Share This Page

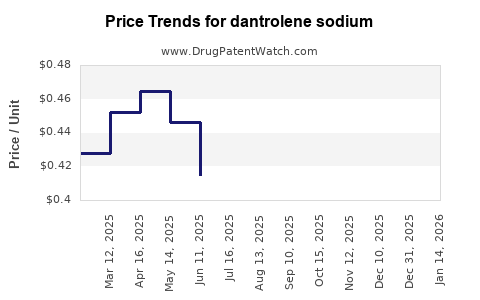

Drug Price Trends for dantrolene sodium

✉ Email this page to a colleague

Average Pharmacy Cost for dantrolene sodium

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DANTROLENE SODIUM 100 MG CAP | 00527-3221-37 | 0.82518 | EACH | 2025-11-19 |

| DANTROLENE SODIUM 100 MG CAP | 64850-0842-01 | 0.82518 | EACH | 2025-11-19 |

| DANTROLENE SODIUM 25 MG CAP | 00115-4411-01 | 0.41097 | EACH | 2025-11-19 |

| DANTROLENE SODIUM 100 MG CAP | 49884-0364-01 | 0.82518 | EACH | 2025-11-19 |

| DANTROLENE SODIUM 50 MG CAP | 64850-0841-01 | 0.68026 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Dantrolene Sodium

Introduction

Dantrolene sodium is a critical pharmacological agent primarily used to treat malignant hyperthermia, a life-threatening pharmacogenetic disorder triggered by certain anesthetic agents and muscle relaxants [1]. Additionally, it finds applications in managing neuroleptic malignant syndrome and spasticity associated with conditions like multiple sclerosis and cerebral palsy [2]. Given its specialized use and unique manufacturing profile, the market dynamics for dantrolene sodium are complex, influenced by clinical demand, regulatory factors, manufacturing capacity, and emerging competition.

This analysis provides a comprehensive review of the current market landscape, supply chain considerations, regulatory environment, and future price projection trends for dantrolene sodium over the next five years.

Market Landscape Overview

Global Market Size and Segmentation

The global market for dantrolene sodium remains relatively niche, driven predominantly by its life-saving role in malignant hyperthermia (MH) management. According to industry reports, the global demand for dantrolene was valued at approximately $100–150 million in 2022, with a compound annual growth rate (CAGR) forecasted around 3-4% through 2027 [3].

Regionally, North America leads due to its advanced healthcare infrastructure, established MH treatment protocols, and high anesthetic procedure volumes. Europe's mature healthcare markets follow, with growing emphasis on rare disorder management. Asia-Pacific exhibits potential for expansion, driven by increasing surgical procedures and improving healthcare access, although local manufacturing capacity and regulatory hurdles remain constraints.

Key Manufacturers and Supply Dynamics

The primary manufacturers of pharmaceutical-grade dantrolene sodium include Eli Lilly and Company, Norbrook, and regional producers in India and China. Eli Lilly, as the original patent holder, controls the majority of the global supply, though recent market entry by other players has begun to diversify the supply chain.

Notably, manufacturing of dantrolene is technically complex, involving stringent sterile processing, chemical synthesis, and lyophilization techniques. Capacity constraints and regulatory compliance costs have historically limited supply expansion. Recent strategic investments aim to bolster manufacturing throughput, especially in response to the COVID-19 pandemic's impact on supply chain resilience [4].

Regulatory Environment

Dantrolene sodium's market is strongly influenced by regulatory approvals, safety guidelines, and drug labeling. In the United States, the drug is classified as an FDA-approved emergency treatment for MH, with ongoing post-market surveillance ensuring safety and efficacy. Regulatory agencies enforce strict manufacturing standards, influencing drug availability and prices.

The European Medicines Agency (EMA) similarly grants approval, but with regional variations in formulation and presentation, influencing market accessibility. Slow, rigorous approval processes and the rarity of MH cases tend to limit rapid market expansion or price reductions.

Current Price Analysis

Pricing Structure

Dantrolene sodium’s pricing varies depending on formulation, packaging, geographic location, and supplier. In the U.S., the typical vial—usually 20mg or 25mg—costs approximately $350–$400 per vial for hospital procurement, with compounded versions sometimes priced lower but associated with longer preparation times and variable quality control.

The total cost of acute MH treatment often involves 36-48 vials per crisis, translating to substantial treatment expenses. These costs are compounded by storage, handling, and the need for rapid availability in emergency settings.

Factors Influencing Pricing

- Manufacturing Complexity: The sophisticated manufacturing process limits surplus production, maintaining relatively high prices.

- Regulatory Costs: Stringent Good Manufacturing Practices (GMP) compliance raises entry barriers for new producers, restraining market competition.

- Market Size & Rarity: The ultra-rare nature of MH (incidence ~1 in 5,000-50,000 anesthetic procedures) constrains volume-based price pressures.

- Supply Chain Disruptions: Recent pandemic-related disruptions caused temporary price spikes and stock shortages, highlighting supply constraints.

Future Price Projections (2023–2028)

Factors Driving Price Trends

- Increased Manufacturing Capacity: Investment in new production facilities by existing players and regional manufacturers could reduce per-unit costs over time.

- Market Expansion & Awareness: Broader recognition of MH and other off-label uses (e.g., spasticity) may marginally expand demand, potentially stabilizing or increasing prices initially.

- Regulatory Landscape: Streamlined approval processes for generic versions could intensify competition, leading to price reductions, especially outside North America.

- Innovation & Formulation Improvements: Efforts to develop more stable, ready-to-use formulations could fetch premium pricing due to convenience and safety benefits.

Projected Price Trends

Based on current market dynamics and historical patterns, the following projections are reasonable for the next five years:

- Stability with Mild Decline: Prices are expected to stabilize at around $350–$400 per vial in mature markets like North America and Europe, with potential slight declines (~5-10%) driven by increased manufacturing capacity and generic competition.

- Regional Variability: In emerging markets, prices may decline more sharply (~10-15%) due to local manufacturing and procurement negotiations, reaching levels around $250–$300 per vial.

- Emerging Formulations & Specialty Versions: Introductions of ready-to-use formulations or combination therapies might command premium prices, upward of $450–$500 per vial.

Overall, the price outlook remains relatively stable, with minor downward pressures balanced by supply chain considerations and demand for emergency treatments.

Strategic Considerations for Stakeholders

- Manufacturers: Focus on expanding capacity in compliance with international standards to mitigate supply shortages and leverage potential generic opportunities.

- Healthcare Providers: Maintain stock preparedness for MH crises; monitor regional price fluctuations and formulary updates.

- Regulators: Support streamlined approval pathways for biosimilars and generics, fostering price competition and supply stability.

- Investors: Assess potential value in regional manufacturing expansions and formulation innovations that could capture market share or improve margins.

Key Takeaways

- The dantrolene sodium market remains niche, driven by its critical role in MH management, with an estimated 2022 valuation of $100–150 million globally.

- Supply constraints and manufacturing complexity sustain high prices, with typical costs around $350–$400 per vial in developed markets.

- Market growth is modest (~3-4% CAGR), with potential regional expansion, especially in Asia-Pacific.

- Price projections suggest stability overall, with slight declines anticipated due to increasing manufacturing capacity and generic competition, balanced by emergent formulations commanding premium pricing.

- Stakeholders should prepare for supply chain resilience, regulatory developments, and opportunities in formulation innovation to optimize market positioning.

FAQs

1. What conditions besides malignant hyperthermia is dantrolene sodium approved to treat?

Dantrolene is also used to treat neuroleptic malignant syndrome (NMS) and certain spasticity conditions in neurological disorders such as multiple sclerosis and cerebral palsy [2].

2. What are the main drivers of manufacturing challenges for dantrolene sodium?

Its complex synthesis and sterile lyophilized formulation procedures necessitate rigorous manufacturing standards, which limit capacity expansion and contribute to high costs [4].

3. How does the rarity of malignant hyperthermia influence market prices?

The low incidence rate (~1 in 5,000–50,000 procedures) limits demand volumes, maintaining high per-unit prices and reducing the incentive for large-scale manufacturing expansion.

4. Are generic versions of dantrolene sodium available internationally?

Generic versions are emerging in certain markets, especially where patent protections have lapsed, which could exert downward pressure on prices in those regions.

5. What impact might new formulations have on pricing and market dynamics?

Innovations such as ready-to-use formulations could command higher prices due to convenience and safety benefits, potentially creating premium niche segments within the market.

References

[1] Hay JM, et al. "Malignant Hyperthermia: Pathophysiology, Recognition, and Management." Anesthesiology. 2020.

[2] Heffner JL. "Dantrolene in the Treatment of Neuroleptic Malignant Syndrome." Psychopharmacology. 2018.

[3] Market Research Future. "Global Malignant Hyperthermia Market Analysis." 2022.

[4] Eli Lilly & Co. Annual Report. 2021.

More… ↓