Last updated: July 27, 2025

Introduction

Desmopressin acetate, a synthetic analog of the vasopressin hormone, is primarily used to treat conditions such as diabetes insipidus, nocturnal enuresis, and certain bleeding disorders like von Willebrand disease and hemophilia A. Its therapeutic efficacy and established clinical profile have sustained robust demand, fostering a competitive and dynamic market landscape. This report examines current market trends, competitive positioning, regulatory factors, and provides price projections for desmopressin acetate over the next five years, offering insights crucial to stakeholders involved in manufacturing, distribution, and healthcare planning.

Market Overview

Current Market Size

The global desmopressin market was valued at approximately USD 320 million in 2022, with a compound annual growth rate (CAGR) of around 4.5% from 2018 to 2022, according to industry reports [1]. Growth is driven by increasing prevalence of the target conditions, advancements in drug delivery systems, and expanding healthcare infrastructure in emerging markets.

Key Therapeutic Segments

- Diabetes Insipidus: The largest segment, representing over 60% of total sales, driven by the drug’s efficacy in reducing urine production.

- Bleeding Disorders: Including hemophilia A and von Willebrand disease, accounting for roughly 25%, with demand linked to advanced treatment protocols.

- Nocturnal Enuresis: Estimated at 15%, particularly in pediatric populations.

Geographical Distribution

North America leads the market, contributing approximately 40% of revenue, propelled by high diagnosis rates and insurance coverage. Europe follows, with about 30%. Emerging markets in Asia-Pacific and Latin America are experiencing rapid growth, fueled by increasing awareness and affordability of treatment.

Competitive Landscape

Major pharmaceutical players include Ferring Pharmaceuticals, Pfizer, and Sandoz, with both branded and generic formulations available. Ferring holds significant market share due to its early entry and continuous innovation. The generic segment is expanding as patent expirations and regulatory approvals facilitate new entrants, intensifying competition and influencing pricing dynamics.

Regulatory and Patent Landscape

- Patents and Exclusivity: Ferring’s patents for specific formulations and delivery systems expire between 2023-2025, opening up opportunities for generics.

- Regulatory Approvals: Stringent registration procedures in different jurisdictions require localized clinical data, impacting entry timelines and market penetration strategies.

Market Drivers and Challenges

Drivers

- Rising prevalence of conditions such as diabetes insipidus and bleeding disorders.

- Advances in administration routes, e.g., nasal sprays enhancing patient compliance.

- Expanding healthcare infrastructure in emerging markets.

Challenges

- Price sensitivity in developing regions.

- Stringent regulatory hurdles, especially concerning biosimilars.

- Competition from alternative therapies, including desmopressin-like agents.

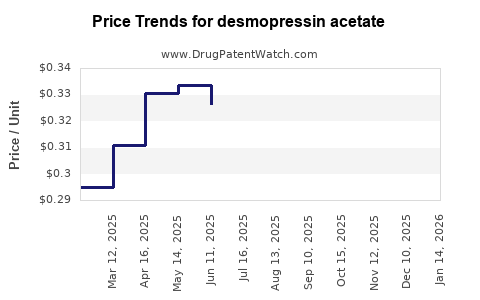

Price Trends and Projections

Current Pricing Dynamics

In North America, the average wholesale price (AWP) for branded desmopressin acetate nasal spray ranges between USD 50-70 per unit, with generic products selling for approximately 40% less. Injectable formulations cost roughly USD 10-15 per vial. Pricing varies by formulation and dosage, with some discounts available through insurance and institutional purchasing agreements [2].

Factors Influencing Future Pricing

- Patent Expiries: Expected between 2023-2025, will catalyze generic entry and drive prices downward.

- Regulatory Pathways: Streamlined approvements for biosimilars could further influence pricing.

- Manufacturing Costs: Advances in synthesis and manufacturing efficiencies will moderate price reductions.

- Market Demand: Steady growth ensures volume-driven revenues, potentially offsetting unit price declines.

Price Projections (2023-2028)

| Year |

Expected Average Price (USD) per Unit |

Major Factors |

| 2023 |

$50-$70 (Brand), $30-$45 (Generic) |

Patent expiries, market penetration |

| 2024 |

$45-$65, $25-$40 |

Increased biosimilar competition |

| 2025 |

$40-$60, $20-$35 |

Expanded biosimilar approvals |

| 2026 |

$35-$55, $15-$30 |

Market saturation, cost reduction |

| 2027 |

$30-$50, $10-$25 |

Price stabilization, volume gains |

| 2028 |

$25-$45, $10-$20 |

Mature market, competitive pricing |

Note: These projections are contingent upon regulatory actions, patent landscapes, and market acceptance of biosimilars and generics.

Strategic Implications for Stakeholders

- Manufacturers: Investing in biosimilar development and optimizing production to capitalize on patent cliffs.

- Distributors: Adjusting pricing strategies in response to competitive pressures and ensuring robust supply chains.

- Healthcare Providers: Emphasizing personalized treatment plans that consider cost and access considerations.

- Regulators: Facilitating pathways for biosimilar approval to enhance market competition and affordability.

Regulatory and Policy Considerations

Streamlined approval processes for biosimilars and policies promoting market competition will be pivotal. Countries adopting policies similar to the European Medicines Agency (EMA)’s biosimilar guidelines or the US FDA’s biosimilar pathway are likely to see accelerated entry of lower-cost alternatives, impacting overall pricing and market dynamics.

Key Factors Impacting Future Market Dynamics

- Patent expirations create opportunities for affordable generics.

- Emerging markets’ healthcare infrastructure development broadens access.

- Regulatory environments will influence biosimilar adoption.

- Innovation in delivery systems (e.g., nasal sprays, subcutaneous injections) improves patient adherence and market expansion.

- Political and economic factors, such as healthcare reforms and pricing controls, can influence pricing strategies.

Conclusion

The desmopressin acetate market is positioned for moderate growth driven by clinical demand, aging populations, and expanding healthcare access globally. Price reductions are inevitable as patent protections lapse, fostering increased adoption of generics and biosimilars. Stakeholders who strategically invest in biosimilar development, navigate regulatory pathways efficiently, and adapt to pricing shifts will benefit from this evolving landscape.

Key Takeaways

- The global desmopressin market is expected to grow at a CAGR of approximately 4-5% through 2028, driven by demographic and clinical demand.

- Patent expiration between 2023 and 2025 will catalyze increased generic and biosimilar competition, resulting in significant price declines.

- Pricing for branded formulations currently ranges from USD 50-70 per unit, with generics offering a 40% reduction, trending downward over the forecast period.

- Market expansion into emerging regions will further influence pricing and supply chain strategies.

- Stakeholders should monitor regulatory developments and patent landscapes closely to optimize market entry and pricing strategies.

FAQs

-

What are the primary indications for desmopressin acetate?

Desmopressin acetate is primarily used for diabetes insipidus, nocturnal enuresis, and certain bleeding disorders such as hemophilia A and von Willebrand disease.

-

When are patents for desmopressin expected to expire?

Patents are anticipated to expire between 2023 and 2025, creating opportunities for generic manufacturers.

-

How will biosimilars impact the market and pricing?

Biosimilars are expected to increase market competition, lead to lower prices, and improve access, contingent upon regulatory approval processes.

-

What are the key challenges facing desmopressin market growth?

Challenges include pricing pressures, regulatory hurdles for generics and biosimilars, and competition from alternative therapies.

-

How can stakeholders prepare for future market changes?

Stakeholders should invest in biosimilar development, stay informed on patent statuses, engage with regulatory developments, and adapt pricing and distribution strategies accordingly.

References

[1] MarketResearch.com, “Global Desmopressin Market Report,” 2022.

[2] IQVIA, “Healthcare Market Data,” 2022.