Last updated: July 27, 2025

Introduction

Diazepam, a long-established benzodiazepine, remains a cornerstone in the treatment of anxiety, seizures, muscle spasms, and alcohol withdrawal symptoms. Despite the advent of newer medications, its widespread use persists, driven by cost-effectiveness and extensive clinical familiarity. This analysis assesses the current market landscape, factors influencing demand and supply, pricing trends, and offers projections over the next five years, assisting stakeholders in strategic decision-making.

Current Market Landscape

Global Market Size

The global diazepam market was valued at approximately USD 400 million in 2022, with projections to grow at a compound annual growth rate (CAGR) of 2-3% through 2028. The key drivers include its longstanding efficacy, low manufacturing costs, and regulatory approval across numerous markets. The Asia-Pacific region, notably China and India, are significant contributors due to their large populations and expanding healthcare infrastructure.

Key Regional Markets

- North America: The U.S. dominates due to high prescription volumes, driven by anxiety and seizure disorder demographics, and well-established healthcare infrastructure.

- Europe: Europe maintains steady demand; regulatory frameworks restrict over-prescription, but approved uses remain consistent.

- Asia-Pacific: Emerging markets exhibit increasing prescriptions, driven by expanding healthcare access and a growing prevalence of anxiety and neurological disorders.

Market Players

Leading manufacturers include Sanofi, Mylan, Teva Pharmaceuticals, and Hikma Pharmaceuticals, mainly producing generic formulations. Limited innovation exists, with most formulations being off-patent, which intensifies price competition.

Regulatory Environment

Diazepam's generic status simplifies market entry, but regional regulatory hurdles can affect supply. Hawaii and certain U.S. states report oversight due to its potential for misuse.

Demand Dynamics

Medical and Clinical Use

Although prescribed for decades, ongoing concerns about dependence and abuse have led to regulatory scrutiny, especially in North America and Europe, constraining some applications. Nonetheless, demand persists owing to longstanding clinical acceptance.

Generic Availability

The drug's patent expiration in most regions has resulted in an intense generic market, significantly reducing treatment costs and limiting margins for manufacturers. In the U.S., the FDA-approved generic market share exceeds 95%, reflecting high availability and competition.

Emerging Trends

- Shift toward Digital and Telemedicine: This facilitates prescription management, although no significant impact on volume is evident yet.

- Mental Health Awareness: Rising awareness may sustain or slightly increase demand for anxiolytics, including diazepam.

COVID-19 Impact

The pandemic marginally affected distribution and prescribing patterns, with supply chain disruptions in early 2020 but recovery by 2021. Increased stress-related disorders could sustain demand in certain segments.

Pricing Trends and Projections

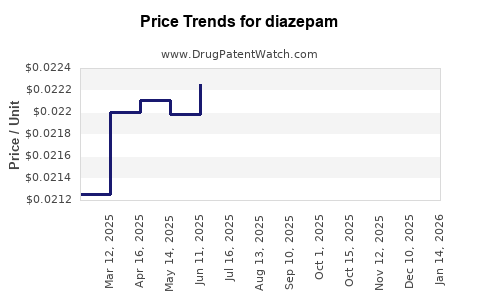

Historical Price Trends

In high-income regions, the retail price for a 5mg tablet ranged from USD 0.10 to USD 0.20 pre-pandemic. The proliferation of generics in 2010 onward catalyzed a steady decline, with prices stabilizing around USD 0.05-0.10 per tablet in the U.S. and Europe.

Current Price Drivers

- Manufacturing Costs: Low, especially for generic producers.

- Regulatory Overheads: Minimal compared to patent-protected drugs.

- Market Competition: Intense, leading to price erosion.

- Distribution and Supply Chain Considerations: Fluctuations influence retail prices marginally.

Future Price Projections (2023-2028)

Given the saturation of generics and limited innovation, prices are expected to decline gradually or plateau. The anticipated CAGR of prices in mature markets is approximately -1% to -2%, driven by ongoing competition and potential regulatory restrictions on prescriptions due to abuse concerns.

In emerging markets, prices may remain stable or increase slightly due to inflation, supply chain improvements, and growing healthcare infrastructure. The overall global price per tablet is projected to decline marginally, reaching approximately USD 0.03-0.07 by 2028.

Potential Price Influencers

- Regulatory Crackdowns: Stricter controls could reduce supply, temporarily increasing prices.

- Supply Chain Disruptions: Geo-political tensions or pandemics can cause fluctuations.

- Innovative Formulations: Introduction of abuse-deterrent forms might command higher prices but remain niche.

Market Challenges and Opportunities

Challenges

- Drug Dependence and Abuse: Growing societal and regulatory concerns constrain prescribing and could limit market expansion.

- Regulatory Restrictions: Some countries impose dosage or prescription limits.

- Shift to Alternative Agents: Unconventional therapies like SSRIs or newer anxiolytics may curtail growth.

Opportunities

- Expanding Indications: Exploration of new uses, such as in certain neuropathic pain conditions, could boost demand.

- Formulation Innovations: Abuse-deterrent formulations may provide premium pricing.

- Manufacturing Economies: Low-cost production centers in Asia can further reduce prices and increase supply.

Regulatory and Ethical Considerations

The increasing focus on mental health awareness and the risks associated with benzodiazepines could influence future regulatory policies. Governments may adopt stricter prescribing protocols, impacting revenue streams and pricing structures.

Conclusion

The diazepam market remains mature, with stable demand driven by chronic condition management and cost-effective generics. Price erosion is anticipated to continue, with modest declines over the next five years, particularly in developed markets. Growth opportunities hinge on the pharmaceutical industry's ability to implement innovative, abuse-deterrent formulations and expand indications responsibly, amid regulatory and societal concerns.

Key Takeaways

- The global diazepam market is stable but highly competitive, dominated by generics.

- Prices have steadily declined over the past decade and are projected to decrease marginally until 2028.

- Regional disparities exist; emerging markets may see stable or slightly increased prices.

- Regulatory scrutiny and abuse concerns pose ongoing challenges but also create avenues for innovation.

- Stakeholders should monitor policy shifts and technological advancements to capitalize on market opportunities and mitigate risks.

FAQs

1. Will the price of diazepam increase due to regulatory restrictions?

While stricter regulations could temporarily limit supply or increase costs, the entrenched nature of generic manufacturing and low production costs suggest a minimal long-term impact on prices. However, localized restrictions could cause regional price fluctuations.

2. Are there any new formulations of diazepam planned?

Currently, most innovation focuses on abuse-deterrent formulations, but widespread adoption remains limited. Development of new delivery systems or combination therapies is in early stages and unlikely to significantly impact prices soon.

3. How does the rise of alternative treatments affect diazepam's market?

Emerging drugs like SSRIs or atypical anxiolytics are increasingly preferred due to lower abuse potential. This trend may exert downward pressure on diazepam demand, particularly in countries emphasizing safety.

4. Which regions present the most growth opportunity for diazepam?

Asia-Pacific markets offer growth potential due to expanding healthcare infrastructure and increasing mental health awareness. Additionally, low-cost manufacturing hubs can capitalize on global demand.

5. How has the COVID-19 pandemic influenced the diazepam market?

Pandemic-related supply chain disruptions temporarily affected distribution, but overall demand held steady. Stress-related disorders may sustain or slightly boost future demand, especially with increased telehealth prescriptions.

References

[1] MarketWatch, “Global Diazepam Market Size and Forecast,” 2023.

[2] Research & Markets, “Benzodiazepines Market Analysis,” 2022.

[3] U.S. Food & Drug Administration, “Generic Drug Approvals,” 2022.

[4] IQVIA, “Global Prescription Drug Trends,” 2022.

[5] World Health Organization, “Mental Health and Psychotropic Substance Use,” 2022.