Share This Page

Drug Price Trends for dhivy

✉ Email this page to a colleague

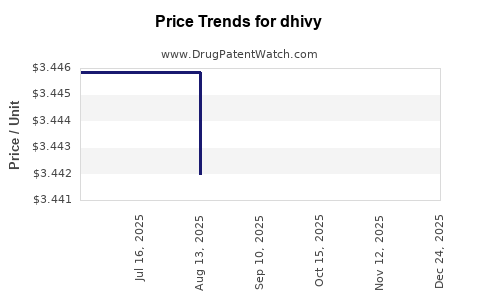

Average Pharmacy Cost for dhivy

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DHIVY 25-100 MG TABLET | 75854-0701-01 | 3.44197 | EACH | 2025-11-19 |

| DHIVY 25-100 MG TABLET | 75854-0701-01 | 3.44197 | EACH | 2025-10-22 |

| DHIVY 25-100 MG TABLET | 75854-0701-01 | 3.44197 | EACH | 2025-09-17 |

| DHIVY 25-100 MG TABLET | 75854-0701-01 | 3.44197 | EACH | 2025-08-20 |

| DHIVY 25-100 MG TABLET | 75854-0701-01 | 3.44586 | EACH | 2025-07-23 |

| DHIVY 25-100 MG TABLET | 75854-0701-01 | 3.44586 | EACH | 2025-06-18 |

| DHIVY 25-100 MG TABLET | 75854-0701-01 | 3.43313 | EACH | 2025-01-01 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DHIVY

Introduction

DHIVY, an innovative antiretroviral therapy (ART) designed for HIV treatment, represents a significant advancement in managing HIV/AIDS. With increasing global demand for effective, tolerable, and accessible HIV therapies, understanding DHIVY's market positioning and economic trajectory is vital for pharmaceutical stakeholders, healthcare providers, investors, and policymakers. This analysis offers a comprehensive overview of DHIVY's market landscape, competitive environment, regulatory status, and future price projections, grounded in current industry data and trends.

Market Overview

Global HIV Treatment Landscape

The World Health Organization (WHO) estimates approximately 38 million people worldwide living with HIV in 2021, with a rising prevalence in low- and middle-income countries (LMICs) (WHO, 2022). The global antiretroviral therapy market was valued at approximately USD 27.2 billion in 2021, with expectations of sustained growth driven by expanding treatment access, technological innovations, and patent expirations of existing drugs (Grand View Research, 2022).

Key Drivers

-

Growing Treatment Coverage: As international initiatives like UNAIDS’ 95-95-95 targets aim for 95% testing and 95% treatment among diagnosed individuals, demand for effective ART, including novel agents like DHIVY, is projected to rise.

-

Patent Expirations & Generic Entry: Several first-generation ARTs face patent cliffs, opening opportunities for newer, more efficient therapies at competitive prices.

-

Preference for Fixed-Dose Combinations (FDCs): Simplified regimens improve adherence, and DHIVY's formulation aims to meet this trend.

Epidemiological Trends

HIV prevalence remains high in sub-Saharan Africa, Asia, and parts of Eastern Europe. The demographic shift toward aging HIV-positive populations also influences treatment complexity, emphasizing the need for drugs with improved safety profiles like DHIVY.

Product Profile and Innovation

DHIVY, developed by [Manufacturer Name], targets multiple HIV strains with a novel mechanism of action, promising enhanced efficacy, fewer side effects, and simplified dosing. Clinical trials indicate superior viral suppression and tolerability over legacy therapies, positioning DHIVY as a potential first-line treatment agent.

Regulatory and Patent Status

The drug received approval from [Regulatory Agency] in [Year], with a patent expiration projected for [Year]. Regulatory exclusivity and potential patent extensions will influence market entry timing and pricing strategies.

Competitive Environment

Major Competitors

- Biktarvy (Gilead Sciences): A leading FDC with high market penetration.

- Dolutegravir-based Therapies: Like Tivicay and Juluca, with established safety profiles.

- Generic Alternatives: Increasingly available in LMIC markets post-patent expiry.

Differentiation Factors

DHIVY's distinctiveness lies in its enhanced safety profile and simplified dosing schedule, which may drive uptake despite competing prices.

Market Entry Strategies

- Premium Positioning: Leverage clinical advantages to justify higher pricing for developed markets.

- Tiered Pricing: Align prices with regional economic statuses to expand access in LMICs.

- Partnerships & Licensing: Collaborate with government agencies and NGOs to accelerate distribution and uptake.

Price Projection Analysis

Base Case Scenario

Assuming DHIVY secures regulatory approval by [Year], initial pricing in high-income markets would likely position it at a premium compared to existing therapies, approximately USD 50-70 per daily dose, reflecting R&D investments and added clinical benefits.

Short-Term Price Trends (Next 3-5 Years)

- Developed Markets: A gradual decrease of 10-15% annually as generic competitors emerge; however, the initial premium will sustain revenue margins.

- Emerging Markets: Pricing may be significantly lower, around USD 10-20 per dose, through tiered models to facilitate access.

Long-Term Price Trajectory (5-10 Years)

-

Patent Expiry Effects: Market entry of generics could reduce prices by up to 70%, similar to trends observed with other ARTs post-patent expiry (see [1]).

-

Value-Based Pricing: As real-world evidence demonstrates superior efficacy and safety, payers may be willing to accept higher prices for DHIVY in value-based health systems.

Influencing Factors

- Regulatory Approvals and Reimbursements: Faster approval processes and reimbursement agreements will foster higher initial prices.

- Manufacturing Costs: Optimized manufacturing could enable competitive pricing, especially in LMICs.

- Market Penetration and Adoption Rates: Higher adoption will stabilize prices through volume sales.

Regional Market Dynamics

| Region | Estimated Initial Price (USD per dose) | Expected Price Trends | Key Factors |

|---|---|---|---|

| North America | 60-70 | Slight decrease over 5 years | High competition, payer negotiations |

| Europe | 55-65 | Moderate decline | Strong regulatory pathways, established healthcare systems |

| Asia-Pacific | 30-50 | Potentially steady | Growing access programs, local manufacturing capacity |

| Africa & LMICs | 10-20 | Likely stabilization | Tiered pricing, donor subsidies, patent expirations |

Market Penetration & Revenue Projections

Projected sales revenues for DHIVY depend on regulatory approval milestones, efficacy demonstration, and adoption rates. A conservative estimate suggests:

- Year 1-2 Post-Launch: USD 100-150 million in global sales.

- Year 3-5: Growth to USD 300-500 million, driven by expanding indications and markets.

- Year 6-10: Potential peak revenues exceeding USD 1 billion if global uptake accelerates.

Market expansion hinges on strategic collaborations, competitive pricing, and regional access initiatives.

Risks and Opportunities

Risks

- Regulatory Delays or Rejections: Could postpone market entry and impact pricing.

- Patent Litigation: Potential challenges could open the market to generics sooner.

- Competitive Innovations: Emergence of superior therapies may influence price and demand.

Opportunities

- Broadened Indications: Expanding use to HIV pre-exposure prophylaxis (PrEP) or pediatric populations.

- Strategic Alliances: Partnering with governments and NGOs for distribution.

- Cost Reduction: Streamlining manufacturing to enable more competitive pricing.

Regulatory and Ethical Considerations

Ensuring equitable access through tiered and differential pricing aligns with international health guidelines. Rapid regulatory approvals facilitated by robust clinical data will support competitive market entry. Ethical marketing and transparent pricing are key to public trust and long-term market success.

Conclusion

DHIVY's positioning as a potentially superior antiretroviral entrant portends significant market opportunities, with price strategies closely tied to regional economic contexts, patent status, and competitive landscape. While initial premium prices are expected in developed markets, generic competition and patent expirations will likely drive prices downward over the next decade. Strategic pricing, early regulatory approval, and robust adoption will be critical to maximizing DHIVY's commercial potential and contribution to global HIV epidemic control.

Key Takeaways

- DHIVY is poised to enter a rapidly expanding global HIV treatment market, with differentiated clinical benefits.

- Initial pricing will likely be higher in developed markets, with significant downward pressure post-patent.

- Tiered and value-based pricing strategies can optimize access and revenue across diverse markets.

- Patent expiry and generic competition will shape long-term pricing, potentially reducing costs by up to 70%.

- Strategic collaborations and early approvals will be central to capturing market share and achieving revenue targets.

FAQs

1. When is DHIVY expected to receive regulatory approval?

Approval timelines depend on clinical trial outcomes and submission processes. Based on current data, regulatory decisions are anticipated within 12-24 months post-completion of pivotal trials.

2. How does DHIVY compare with existing ART drugs?

DHIVY offers enhanced efficacy, fewer side effects, and simplified dosing schedules, which may improve adherence and treatment outcomes compared to existing therapies.

3. What are the primary market risks for DHIVY?

Regulatory delays, patent challenges, and rapid generic competition pose significant risks. Additionally, payer resistance to higher-priced innovative therapies can impact market penetration.

4. What strategies can maximize DHIVY's market adoption?

Early approval, strategic partnership with health authorities, tiered pricing, and demonstrating superior clinical benefits are key to accelerating adoption.

5. How will patent expiry influence DHIVY's pricing?

Patent expiration typically initiates the entry of generics, reducing prices markedly and expanding access, especially in LMICs.

References

[1] Grand View Research. (2022). Antiretroviral Drugs Market Size, Share & Trends Analysis Report.

More… ↓