Last updated: July 27, 2025

Introduction

Dextroamphetamine, a central nervous system (CNS) stimulant primarily used for attention deficit hyperactivity disorder (ADHD) and narcolepsy, commands a significant position within the pharmaceutical landscape. Its patent status, manufacturing dynamics, regulatory environment, and market demand influence its price trajectory. This article provides a comprehensive analysis of the current market landscape and offers price projections grounded in industry trends, patent expirations, patent litigations, and emerging therapies.

Market Overview

Therapeutic Applications and Market Demand

Dextroamphetamine is approved for ADHD and narcolepsy, with off-label uses expanding into treatment of obesity and treatment-resistant depression. The global ADHD therapeutics market, estimated at approximately USD 16.8 billion in 2021, is projected to grow at a compound annual growth rate (CAGR) of 6.4% through 2028 [1]. This growth is underpinned by increasing diagnosis rates, particularly in North America and parts of Asia-Pacific, and heightened awareness around mental health.

In 2022, the U.S. accounted for nearly 75% of the global demand for stimulant medications, driven by robust prescribing practices and insurance coverage [2]. Dextroamphetamine, marketed through brand names like Adderall (a combination of amphetamine salts, including dextroamphetamine), remains a dominant product in this space.

Manufacturing and Supply Chain Dynamics

Major pharmaceutical companies such as Teva Pharmaceuticals, Teva, and Global Beverages are prominent producers of dextroamphetamine formulations. The manufacturing of dextroamphetamine involves complex synthetic pathways requiring controlled substances licenses due to its potential for abuse.

Supply chain disruptions—particularly during the COVID-19 pandemic—affected raw material availability, impacting pricing stability. Additionally, regulatory controls, such as the Drug Enforcement Agency (DEA) scheduling of schedule II substances, shape production and distribution limits.

Patent and Regulatory Landscape

Patent Lifecycle and Market Exclusivity

Dextroamphetamine’s primary formulations, most notably Adderall, faced patent expiration in the United States in 2023, with several patents dating back to the early 2000s. The original patents for Adderall’s specific formulations expired, paving the way for generic manufacturers to introduce equivalent products.

The expiration of key patents typically precipitates a sharp decrease in drug prices due to increased generic competition. Nonetheless, certain formulation patents—such as extended-release (ER) versions—may still be in force, offering market exclusivity for specific formulations or delivery mechanisms.

Regulatory Factors

Strict classification as a Schedule II controlled substance places constraints on manufacturing, distribution, prescribing, and dispensing. Regulatory oversight influences market entry barriers for generics, with some manufacturers pursuing abuse-deterrent formulations to extend market exclusivity.

Current Pricing Landscape

Brand vs. Generic Products

Brand-name formulations, once predominant, have transitioned into a predominantly generic market landscape following patent lapses. Generic dextroamphetamine products, accessible through multiple manufacturers, have driven prices down substantially.

In the United States, the average retail price of a 30-count sheet of generic dextroamphetamine tablets (dosages 5 mg, 10 mg, 20 mg, 30 mg) ranges from USD 15 to USD 50, depending on dosage, formulation, and pharmacy. In contrast, brand-name products like Adderall XR (extended-release) command prices exceeding USD 200 for a 30-count bottle, although insurance typically reduces patient out-of-pocket expenses.

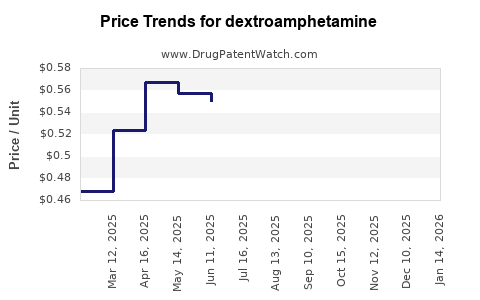

Pricing Trends Post-Patent Expiration

Following patent expiry, wholesale and retail prices experienced reductions of approximately 50-70%. The entry of multiple generic manufacturers stabilizes prices, making dextroamphetamine substantially more affordable for healthcare systems.

Future Price Projections

Factors Influencing Price Trajectory

-

Patent and Formulation Changes: While the original patents for immediate-release formulations have expired, novel sustained-release (SR) and abuse-deterrent formulations are under development, potentially extending exclusivity and maintaining higher prices.

-

Regulatory Changes: Stricter controls, such as scheduling adjustments, could restrict supply or manufacturing quotas, affecting market supply and prices.

-

Market Competition: Increased generic proliferation tends to suppress prices, but limited number of manufacturers with DEA licenses may create oligopolistic conditions, supporting higher prices for certain formulations.

-

Emergence of Alternatives: Advances in non-stimulant ADHD medications (e.g., atomoxetine, guanfacine) could eventually limit demand for dextroamphetamine, exerting downward pressure on prices.

Price Forecasts (Next 5 Years)

-

Immediate-Release Dextroamphetamine: Prices are projected to stabilize or decline slightly, with retail prices remaining within USD 10-USD 20 for a 30-dose supply. The widespread availability of generics and insurance coverage will sustain affordability.

-

Extended-Release and Abuse-Deterrent Formulations: These are expected to command premium pricing—USD 150-USD 250—due to manufacturing complexity and patent protections. The pace of new formulation approvals will influence market premiums.

-

Impact of Patent Litigation and New Formulations: Patent litigations and delays in approval for novel formulations could prolong periods of higher prices for branded products. Conversely, patent lapses for certain formulations may accelerate price declines, especially in the US.

Long-term Outlook (Beyond 5 Years)

-

As multiple generic versions saturate the market, prices for immediate-release formulations will plateau, potentially approaching USD 5-10 per 30-dose pack.

-

The development and regulatory approval of alternative delivery mechanisms—such as transdermal patches or implantable devices—may alter the price dynamics in the mid to long term.

Market Opportunities and Challenges

Opportunities:

- Growing demand for ADHD medications due to increased diagnosis rates.

- Development of abuse-deterrent formulations extending market exclusivity.

- Potential expansion into emerging markets with rising mental health awareness.

Challenges:

- Stringent regulatory controls limiting new market entrants.

- Heightened scrutiny over prescription abuse and diversion.

- Competition from non-stimulant therapies and non-pharmacologic interventions.

Conclusion

The dextroamphetamine market is positioned at an inflection point driven by patent lapses, increasing generics penetration, and evolving formulation technologies. Prices for immediate-release formulations are expected to remain stable or decline slightly owing to competition, while innovative formulations could sustain higher price points for longer periods. Strategic market positioning, regulatory compliance, and understanding evolving prescribing trends are critical for stakeholders aiming to optimize profitability.

Key Takeaways

- The expiring patents for classic dextroamphetamine formulations have precipitated significant price reductions, enhancing affordability and broadening access.

- Abusiveness-deterrent and extended-release formulations are likely to maintain higher prices, supported by ongoing patent protections and technological innovation.

- Regulatory controls over Schedule II substances continue to influence manufacturing and distribution, impacting supply and pricing.

- Market growth is driven by increasing ADHD diagnoses, though future shifts toward non-stimulant therapies may temper demand.

- Manufacturers should monitor patent statuses, formulation innovations, and regulatory developments to maximize market opportunities.

FAQs

1. How have patent expirations impacted dextroamphetamine prices?

Patent expirations have led to the influx of generic versions, significantly reducing prices by approximately 50-70%, thereby making therapy more affordable.

2. Are there any upcoming innovations that could influence dextroamphetamine pricing?

Yes. Development of abuse-deterrent and extended-release formulations, along with novel delivery mechanisms, can extend exclusivity periods and support premium pricing.

3. What are the primary factors constraining new market entry for dextroamphetamine?

Strict scheduling regulations, licensing requirements, and the potential for diversion limit new entrants and influence market competition.

4. How does insurance coverage affect the retail price for patients?

Insurance plans typically negotiate discounts, resulting in out-of-pocket costs often much lower than retail prices. This dynamic sustains consistent demand despite high list prices.

5. What is the preference trend among prescribers—immediate-release vs. extended-release dextroamphetamine?

Extended-release formulations are preferred for convenience and adherence, and they generally command higher prices, but immediate-release variants are favored for flexibility and lower cost.

References

[1] Grand View Research. ADHD therapeutics market size & trends. 2021.

[2] IQVIA Institute. The Use of Stimulus and Nontreatment Medications in Mental Health. 2022.