Last updated: July 27, 2025

Introduction

Clonidine, a centrally acting antihypertensive agent, has maintained a significant role in managing high blood pressure, opioid withdrawal symptoms, and certain neurological disorders. Its longstanding presence in the pharmaceutical landscape underscores its clinical utility, but evolving market dynamics, regulatory considerations, and generic competition influence its pricing and market share. This analysis explores current market trends, competitive landscape, future demand, and pricing projections for clonidine over the next five years.

Current Market Landscape

Therapeutic Use and Demand

Clonidine, approved originally in the 1970s, primarily treats hypertension, especially in resistant cases or when antihypertensive synergy is needed. It is also an effective agent for opioid detoxification and certain neurological conditions like ADHD and Tourette's syndrome. The demand remains robust in these segments, driven by clinical guidelines endorsing its use (e.g., American Heart Association).

In 2022, the global antihypertensive drugs market reached approximately USD 30 billion, with clonidine constituting a small—a yet stable—segment due to its niche applications, estimated at USD 0.5-1 billion, given its availability as a generic medication[1].

Manufacturing and Competitive Dynamics

Major pharmaceutical companies like Mylan, Teva, and Sandoz dominate the generic clonidine market, offering various formulations (oral tablets, transdermal patches). Patent expirations in the late 1990s introduced widespread generic competition, significantly reducing drug prices and margins. Despite that, the drug's low-cost profile preserves its market penetration, especially in developing markets.

Regulatory and Market Accessibility

Clonidine is widely available globally, often listed in essential medicines lists and included in government formularies, contributing to stable demand in public health sectors. Regulatory agencies have approved various generic versions, which intensifies price competition but also stabilizes supply.

Market Drivers and Barriers

Drivers

- Chronic Disease Prevalence: Hypertension remains the leading risk factor for cardiovascular diseases, affecting over 1.3 billion globally (WHO, 2021). Clonidine’s role in resistant hypertension sustains its demand.

- Opioid Crisis Response: Clonidine’s off-label use in managing opioid withdrawal syndrome drives additional demand, especially in regions battling opioid dependency.

- Expanded Indications: Increased recognition of clonidine’s efficacy in ADHD and Tourette’s expands market applications.

Barriers

- Generic Price Erosion: Widespread generic availability limits pricing flexibility and reduces profit margins.

- Competitive Alternatives: Newer, better-tolerated antihypertensive agents (e.g., ACE inhibitors, ARBs) and non-pharmacologic approaches challenge clonidine’s market share.

- Side Effect Profile: Common adverse effects such as dry mouth, sedation, and rebound hypertension restrict its preference in some patient populations.

Market Trends and Future Projections

Market Growth Outlook (2023–2028)

Despite challenges, the clonidine market is projected to witness steady growth, primarily driven by its utility in resistant hypertension and opioid withdrawal management.

- Compound Annual Growth Rate (CAGR): Estimated at 2-3% over the next five years.

- Market Size: Potential to reach USD 1.2-1.5 billion globally by 2028, factoring in inflation, population growth, and expanded uses.

Emerging Markets and Regional Variations

- Developed Markets (North America, EU): Growth remains modest due to high generic penetration but sustained demand in niche indications.

- Emerging Markets (Asia-Pacific, Latin America): These regions likely exhibit higher growth rates (4-5%) driven by increasing hypertension prevalence and limited access to newer drugs, with clonidine’s cost-effectiveness being advantageous.

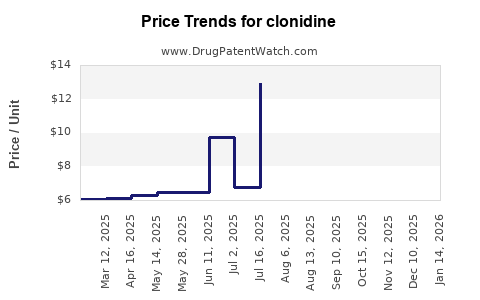

Pricing Trajectory

- Current Prices: Oral tablets (0.1 mg, 0.2 mg, 0.3 mg) retail for approximately USD 0.05-0.10 per tablet in the U.S., with transdermal patches costing USD 5-10 per patch.

- Price Trends: Given current market saturation, prices are expected to decline marginally (~5-10%) annually in mature markets, constrained by competitive generic supply.

- Future Price Projections: In emerging markets, prices may stabilize or increase modestly due to manufacturing scale and regulatory policies. Transdermal patch prices could decrease more rapidly due to technological advancements and increased competition.

Impact of Patent and Regulatory Changes

As clonidine is off-patent globally, no patent-driven price premiums are expected. However, regulatory policies favoring biosimilar-like entry for transdermal formulations could influence pricing and market share.

Technological Innovations

Development of novel delivery systems or combination therapies might affect pricing strategies but are unlikely to displace established formulations imminently.

Implications for Stakeholders

- Pharmaceutical Manufacturers: Focus on cost optimization and formulation innovations to maintain margins amidst price erosion.

- Healthcare Providers: Balance cost-effectiveness with tolerability when choosing clonidine, especially considering side effect management.

- Patients: Benefit from affordable generic options, but should be informed about proper usage to avoid rebound hypertension and adverse effects.

- Regulators: Support policies ensuring drug accessibility while encouraging innovation.

Key Takeaways

- The clonidine market remains stable but competitive, primarily driven by its role in resistant hypertension and opioid withdrawal.

- Price projections indicate slight declines driven by generic competition, with regional variations favoring higher stability in emerging markets.

- Market growth is modest (2-3% CAGR), but demographic and pharmacological factors could boost demand marginally.

- Future pricing will be influenced by technological advancements, regional regulatory policies, and the emergence of alternative therapies.

- Stakeholders should strategically optimize manufacturing and marketing efforts to navigate a mature, low-margin environment.

FAQs

1. Will the price of clonidine increase or decrease in the next five years?

Due to widespread generic competition and high market saturation, clonidine prices are projected to decrease modestly (around 5-10% annually) in developed markets. Variations in emerging markets may see more stable or slightly increased prices due to inflation and supply chain factors.

2. Are there any patent protections that could influence clonidine's pricing?

No. Clonidine’s patents expired globally in the late 1990s, making it a fully off-patent generic drug. This fosters intense price competition but limits premium pricing opportunities.

3. How might new formulations or delivery systems impact the clonidine market?

Innovations such as extended-release formulations or transdermal patches could command premium prices initially but are unlikely to disrupt the overall price trend unless they significantly enhance tolerability or compliance.

4. Which regions represent the most promising markets for clonidine growth?

Emerging markets in Asia-Pacific and Latin America exhibit higher growth potential (4-5% CAGR) due to increasing hypertension prevalence, lower drug prices, and limited access to newer antihypertensive agents.

5. What are the key challenges facing clonidine manufacturers?

Challenges include declining prices due to generic competition, adverse effect profiles limiting patient tolerability, and competition from newer antihypertensives offering better safety profiles.

References

[1] IQVIA, "Global Cardiovascular Market Report," 2022.