Last updated: July 28, 2025

Introduction

Bisoprolol fumarate, a selective beta-1 adrenergic receptor blocker, is a cornerstone in the management of cardiovascular diseases such as hypertension, angina pectoris, and heart failure. Its efficacy, favorable side-effect profile, and once-daily dosing have sustained its prominence within the pharmacological landscape. This comprehensive market analysis examines the current global positioning of bisoprolol fumarate, evaluates competitive forces, and presents forward-looking price projections grounded in market dynamics, manufacturing trends, regulatory factors, and emerging therapeutic developments.

Market Overview

Global Market Size and Growth Trajectory

The bisoprolol fumarate market forms a significant segment within the broader beta-blocker landscape, which is projected to grow at a compound annual growth rate (CAGR) of approximately 4% between 2022 and 2028 [1]. The global cardiovascular therapeutic market exceeded USD 80 billion in 2021, with beta-blockers accounting for roughly 20-25%, reflecting their enduring clinical utility. Bisoprolol’s contributions are particularly prominent in North America, Europe, and Asia-Pacific.

Market Drivers

-

Increasing Prevalence of Cardiovascular Diseases: The World Health Organization estimates over 17 million deaths annually attributable to CVDs [2]. The aging global population amplifies the demand for effective antihypertensives like bisoprolol.

-

Clinician Preference for Beta-1 Selectivity: Bisoprolol’s cardioselectivity reduces pulmonary side effects, making it preferable in patients with comorbid respiratory conditions.

-

Long-Acting Formulation Advantages: The once-daily dosing schedule enhances patient adherence, fostering sustained demand.

Market Challenges

-

Pricing Pressures and Generics: The expiration of patent exclusivity on branded bisoprolol fumarate formulations has precipitated a surge in generic versions, exerting downward pressure on prices.

-

Competitive Landscape: Presence of alternatives such as metoprolol, atenolol, and emerging agents like nebivolol influences market share dynamics.

-

Regulatory and Reimbursement Barriers: Variations in health policies across countries impact pricing and market penetration.

Manufacturing and Supply Dynamics

Production Sources and Cost Factors

Major pharmaceutical companies, including Teva, Novartis (Sandoz), and Mylan, produce generic bisoprolol fumarate. Manufacturing costs are affected by raw material prices, regulatory compliance costs, and economies of scale. Patent expirations, typically occurring around 2015-2020 in various jurisdictions, have extensively increased generic supply.

Impact of Patent Expiration

The spillover effects of patent expiry have led to substantial price declines. For example, in the U.S., generic bisoprolol fumarate prices dropped by approximately 50% within two years post-patent expiry [3]. This trend continues, driving affordability and expanding patient access.

Pricing Dynamics and Projections

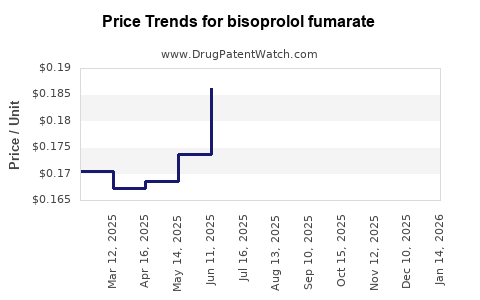

Current Price Benchmarks

-

Brand-Name Bisoprolol Fumarate: In the U.S., a 30-day supply of brand-name Bisoprolol (e.g., by AstraZeneca or equivalent) averages USD 60-80 [4].

-

Generic Bisoprolol Fumarate: The approximate cost drops to USD 10-20 for a 30-day supply, depending on dosage and pharmacy discounts.

Factors Influencing Future Prices

-

Market Saturation of Generics: Increased competition is expected to sustain low prices, especially in mature markets.

-

Regulatory Environment: Price controls or reimbursement policies, especially in Europe and Asia, may influence pricing trajectories.

-

Emergent Therapies: Development of new antihypertensive agents with superior profiles could erode market share and affect prices.

Projected Price Trends (2023-2030)

Given current trends, the following projections are anticipated:

-

Immediate Term (2023-2025): Slight price stabilization at generic levels (-10% to -15%), driven by manufacturing efficiencies and market saturation.

-

Mid to Long Term (2026-2030): Further declines of 5-10% driven by increased penetration in emerging markets and potential new formulations or biosimilars.

-

Premium Pricing Possibility: Branded bisoprolol fumarate may retain a higher premium in markets with limited generic access or for specific formulations, but this premium is expected to narrow.

Market Dynamics and Competitive Outlook

Key Players and Market Share

The generic segment dominates, with players like Mylan, Sandoz, and Teva controlling significant shares. Brand manufacturers like AstraZeneca hold a smaller segment constrained by patent expiry.

Emerging Trends

-

Biosimilars and Formulations: While biosimilars are less relevant for small-molecule drugs like bisoprolol, innovative delivery systems (e.g., transdermal patches) may impact prices.

-

Combination Therapies: The integration of bisoprolol with other antihypertensive agents (e.g., bisoprolol-hydrochlorothiazide) offers new pricing and market opportunities.

Regulatory and Reimbursement Considerations

Regulatory agencies elsewhere, such as the EMA, and payers, particularly in developed markets, prefer cost-effective generics, influencing pricing strategies. Cost-effectiveness analyses often favor bisoprolol over less selective beta-blockers, supporting sustained demand and stable pricing for generics.

Strategic Implications for Industry Stakeholders

-

Manufacturers: Focus on cost reduction and expanding formulations to sustain profitability in a competitive landscape.

-

Healthcare Providers: Emphasize formulary inclusion of cost-effective generics, facilitating broader patient access.

-

Policymakers: Balance pricing controls with incentives for innovation, especially for extended-release or combination formulations.

Conclusion

The bisoprolol fumarate market remains robust within the cardiovascular therapeutic arena. The imminent dominance of generics is projected to sustain low pricing levels over the next decade, with prices likely declining marginally due to intense competition and manufacturing efficiencies. However, niche premium opportunities may persist for branded formulations, particularly in regions with less generic penetration.

Key Takeaways

-

The global bisoprolol fumarate market is expected to grow modestly at a CAGR of 4%, driven by the rising burden of cardiovascular diseases.

-

Generic versions dominate, leading to sustained price reductions; current prices are approximately USD 10-20 per 30-day supply in mature markets.

-

Price projections indicate minor declines (5-10%) through 2030, primarily driven by competitive pressure, patent expiries, and manufacturing efficiencies.

-

Emerging therapies and combination formulations may offer new revenue streams but are unlikely to significantly alter the pricing landscape in the short term.

-

Strategic focus on cost management, formulation innovation, and geographical expansion will remain key for market participants.

FAQs

1. How does patent expiration affect bisoprolol fumarate prices?

Patent expiration typically leads to the entry of generic manufacturers, increasing supply and driving prices downward. Post-expiry, generic prices can decline by 50% or more within a few years, making the drug more accessible.

2. What are the primary factors influencing future bisoprolol fumarate prices?

Market competition, manufacturing costs, regulatory policies, and the development of alternative therapies influence pricing dynamics. Increasing generic competition will likely maintain low prices.

3. Are there regional differences in bisoprolol fumarate pricing?

Yes. Developed markets like the U.S., Europe, and Japan generally have lower prices for generics due to higher healthcare spending and procurement strategies, while emerging markets may see higher prices due to supply constraints.

4. Will new formulations or combination therapies impact bisoprolol fumarate prices?

Potentially. While innovative formulations or combination drugs can command premium pricing, their market share is limited initially. Over time, they could influence overall pricing patterns.

5. What is the outlook for Pfizer or AstraZeneca in the bisoprolol fumarate market?

Pfizer and AstraZeneca primarily focus on branded formulations, which face pricing pressures due to generics. Their market position may stabilize in niche segments or via development of novel formulations, but overall market share is expected to decline post-generic entry.

Sources:

[1] GlobalData. (2022). Beta-Blockers Market Analysis.

[2] WHO. (2021). Cardiovascular Diseases Fact Sheet.

[3] IMS Health. (2020). Impact of Patent Expiries on Beta-Blocker Prices.

[4] GoodRx. (2023). Bisoprolol Fumarate Cost Guide.