Last updated: July 27, 2025

Introduction

Benzoyl peroxide (BPO) remains a cornerstone in dermatology, primarily used for treating acne vulgaris. Its enduring efficacy, over-the-counter availability, and broad acceptance secure its position within the dermatological therapeutics market. This analysis evaluates current market dynamics, competitive landscape, manufacturing considerations, regulatory environment, and future price projections for benzoyl peroxide.

Market Overview

Global Demand and Market Size

Benzoyl peroxide's global market surpassed $500 million in 2022, driven by rising dermatological conditions and increased consumer awareness about skin health. The Compound Annual Growth Rate (CAGR) from 2017 to 2022 is estimated at approximately 4%, with North America and Europe leading due to high skincare awareness and established OTC markets. Emerging markets, including Asia-Pacific, are experiencing accelerated growth owing to rising disposable incomes and urbanization.

Market Segments

Benzoyl peroxide's products vary by concentration—2.5%, 5%, and 10%—and formulation type, including gels, creams, and washes. The over-the-counter segment dominates, with a growing niche for prescription formulations aimed at severe cases. The consumer-driven OTC segment accounts for over 70% of sales, highlighting widespread accessibility.

Competitive Landscape

Key Players

Major manufacturers include Johnson & Johnson, Galderma, and Glenmark Pharmaceuticals, alongside numerous regional producers. Patent protections are largely expired or not applicable, leading to a highly commoditized market characterized by generic availability.

Manufacturing and Supply Chain

Benzoyl peroxide's production requires stability considerations, as it decomposes at high temperatures and in the presence of light. The synthesis involves the acetyl bleaching process, with raw materials like benzoyl chloride readily available. Production is relatively cost-efficient, with bulk synthesis driving down manufacturing costs, facilitating price competition.

Regulatory Environment

Benzoyl peroxide is classified as an over-the-counter dermatological ingredient in many markets, notably in the U.S., Canada, and the European Union. Regulatory agencies like the FDA and EMA approve its use at specified concentrations, simplifying market access. Nonetheless, regional regulations influence labeling, packaging, and permissible concentrations, impacting distribution.

Pricing Dynamics

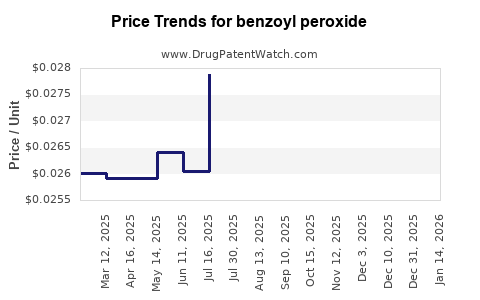

Current Pricing Landscape

The average retail price for OTC benzoyl peroxide products ranges from $5 to $15 per ounce, varying by strength, formulation, and brand. Generics comprise most of the market, exerting downward pressure on prices. Bulk purchasing by pharmacies and chain stores further reduces unit costs.

Factors Influencing Price Fluctuations

- Raw Material Costs: Benzoyl chloride, the primary raw material, experienced price volatility in recent years due to supply chain disruptions, impacting the end-product price.

- Manufacturing Costs: Automation and process optimization enhance margin stability, but regulatory compliance adds overhead.

- Market Competition: High competition leads to price wars, particularly in saturated OTC segments.

- Regulation and Approval: Changes in permissible concentrations or labeling requirements can affect production and distribution costs.

Future Price Projections (2023–2028)

Market Trends Impacting Pricing

- Increased Competition: The influx of manufacturers in emerging markets is likely to maintain or reduce prices.

- Technological Advances: Development of improved formulations with enhanced stability or reduced irritation potential might command premium pricing.

- Consumer Preferences: Growing demand for natural and organic skincare products could shift some manufacturers toward premium positioning, slightly elevating prices.

- Regulatory Changes: Stricter quality control and environmental regulations could marginally increase manufacturing costs, tempering price declines.

Projected Price Trajectory

For the next five years, wholesale prices are expected to decrease modestly at a CAGR of approximately 1.5%–2%, driven primarily by increased competition and manufacturing efficiencies. Retail prices will likely follow suit, with premium formulations and novel delivery mechanisms commanding higher price points, balancing the overall trend toward affordability.

Key Market Opportunities and Challenges

Opportunities

- Expansion into developing markets due to increasing skin health awareness

- Innovation in formulations to improve tolerability and efficacy

- Integration into combination products for enhanced dermatological treatment

Challenges

- Regulatory hurdles in new markets

- Price sensitivity among consumers, especially in price-competitive regions

- Raw material supply limitations, affecting cost stability

Conclusion

Benzoyl peroxide remains a vital dermatological agent with a stable global market and consistent demand. Price stability is anticipated over the next five years, primarily due to intense competition and manufacturing efficiencies. Opportunities for premium product development exist, although market entry barriers and raw material concerns require strategic navigation.

Key Takeaways

- The global benzoyl peroxide market was valued above $500 million in 2022, with steady growth expected.

- Over-the-counter products dominate, driven by affordability, accessibility, and consumer preference.

- Competition and raw material costs predominantly influence pricing, with modest unit price declines projected.

- Innovation and emerging market expansion offer growth prospects for manufacturers.

- Regulatory environments remain favorable but necessitate ongoing compliance vigilance.

FAQs

1. What factors influence the price of benzoyl peroxide globally?

Pricing is primarily affected by raw material costs (benzoyl chloride), manufacturing efficiency, competition among generic producers, regulatory compliance costs, and regional market dynamics.

2. Will the price of benzoyl peroxide decrease significantly in the next five years?

Overall, prices are expected to decline gradually (CAGR 1.5%-2%), influenced by increasing competition and production efficiencies, although premium formulations may carry higher prices.

3. Are there regulatory challenges affecting benzoyl peroxide pricing?

While generally approved as an OTC ingredient, variations in permissible concentrations and labeling requirements across regions may impact manufacturing and distribution costs, subtly affecting prices.

4. How do emerging markets impact benzoyl peroxide pricing?

Growing demand and increased manufacturing presence in emerging markets can lead to lower prices globally due to heightened competition and local production advantages.

5. What opportunities exist for premium benzoyl peroxide formulations?

Innovations targeting improved stability, decreased irritation, or natural ingredients may command higher retail prices, opening avenues for differentiation and margin growth.

Sources:

- Market research reports (e.g., Grand View Research, 2023)

- Regulatory agencies (FDA, EMA) official publications

- Industry analyses and dermatology market data