Last updated: July 28, 2025

Introduction

Carvedilol, a non-selective beta-adrenergic blocker with alpha-1 blocking activity, is widely prescribed for heart failure, hypertension, and post-myocardial infarction management. Since its approval by the FDA in 1995, carvedilol has become a cornerstone in cardiovascular therapy. The drug's market dynamics are influenced by evolving clinical guidelines, patent status, emerging competitors, and broader healthcare trends. This report provides an in-depth analysis of the current market landscape and offers structured price projections for carvedilol over the coming five years.

Market Overview

Global Market Size

The global carvedilol market was valued at approximately USD 540 million in 2022, reflecting its widespread use across developed and emerging markets. The North American region dominates due to high prescription rates, advanced healthcare infrastructure, and robust reimbursement systems. Europe accounts for a significant share, driven by widespread adoption of evidence-based heart failure therapies. The Asia-Pacific region is witnessing rapid growth, propelled by increased cardiovascular disease prevalence and expanding healthcare coverage.

Market Drivers

-

Rising Cardiovascular Disease Prevalence: The incidence of heart failure, hypertension, and post-MI conditions continues to escalate globally, fueling demand for beta-blockers like carvedilol.

-

Guideline Endorsements: Clinical guidelines from the American Heart Association (AHA) and European Society of Cardiology (ESC) increasingly recommend carvedilol for heart failure with reduced ejection fraction (HFrEF), boosting prescriptions.

-

Preference for Generic Formulations: Patent expirations in many jurisdictions transitioned carvedilol from branded to generic, expanding access and market penetration.

Market Constraints

-

Generic Competition: As patents expired in numerous markets, generic formulations have substantially eroded the branded drug’s market share, leading to price competition.

-

Alternative Therapies: Introduction of new drugs, such as nebivolol and bisoprolol, offers clinicians alternative options, though carvedilol's unique profile sustains its relevance.

-

Regulatory and Pricing Challenges: Variability in reimbursement policies and pricing regulations across markets influence overall sales and profitability.

Product Landscape

Formulations and Patent Status

Carvedilol is available in multiple formulations, including tablets and extended-release capsules. Its patent expiration timeline varies by jurisdiction:

- United States: Patents expired in 2007, leading to a surge in generic availability.

- European Union: Similar timeline with generic competition emerging around 2008–2010.

- Emerging Markets: Patent protections vary, with some extending into the late 2010s, allowing for branded sales in certain regions.

Manufacturers

Major pharmaceutical companies such as Mylan, Teva Pharmaceuticals, and Sandoz dominate the generic carvedilol market. The branded market, historically led by GlaxoSmithKline (brand name: Coreg), now faces significant generic competition.

Market Trends and Future Outlook

Emerging Trends

-

Increased Adoption in Developing Countries: As healthcare infrastructure improves, the prescription of carvedilol is expanding in Asia, Latin America, and Africa.

-

Shift Toward Combination Therapies: Increasing use of fixed-dose combinations in cardiovascular disease management may influence carvedilol's standalone market share.

-

Bioequivalence and Formulation Innovations: Generic manufacturers focus on bioequivalent, cost-effective formulations, driving down prices further.

Regulatory and Reimbursement Impacts

Reimbursement policies increasingly favor generic drugs, supporting price reductions and widespread adoption. However, evolving regulatory environments with drug pricing controls could limit revenue growth.

Price Projection Analysis

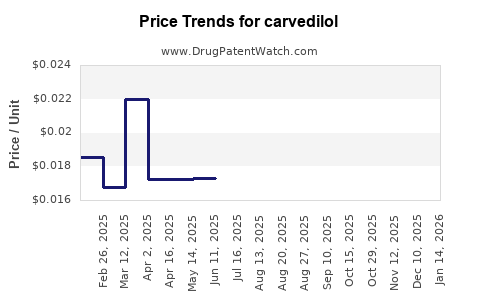

Historical Pricing Trends

-

Branded Carvedilol: Historically priced higher (approx. USD 2–3 per tablet in the U.S.), with significant reductions post-patent expiry (~USD 0.20–0.50 per tablet for generics).

-

Generic Market: Prices have stabilized around USD 0.10–0.20 per tablet in mature markets but may decline further due to heightened competition.

Forecast Assumptions

- Patent Status: Continuation of patent expiration in most markets by 2010–2015, with no significant new patent protections.

- Market Penetration: Increased generic penetration, especially in emerging markets.

- Reimbursement Economics: Price sensitivity and healthcare cost containment measures will exert downward pressure.

Price Projection (2023–2028)

| Year |

Average Price per Tablet |

Notes |

| 2023 |

USD 0.12 |

Stable with minor fluctuations, primarily driven by regional policy adjustments. |

| 2024 |

USD 0.11 |

Slight decline attributable to intensified competition. |

| 2025 |

USD 0.10 |

Market stabilization anticipated as supply chain equilibrates. |

| 2026 |

USD 0.09 |

Potential for further reductions in cost-sensitive markets. |

| 2027 |

USD 0.09 |

Marginal decline, with some stabilization due to market saturation. |

| 2028 |

USD 0.08 |

Continued price pressure; premium pricing unlikely. |

Note: These projections assume no significant regulatory or market upheavals and baseline global economic stability.

Implications for Stakeholders

-

Manufacturers: Expect margins to compress due to increased generic competition; innovation in formulations may be critical for differentiation.

-

Healthcare Providers: Favorable pricing enhances accessibility; clinicians can prioritize evidence-based prescribing without cost constraints.

-

Payers and Policy Makers: Price pressures contribute to cost savings but may challenge supply chain resilience and formulary management.

Key Challenges and Opportunities

- Challenges: Margin erosion for branded pharmaceuticals, pricing regulation mandates, and substitution policies.

- Opportunities: Growing demand in emerging markets, potential for biosimilar or innovative delivery systems, and expanding indications.

Conclusion

The carvedilol market is poised for continued price erosion driven by generic proliferation, compliance with healthcare cost initiatives, and increasing adoption in developing nations. While revenue growth may slow, the drug's entrenched position in cardiovascular treatment paradigms underscores sustained demand. Stakeholders must navigate competitive pressures, regulatory landscapes, and evolving clinical practices to optimize market strategies.

Key Takeaways

- Carvedilol's US patent expiry (~2007) catalyzed a shift toward low-cost generics, significantly reducing prices.

- The global market remains sizable (~USD 540 million in 2022) with growth driven primarily by emerging markets.

- Price projections indicate a gradual decline of approximately 20% over the next five years, stabilizing around USD 0.08–0.09 per tablet.

- Industry players should focus on formulation innovation and emerging market penetration to sustain margins.

- Healthcare systems increasingly favor generics, ensuring ongoing access but intensifying pricing pressures.

Frequently Asked Questions

-

What factors influence carvedilol's pricing in different markets?

Reimbursement policies, patent status, local competition, healthcare infrastructure, and regulatory environment primarily drive pricing variations.

-

Will branded carvedilol regain market share in the future?

Unlikely, given widespread availability of cost-effective generics and no recent patent protections, though branding remains relevant in specific niche markets.

-

How does the emergence of biosimilars impact carvedilol?

As a small-molecule drug, carvedilol is not subject to biosimilar competition; however, similar drugs may emerge as alternatives.

-

Are there promising formulation innovations for carvedilol?

Extended-release formats and combination therapies are areas of ongoing research, but current market dynamics favor cost reduction and bioequivalent generics.

-

What is the potential for carvedilol in emerging markets?

Significant growth potential exists due to rising cardiovascular disease prevalence, expanding healthcare coverage, and cost sensitivity favoring generic adoption.

References

[1] Grand View Research, "Carvedilol Market Size & Share Analysis," 2023.

[2] U.S. Food and Drug Administration, Patent Expiry Data, 2022.

[3] European Medicines Agency, Summary of Markets Authorization, 2022.

[4] IMS Health, "Global Cardiology Drug Market Trends," 2022.

[5] World Health Organization, "Cardiovascular Diseases Fact Sheet," 2022.