Last updated: July 27, 2025

Introduction

Cephalexin, a first-generation cephalosporin antibiotic, remains a cornerstone in treating a broad spectrum of bacterial infections, including respiratory tract infections, skin infections, and urinary tract infections. As antibiotic resistance evolves and global demand fluctuates, understanding the market landscape and future pricing trajectories of cephalexin is crucial for pharmaceutical stakeholders, healthcare providers, and investors aiming for strategic optimization.

Current Market Landscape

Global Market Overview

The global cephalexin market was valued at approximately USD 0.5 billion in 2022, with a compound annual growth rate (CAGR) estimated around 3.5% from 2023 to 2030. This growth is driven by increasing prevalence of bacterial infections worldwide, especially in regions with limited healthcare infrastructure, and the continued reliance on oral antibiotics for outpatient care.

North America dominates the market, owing to high antibiotic consumption, advanced healthcare systems, and regulatory approvals. Asia-Pacific exhibits significant growth potential, fueled by rising infectious disease incidence, expanding pharmaceutical manufacturing, and increasing healthcare access.

Manufacturing and Supply Dynamics

Several pharmaceutical companies manufacture cephalexin, with generic formulations accounting for a majority of market share post-patent expiration of original branded versions. Key players include Sandoz (Novartis), Mylan, Teva Pharmaceuticals, and local generic producers in emerging markets.

Supply chain disruptions—such as raw material shortages and regulatory challenges—have intermittently impacted supply availability, influencing market prices and stability.

Regulatory and Patent Landscape

Cephalexin's patent expiration in most markets has facilitated a surge in generic manufacturing, leading to market consolidation around cost-competitive producers. No recent patent filings or exclusivity periods are in effect, supporting price competitiveness but also contributing to price erosion over time.

Market Drivers and Challenges

Drivers

- Rising Antimicrobial Resistance (AMR): While AMR complicates treatment, cephalexin remains effective against common susceptible bacteria, sustaining demand.

- Expanding Outpatient Prescriptions: Increased outpatient treatment protocols favor oral antibiotics, boosting cephalexin sales.

- Cost-Effectiveness: Its affordability compared to newer antibiotics maintains its preferred status in many regions.

Challenges

- Antibiotic Stewardship Programs: Stricter prescribing guidelines aim to curb unnecessary antibiotic use, potentially reducing overall demand.

- Competition from Alternative Antibiotics: Drugs like cefadroxil and cephalosporins with different spectrums of activity challenge cephalexin's market share.

- Resistance Development: Emergence of resistant strains reduces clinical efficacy, potentially decreasing usage.

Market Segmentation

By Formulation

- Capsules: Most common, accounting for approximately 60% of sales.

- Syrups: Popular in pediatric care.

- Powders & Suspensions: Used for specific patient populations.

By Distribution Channel

- Hospital pharmacies: Approx. 40%

- Retail pharmacies: Around 50%

- Online & direct sales: Emerging, especially in developed markets.

Price Trends and Future Projections

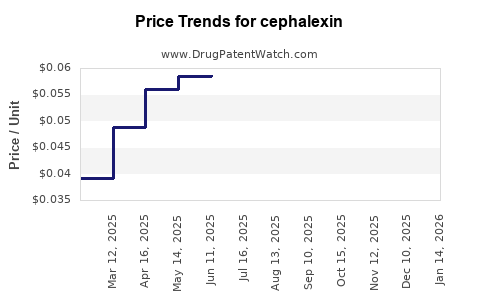

Historical Pricing Trends

Over the past decade, cephalexin prices have steadily declined due to intensified generic competition. In the US, the average retail price of a standard 500 mg capsule decreased from USD 0.20 in 2013 to about USD 0.07 in 2022, reflecting a 65% reduction. Similar trends occur globally, especially in price-sensitive markets.

Factors Influencing Future Pricing

- Increased generic competition will likely maintain downward pressure.

- Raw material costs and manufacturing efficiencies will influence price stability.

- Regulatory changes and quality standards may impose cost adjustments.

- Emerging resistance could lead to drug discontinuation or reduced prescribing, impacting volume and price.

Projected Price Outlook (2023-2030)

- Short-term (2023-2025): Prices are anticipated to stabilize with minor declines (~2-3% annually), as markets reach saturation and supply chains stabilize.

- Mid-term (2026-2028): A potential plateau or slight increase may occur if resistance impacts efficacy or if new formulations introduce premium pricing.

- Long-term (2029-2030): Prices could decline modestly or stabilize, influenced by significant generics entry, or even see incremental increases if resistance reduces supply efficacy or demand.

Emerging Trends and Strategic Insights

- Biotechnological Innovations: Development of formulations with extended release or combination therapies could alter pricing dynamics.

- Regulatory Incentives: Governments may implement price controls or reimbursement policies favoring low-cost generics.

- Market Penetration in Emerging Economies: Continued expansion in Asia, Africa, and Latin America offers growth but pressures prices downward due to price sensitivity.

Key Market Players and Competitive Landscape

| Company |

Market Share (Est.) |

Notable Activities |

| Sandoz (Novartis) |

~20% |

Broad generic portfolio, focused on cost-competitiveness |

| Mylan (now part of Viatris) |

~15% |

Extensive distribution network, lower-price offerings |

| Teva Pharmaceuticals |

~10% |

Focus on emerging markets, aggressive pricing strategies |

| Local generic manufacturers |

Remaining |

Price competition, regulatory navigation in regional markets |

Regulatory and Economic Considerations

Pricing strategies are heavily influenced by regional regulations. Countries with government-regulated drug prices (e.g., India, China, parts of Europe) tend to have lower retail prices, constraining profit margins but ensuring market penetration. Conversely, markets with less price regulation may see higher prices, driven by payers and formulary negotiations.

Economic factors such as inflation, currency exchange fluctuations, and raw material costs also impact pricing stability.

Conclusion

The cephalexin market is characterized by mature, competitive dynamics with steady demand driven by outpatient needs. Price projections suggest a largely stable or slightly decreasing trajectory over the next decade due to prevalent generic competition and market saturation. However, resistance patterns and regulatory shifts will significantly influence future pricing strategies.

Key Takeaways

- The cephalexin market is mature with high generic penetration, ensuring consumer-friendly prices.

- Price declines are expected to continue marginally, emphasizing cost competitiveness for manufacturers.

- Resistance development could affect demand and influence pricing, especially if alternative therapies emerge.

- Emerging markets present opportunities for volume growth, albeit with downward price pressures.

- Strategic positioning requires monitoring resistance trends, regulatory changes, and supply chain stability.

FAQs

1. Will the price of cephalexin increase due to antimicrobial resistance?

While resistance may diminish clinical efficacy in some settings, it is unlikely to directly cause price increases. Instead, resistance could lead to reduced prescribing or the need for alternative therapies, indirectly affecting demand and pricing.

2. How does patent expiry influence cephalexin prices?

Patent expiration typically results in increased generic competition, driving prices downward. The absence of recent patents or exclusivities indicates a mature, price-competitive market landscape.

3. Are there new formulations of cephalexin expected to impact the market?

Developments like extended-release formulations or combination therapies could command higher prices temporarily, but widespread adoption depends on clinical advantages and regulatory approvals.

4. What demographic factors influence future demand for cephalexin?

Growing populations, increasing healthcare access in emerging markets, and aging populations susceptible to bacterial infections will sustain demand, though the rate may plateau due to competition and stewardship efforts.

5. How might regulatory changes impact cephalexin’s pricing and availability?

Stringent price controls may suppress profits but expand access. Conversely, relaxed regulations could allow for marginal price increases or the introduction of premium products, affecting market dynamics.

References

[1] MarketResearch.com. "Global Cephalexin Market Report," 2022.

[2] Grand View Research. "Antibiotics Market Size & Share," 2023.

[3] WHO. "Antimicrobial Resistance: Global Report," 2019.

[4] IMS Health. "Prescription Trends for Cephalexin," 2022.

[5] European Medicines Agency. "Drug Price Regulations," 2021.