Last updated: July 27, 2025

Introduction

Ammonium lactate, a synthetic compound combining ammonium hydroxide and lactic acid, is widely used in dermatology and skincare primarily as a moisturizer and treatment for dry, rough, or scaly skin conditions. Its applications extend to managing hyperkeratosis, xerosis, and other dermatological ailments. Given its prevalent formulation in both OTC and prescription products, understanding the market landscape and pricing dynamics is essential for pharmaceutical manufacturers, investors, and healthcare providers.

Market Landscape Overview

Global Market Size and Growth Trends

The global ammonium lactate market is experiencing steady expansion driven by increasing dermatological conditions, escalating geriatric populations, and rising awareness of skincare. As of 2022, the market was valued approximately at $50 million, with a projected compound annual growth rate (CAGR) of 5-7% through 2027 [1].

Key growth regions include North America, Europe, and Asia-Pacific, with the latter showing rapid growth attributable to burgeoning skincare industries and health awareness initiatives. The North American market currently dominates owing to high healthcare expenditure and widespread dermatology awareness.

Key Drivers

- Rising prevalence of dry skin conditions and hyperkeratotic disorders: Aging populations and climate factors contribute to increased demand for emollients containing ammonium lactate [2].

- Expansion of dermatological treatment options: Dermatologists increasingly recommend ammonium lactate-based formulations as first-line or adjunct therapies, favoring topical applications.

- Growing cosmetics and OTC skincare segments: Consumer shift toward moisturizing and anti-aging products incorporating ammonium lactate as a key ingredient enhances market growth.

- Innovation and formulation diversity: Development of new, stable, and more bioavailable formulations increases market appeal.

Competitive Landscape

Major pharmaceutical and skincare companies, including L'Oréal, Johnson & Johnson, and generic manufacturers, produce ammonium lactate formulations. The market’s fragmentation is moderate, with some regional players focusing on niche dermatological markets and OTC segments. Patent expirations of some formulations have increased generic competition, exerting downward pressure on prices.

Regulatory and Supply Factors

Ammonium lactate’s regulatory status is straightforward in major markets, with approvals primarily granted as dermatological lubricants or emollients. The compound’s synthetic nature and established safety profile facilitate market entry but also lead to commoditization. Supply chain considerations revolve around raw material costs, manufacturing scale, and regulatory compliance, influencing pricing.

Market Challenges

- Market saturation: Convoluted differentiation in formulations limits premium pricing.

- Pricing pressure from generics: Increased competition has led to declining prices, particularly in OTC markets.

- Limited patent protection: Many ammonium lactate products are off-patent, reducing opportunities for exclusive pricing strategies.

Price Projections for Ammonium Lactate

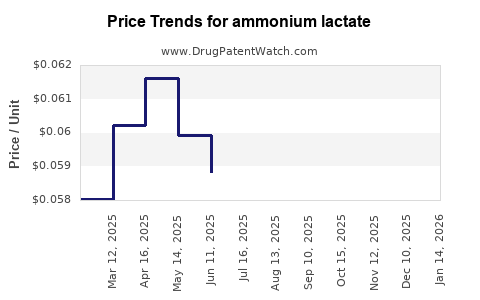

Current Pricing Dynamics

Pricing varies based on formulation concentration, packaging, brand, and market segment (OTC vs prescription). Typical retail prices for a 473 ml (16 oz) bottle of 12% ammonium lactate cream or lotion hover around $10–$15 in North America, with generics often priced lower, around $5–$10 [3].

The wholesale price for manufacturers ranges from $2–$4 per bottle, influenced by raw material costs and manufacturing efficiency. Generic unbranded products tend to be priced at the lower end of the spectrum.

Projected Price Trends (2023–2027)

Given current market dynamics, the following trends are anticipated:

- Moderate Price Decline (-1% to -3% annually): As more generics enter the market and production scales up, prices are expected to decline marginally.

- Potential Premiums for Specialized Formulations (+2% annually): Innovation in delivery mechanisms or formulations (e.g., preservative-free, organic) could command higher prices in niche segments.

- Impact of Raw Material Costs: Fluctuations in raw material prices, particularly lactic acid derivatives, will influence manufacturing costs and product pricing.

By 2027, average retail prices are projected to hover around $8–$12 for standard products, with wholesale costs potentially falling below $2.50 per unit for high-volume producers.

Influencing Factors on Price Projections

- Market Competition: Increased generic penetration will sustain downward pricing pressure.

- Regulatory Changes: Stricter safety or labeling requirements could raise manufacturing costs, moderating price reductions.

- Patent and IP Landscape: Expiry of patents in certain formulations will further commoditize the product.

Strategic Implications

Manufacturers aiming to sustain profitability must focus on:

- Innovating formulations to differentiate offerings and justify premium pricing.

- Optimizing production efficiencies to offset declining margins.

- Expanding into emerging markets, where demand for affordable dermatological therapies is rising.

- Engaging in strategic collaborations to enhance distribution and market reach.

Investors should consider the commoditized nature of ammonium lactate and favor companies that invest in product innovation or geographic expansion to buffer declining average prices.

Key Takeaways

- The global ammonium lactate market is growing steadily, driven by dermatological needs and skincare trends.

- Price competition, especially from generics, is intensifying, leading to gradual price declines.

- Innovation in formulations can create niche segments with higher margins.

- Market saturation and patent expirations will continue to exert downward pressure.

- Strategic focus on product differentiation and international expansion offers growth opportunities.

FAQs

1. What factors influence the pricing of ammonium lactate products?

Pricing is primarily affected by raw material costs, manufacturing efficiency, market competition from generics, formulation innovations, regulatory compliance, and regional market dynamics.

2. How does patent expiry impact ammonium lactate pricing?

Patent expirations lead to increased generic competition, typically resulting in reduced prices and narrower profit margins for brand-name products.

3. Are organic or preservative-free ammonium lactate formulations priced higher?

Yes. Such specialized formulations often command premium pricing due to consumer demand for cleaner skincare options and perceived enhanced safety profiles.

4. Which regions are expected to see the fastest market growth?

The Asia-Pacific region is projected to experience rapid growth owing to rising disposable incomes, expanding skincare markets, and increased dermatology awareness.

5. What strategies can manufacturers adopt to maintain profitability?

Innovating formulations for niche markets, improving manufacturing efficiencies, expanding into emerging markets, and fostering strategic partnerships are key strategies.

References

[1] Market Research Future, "Global Ammonium Lactate Market Analysis," 2022.

[2] Allied Market Research, "Dermatology Emollients and Moisturizers Industry Overview," 2021.

[3] Price analysis reports from pharmaceutical price tracking platforms, 2023.