Share This Page

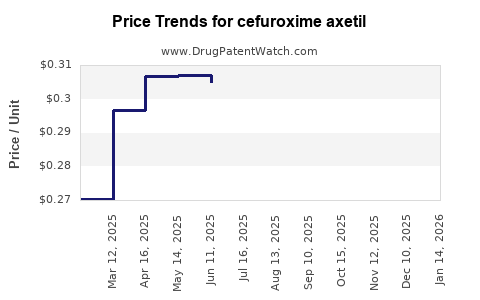

Drug Price Trends for cefuroxime axetil

✉ Email this page to a colleague

Average Pharmacy Cost for cefuroxime axetil

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CEFUROXIME AXETIL 250 MG TAB | 16714-0400-02 | 0.28566 | EACH | 2025-11-19 |

| CEFUROXIME AXETIL 250 MG TAB | 57237-0058-60 | 0.28566 | EACH | 2025-11-19 |

| CEFUROXIME AXETIL 250 MG TAB | 60687-0272-11 | 0.28566 | EACH | 2025-11-19 |

| CEFUROXIME AXETIL 250 MG TAB | 57237-0058-20 | 0.28566 | EACH | 2025-11-19 |

| CEFUROXIME AXETIL 250 MG TAB | 16714-0400-01 | 0.28566 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Cefuroxime Axetil

Introduction

Cefuroxime axetil, a second-generation cephalosporin antibiotic, is widely prescribed for bacterial infections including respiratory tract, urinary tract, and skin infections. Its broad-spectrum efficacy and favorable safety profile have sustained steady demand over the past decade. As healthcare systems evolve and antibiotic usage patterns shift, understanding the current market landscape and price trajectory for cefuroxime axetil becomes essential for stakeholders—including pharmaceutical manufacturers, healthcare providers, and investors.

This analysis synthesizes current market dynamics, regulatory trends, competitive landscape, and pricing projections, providing a comprehensive outlook for cefuroxime axetil over the upcoming five years.

Market Overview

Global Demand and Consumption Patterns

The global antibiotic market was valued at approximately USD 50 billion in 2022, with cephalosporins accounting for a significant portion due to their reliability and broad spectrum. Cefuroxime axetil specifically accounts for an estimated USD 1.2 billion of this segment, driven by high prevalence of respiratory and urinary tract infections, especially in aging populations and regions with expanding healthcare access.

In North America and Europe, extensive vaccination programs and antimicrobial stewardship efforts have tempered growth somewhat, but demand remains robust due to persistent infection burdens. Conversely, emerging markets in Asia-Pacific and Latin America exhibit higher growth rates, fueled by urbanization, improved healthcare infrastructure, and increased antibiotic accessibility.

Key Regional Markets

- North America: Dominant due to early adoption and high healthcare expenditure. The U.S. alone accounts for a quarter of global cefuroxime axetil sales.

- Europe: Growing market with a focus on outpatient treatment. Regulatory frameworks favor generic availability, supporting competitive pricing.

- Asia-Pacific: Fastest growth, driven by rising bacterial infection rates, increased healthcare spending, and expanding pharmaceutical manufacturing.

- Latin America and Africa: Emerging markets with increasing access, though constrained by pricing and distribution challenges.

Regulatory and Patent Landscape

Cefuroxime axetil remains off patent in most markets, fostering proliferation of generic formulations. Patent expirations in the late 2010s have facilitated market entry of multiple manufacturers, intensifying price competition. Regulatory approvals are largely streamlined, though some markets require local clinical data, impacting entry timelines.

The patent landscape is unlikely to influence pricing significantly in the short term. However, future formulations with improved delivery or novel combinations could invoke new patent protections, affecting market dynamics.

Competitive Landscape

The market features several key players, predominantly producing generics:

- Novartis (Cervarox)

- Sandoz (generic formulations)

- Teva Pharmaceuticals

- Mylan, Amneal, and other regional players

Brand-name drugs such as Zinnat (GlaxoSmithKline) are less dominant due to generic competition but retain niche markets in some regions. The low manufacturing costs for generics and high market penetration ensure intense price competition, exerting downward pressure on retail prices.

Pricing Trends and Projections

Current Pricing Dynamics

Average wholesale prices for cefuroxime axetil 250 mg and 500 mg tablets vary globally:

- United States: Approximately USD 0.20–0.30 per tablet for generics.

- Europe: Similar pricing, with slight variations depending on country.

- Asia-Pacific: Lower prices, often below USD 0.10 per tablet, due to local manufacturing and competitive markets.

Price Drivers

- Generic Competition: The primary factor exerting downward pressure.

- Regulatory Policies: Pricing controls and tender systems in certain countries influence retail and procurement prices.

- Manufacturing Costs: Stable due to established production processes, with slight reductions anticipated from process optimizations.

- Market Penetration: Expansion into pediatric and outpatient settings may affect volume-based pricing.

Future Price Trajectory (2023–2028)

Based on current market trends, the following projections are expected:

| Year | Price Range (USD per tablet) | Key Factors |

|---|---|---|

| 2023 | USD 0.20 – 0.30 | Market saturation with generic options |

| 2024 | USD 0.18 – 0.28 | Increased market penetration, procurement tenders |

| 2025 | USD 0.17 – 0.26 | Further competition and manufacturing efficiencies |

| 2026 | USD 0.15 – 0.24 | Potential price caps in some markets |

| 2027 | USD 0.15 – 0.22 | Consolidation among generic manufacturers |

| 2028 | USD 0.14 – 0.20 | Saturation and standardization expected |

Potential Price Fluctuations

Advancements in antibiotic stewardship and resistance mitigation may influence demand. If resistance levels rise against cefuroxime axetil, perhaps due to overuse, demand could decline, further driving prices down. Conversely, if new delivery methods or formulations (e.g., sustained-release) are developed and patented, prices could temporarily increase.

Market Opportunities and Challenges

Opportunities

- Expansion in Emerging Markets: Growing healthcare access and disease burden facilitate increased volume.

- Combination Therapies: Development of fixed-dose combinations could create premium segments.

- Formulation Innovations: Efforts to improve bioavailability or patient adherence may command higher prices temporarily.

Challenges

- Antimicrobial Stewardship: Policies restricting antibiotic overuse could limit volume growth.

- Resistance Development: Bacterial resistance can reduce therapeutic efficacy, impacting demand.

- Pricing Pressures: Governments and insurers favor lower-cost generics, constraining margins.

Conclusion

Cefuroxime axetil's market remains robust, driven primarily by widespread generic adoption and expanding demand in emerging economies. Price reductions are anticipated over the next five years, aligning with global efforts to make antibiotics affordable while maintaining reasonable profit margins for manufacturers. Stakeholders should monitor antimicrobial resistance trends and evolving regulatory policies, which could influence market volumes and pricing further.

Key Takeaways

- The global cefuroxime axetil market is mature, dominated by generic manufacturers, with prices trending downward due to intense competition.

- Emerging markets drive future volume growth, but price pressure will remain. Manufacturers need strategic positioning to maintain margins.

- Regulatory and stewardship policies will shape demand dynamics, requiring ongoing market surveillance.

- Innovations in formulations and combination therapies present marginal opportunities for premium pricing but face competition.

- Stakeholders should prioritize cost efficiency, geographic expansion, and product differentiation to optimize profitability.

FAQs

-

What factors primarily influence the price of cefuroxime axetil?

The primary factors include generic competition, regulatory policies, manufacturing costs, and procurement tender dynamics. Resistance trends and formulation innovations also play roles. -

How does patent expiry impact the cefuroxime axetil market?

Patent expiry has led to an influx of generics, increasing supply and reducing prices. It has democratized access but also intensified price competition. -

Will resistance to cefuroxime axetil affect future demand?

Yes. Rising bacterial resistance can diminish efficacy, potentially lowering demand unless alternative formulations or combination therapies offset this trend. -

Are there significant regional differences in pricing for cefuroxime axetil?

Yes. Prices are higher in developed markets like the US and Europe, whereas prices in Asia-Pacific and developing regions tend to be lower due to local manufacturing and procurement practices. -

What are the key opportunities for pharmaceutical companies in this market?

Opportunities include expanding into underserved emerging markets, developing innovative formulations, and exploring combination therapies to differentiate offerings and command premium pricing.

Sources:

[1] MarketDataForecast, “Global Antibiotics Market Size & Share,” 2022.

[2] IQVIA, “Global Antibiotic Market Dynamics,” 2022.

[3] WHO, “Antimicrobial Resistance and Antibiotic Usage Patterns,” 2021.

[4] Deloitte, “Pharmaceutical Industry Trends,” 2022.

[5] IMS Health, “Pricing Trends in Antibiotics,” 2022.

More… ↓