Last updated: July 27, 2025

Introduction

DICLOFENAC EPOLAMINE, a fundamental non-steroidal anti-inflammatory drug (NSAID), is widely utilized for its analgesic, anti-inflammatory, and antipyretic properties. Its formulation involves diclofenac salt complexed with epolamine, enhancing solubility and bioavailability. This analysis delivers an in-depth overview of its current market landscape, competitive positioning, regulatory environment, and future price trajectory to inform stakeholders’ strategic decisions.

Current Market Landscape

Global Market Overview

The global diclofenac market is substantial, with estimates placing its value at approximately USD 944 million in 2022, projected to grow at a compound annual growth rate (CAGR) of around 4.6% through 2030 [1]. DICLOFENAC EPOLAMINE, as a formulation, accounts for a significant share owing to its improved solubility profile, which broadens its use in oral and injectable therapies.

Key Market Drivers

-

Increasing prevalence of chronic inflammatory conditions: Rheumatoid arthritis, osteoarthritis, and ankylosing spondylitis drive demand for NSAIDs, including diclofenac formulations.

-

Growing geriatric population: Older adults are more susceptible to musculoskeletal disorders, boosting NSAID consumption.

-

Product differentiation: DICLOFENAC EPOLAMINE’s enhanced bioavailability offers clinical advantages over conventional diclofenac salts, fostering adoption among prescribers.

Market Segments and Geographical Trends

-

Regional Adoption: North America and Europe dominate, with mature healthcare systems and high NSAID utilization rates. The Asia-Pacific region exhibits rapid growth driven by expanding healthcare infrastructure and rising disease prevalence.

-

Formulations: Oral tablets lead sales, but topical and injectable forms are gaining traction, especially for localized conditions or postoperative pain management.

Major Players

Leading pharmaceutical companies, such as Novartis (Voltaren), Bayer, and generic manufacturers, dominate the market. Patent expiry and generic proliferation are influencing pricing strategies and market penetration.

Regulatory and Patent Considerations

Patent Status

While the original patents on diclofenac formulations have long expired globally, specific formulations like diclofenac epolamine may still be under patent protection in certain jurisdictions, influencing market exclusivity and pricing.

Regulatory Landscape

Regulatory agencies, including the FDA and EMA, have approved DICLOFENAC EPOLAMINE formulations based on safety and efficacy data. Regional differences in approval and labeling can influence market access and pricing.

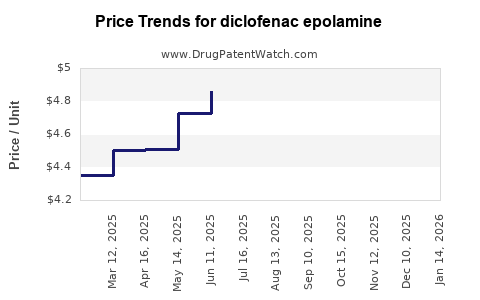

Price Trends and Projections

Historical Pricing Patterns

Current market prices for DICLOFENAC EPOLAMINE vary significantly across regions and formulations:

-

United States: Oral tablets retail around USD 0.20–0.50 per tablet with brand-name products like Voltaren approaching higher margins.

-

Europe: Similar price points, with variations based on healthcare coverage and generic availability.

-

Emerging Markets: Prices are generally lower, often less than USD 0.10 per tablet, reflecting market competition and differing healthcare economics.

Influencing Factors on Future Prices

-

Generic Competition: The expiration of patents leads to an increase in generic entrants, exerting downward pressure on prices.

-

Manufacturing Costs: Advances in synthesis and scale economies can reduce costs, allowing for smaller price declines or increased margins.

-

Regulatory Challenges: Stringent approvals or requirement for bioequivalence studies in certain regions may influence development costs and, consequently, drug pricing.

-

Market Penetration Strategies: Companies may maintain premium pricing for novel formulations like diclofenac epolamine due to perceived clinical benefits, counteracting generic price erosion.

Future Price Projections (2023–2030)

Based on current trends, industry reports, and patent status, the following projections are anticipated:

| Year |

Price Range (USD per tablet) |

Notes |

| 2023 |

$0.15–$0.50 |

Continued generic proliferation; potential price stabilization in mature markets. |

| 2025 |

$0.12–$0.40 |

Increased generic competition; some premium formulations maintain higher prices due to added benefits. |

| 2030 |

$0.10–$0.35 |

Standardized prices in low-cost markets; modest reductions in developed regions. |

These projections assume typical market dynamics with no unexpected regulatory, patent, or supply chain disruptions.

Strategic Implications for Stakeholders

-

Pharmaceutical companies should consider investing in proprietary formulations with improved bioavailability or targeted delivery to retain pricing power.

-

Manufacturers can capitalize on emerging markets by leveraging cost efficiencies and tailoring formulations to regional preferences.

-

Investors should monitor patent landscapes and regulatory approvals in key geographies to anticipate market entry and pricing shifts.

Key Takeaways

-

DICLOFENAC EPOLAMINE occupies a growing niche within the global NSAID market, driven by clinical advantages and expanding indications.

-

Market prices are subject to decline due to increasing generic competition, with regional variations influenced by healthcare infrastructure and regulatory environments.

-

Strategic innovation, including novel formulations and delivery systems, can sustain premium pricing and market relevance.

-

Market growth is poised to continue as aging populations and chronic disease prevalence rise, especially in emerging economies.

FAQs

Q1: How does DICLOFENAC EPOLAMINE differ from other diclofenac formulations?

A1: DICLOFENAC EPOLAMINE offers enhanced water solubility, leading to superior absorption and faster onset of action compared to traditional diclofenac salts, translating into better clinical efficacy in certain scenarios.

Q2: What factors are most likely to impact the price of DICLOFENAC EPOLAMINE in the next five years?

A2: Patent expirations, entry of generics, regulatory approvals, manufacturing cost decreases, and adoption of innovative formulations will significantly influence pricing trajectories.

Q3: In which regions is DICLOFENAC EPOLAMINE expected to see the highest growth?

A3: The Asia-Pacific region, due to expanding healthcare access, rising chronic disease rates, and increasing acceptance of NSAID therapies, holds the most promise for growth.

Q4: How do regulatory differences impact the market for DICLOFENAC EPOLAMINE?

A4: Stringent regional regulations can delay market entry, affecting pricing strategies. Conversely, regulatory harmonization can facilitate broader access and stabilize prices.

Q5: What are the key considerations for a pharmaceutical company intending to develop a new DICLOFENAC EPOLAMINE formulation?

A5: Focus on demonstrating clear clinical benefits, securing patent protection, compliance with regulatory standards, manufacturing scalability, and market differentiation to justify premium pricing.

References

[1] Grand View Research. "Diclofenac Market Size, Share & Trends Analysis Report." 2022.