Voltaren), Mylan (Diclofenac potassium formulations), and Teva Pharmaceuticals. Patents on specific formulations have expired, leading to generic proliferation, which intensifies price competition. The market is also witnessing increasing penetration of OTC sales, especially in developing regions.

Market Drivers and Barriers

Drivers

- Prevalence of Chronic and Acute Pain: Aging populations increase demand for effective pain management solutions.

- Generic Competition: Patent expiries boost accessibility and volume sales, enhancing market penetration.

- Formulation Innovations: Development of fast-dissolving and lower-dose formulations enhances patient compliance.

Barriers

- Safety Concerns: Risks of gastrointestinal bleeding, cardiovascular events, and renal impairment associated with NSAID use. These safety issues lead to stringent prescribing guidelines and limited maximal dosages.

- Regulatory Scrutiny: Tightened regulations and label updates impact market stability.

- Pricing Pressure: Gaining generic market share undercuts pricing margins.

Price Analysis and Projection

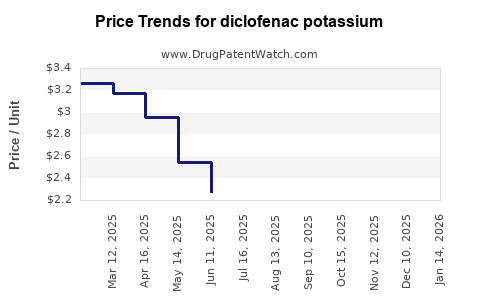

Historical Pricing Trends

- Brand-name Diclofenac Potassium: Historically priced at USD 1.50–2.00 per tablet, reflecting brand premiums.

- Generics: Prices have fallen sharply post-patent expiry, hovering around USD 0.10–0.30 per tablet, according to IMS Health data.

- OTC Formulations: Lower-cost options available in many markets, often priced below USD 0.20 per tablet.

Current Price Dynamics

In mature markets, the average transaction price for generic diclofenac potassium tablets ranges from USD 0.10 to 0.25 per tablet, with variations based on packaging, dosage, and distributor agreements. The OTC segment in emerging markets often sees prices as low as USD 0.05 per tablet, driven by high-volume sales and minimal branding costs.

Factors Influencing Future Prices

- Market Saturation: Increased generic competition is likely to depress prices further.

- Regulatory Changes: Stricter safety labeling may marginally increase manufacturing costs and impact pricing.

- Supply Chain Stability: Raw material availability, particularly of active pharmaceutical ingredients (APIs), influences costs.

- Emerging Markets Growth: Price sensitivity in developing economies will maintain low-cost formulations as dominant.

Price Projections (2023–2030)

- Short-term (2023–2025): Prices are expected to remain stable or decline modestly by 5–10%, primarily due to continued generic competition and OTC market expansion.

- Mid-term (2026–2028): Prices may plateau or slightly increase (2–3%) driven by production efficiencies and potential formulation innovations that command premium pricing.

- Long-term (2029–2030): Market saturation and increased safety regulations could suppress prices further, averaging USD 0.05–0.15 per tablet in the OTC segment and USD 0.10–0.20 for prescription-grade formulations.

Impact of Regulatory and Market Shifts

The increasing scrutiny on NSAID safety may influence prescribing trends, potentially reducing volume but favoring formulations with improved safety profiles or lower doses. Such shifts could lead to differentiated pricing strategies, including premium pricing for formulations with enhanced safety features.

Additionally, the rise of biosimilars and alternative pain management options may further challenge diclofenac potassium’s market share, exerting downward pressure on prices.

Strategic Implications for Stakeholders

- Manufacturers: Focus on cost-effective production, expanding into emerging markets, and differentiating through safety profiles.

- Investors: Monitor patent expiries and regulatory changes that may influence pricing and volume trends.

- Healthcare Providers: Balance cost considerations with safety profiles to optimize patient outcomes.

- Regulators: Continue to enforce safety standards, influencing market composition and pricing.

Key Takeaways

- The global diclofenac potassium market remains sizeable, with growth driven by rising prevalence of pain-related conditions and increasing availability in emerging markets.

- Price trends indicate ongoing decline in generic formulations, with sustained low-cost OTC options.

- Regulatory pressures and safety concerns will shape future pricing strategies and formulation development.

- Market saturation and intensified generic competition are expected to compress profit margins in subsequent years.

- Strategic focus on safety innovation, cost optimization, and broader market access will be critical for long-term competitiveness.

FAQs

1. What factors are primarily influencing diclofenac potassium price reductions?

Generic competition, patent expiries, and increased market penetration of OTC formulations are primary drivers causing prices to decline.

2. How will safety concerns impact future pricing and market share?

Enhanced safety profiles may allow for premium pricing or targeted marketing, but adverse safety signals can also restrict prescribing, reducing demand.

3. Are emerging markets likely to adopt higher-priced formulations?

Typically, emerging markets favor low-cost generics; however, increasing income levels and regulatory improvements can shift preferences toward branded or safer formulations.

4. What role will regulatory agencies play in shaping the diclofenac potassium market?

Regulatory agencies will influence market dynamics through safety labeling, approved indications, and manufacturing standards, indirectly affecting pricing and availability.

5. Will innovations in formulations or delivery methods significantly alter the price landscape?

Yes. Innovations such as fast-dissolving tablets or lower-dose formulations may command higher prices and expand niche markets, impacting overall market pricing.

References

[1] Fortune Business Insights. NSAID Market Size, Share & Industry Analysis, 2022.

[2] IMS Health Data. Global Pharmaceutical Pricing Trends, 2022.

[3] European Medicines Agency. NSAID Safety Guidelines, 2021.

[4] MarketWatch. Emerging Markets and Their Impact on NSAID Pricing, 2023.