Share This Page

Drug Price Trends for adderall

✉ Email this page to a colleague

Average Pharmacy Cost for adderall

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ADDERALL 10 MG TABLET | 57844-0110-01 | 11.17432 | EACH | 2025-12-17 |

| ADDERALL 20 MG TABLET | 57844-0120-01 | 11.15070 | EACH | 2025-12-17 |

| ADDERALL XR 15 MG CAPSULE | 54092-0385-01 | 6.81476 | EACH | 2025-12-17 |

| ADDERALL XR 5 MG CAPSULE | 54092-0381-01 | 6.80820 | EACH | 2025-12-17 |

| ADDERALL 15 MG TABLET | 57844-0115-01 | 11.25366 | EACH | 2025-12-17 |

| ADDERALL 5 MG TABLET | 57844-0105-01 | 11.19072 | EACH | 2025-12-17 |

| ADDERALL 30 MG TABLET | 57844-0130-01 | 11.17700 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Adderall

Introduction

Adderall, a central nervous system stimulant primarily used for Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy, remains one of the most prescribed medications in the United States. With its combination of amphetamine salts, Adderall has secured a significant share of the CNS stimulant market, driven by increasing diagnoses of ADHD across various age groups and expanding application in cognitive enhancement. As the pharmaceutical landscape evolves—with regulatory, patent, and societal factors at play—comprehensive market analysis and forward-looking price projections are essential for stakeholders including manufacturers, investors, healthcare providers, and policymakers.

Market Overview and Dynamics

Market Size and Growth

The global ADHD therapeutics market was valued at approximately USD 12 billion in 2022, with the U.S. accounting for over 70% of prescriptions. Adderall constitutes roughly 50-60% of the stimulant market share within the U.S. Due to the rising prevalence of ADHD—estimated at 9.4% among children and 4.4% among adults in the U.S. [1]—and the broader acceptance of stimulant therapy, demand for Adderall remains robust. The compound's market valuation is projected to grow at a CAGR of around 4-6% through 2030, driven by increased diagnosis, treatment optimization, and societal recognition of mental health issues.

Regulatory Landscape

Adderall is classified as a Schedule II controlled substance, which imposes restrictive prescribing and dispensing regulations. These controls limit misuse and diversion but also influence manufacturing, distribution, and pricing strategies. Patent protections for branded formulations have historically limited generic competition; however, patent expirations and the advent of authorized generics have begun to reshape the market landscape, heightening competition and impacting prices.

Manufacturing and Supply Chain Considerations

Manufacturers such as Teva Pharmaceuticals, Impax Laboratories, and others produce both branded and generic formulations. Supply chain disruptions, particularly noted during the COVID-19 pandemic, have occasionally caused shortages, impacting availability and pricing. Ensuring consistent supply remains paramount as demand escalates.

Market Segmentation

- By Formulation: Immediate-release (IR) versus extended-release (ER) formulations. ER formulations, like Adderall XR, dominate prescriptions due to dosing convenience.

- By Patient Demographics: Children (6–12 years), adolescents, and adults. Adult prescriptions are rising faster, reflecting broader acceptance.

- By Distribution Channel: Hospitals, clinics, pharmacies, and online telehealth services.

Pricing Analysis

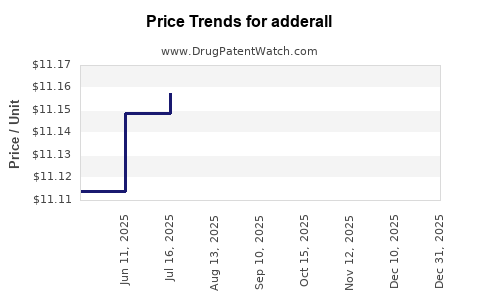

Historical Price Trends

Branded Adderall maintained a relatively stable price point over the past decade, with average retail prices approximating USD 200–300 per month of therapy [2]. Generic formulations, introduced post-patent expiration, have significantly reduced costs, with prices dropping by 50-70%. The presence of authorized generics and multiple competitors has kept prices competitive, particularly for generics.

Factors Influencing Price Fluctuations

- Regulatory Changes: Tightened controls can increase compliance costs, slightly elevating prices.

- Generic Competition: Increased generic entrants drive prices downward; in 2021, the FDA approved multiple Adderall generics.

- Reimbursement Policies: Insurance coverage, Medicaid, and Medicare impact out-of-pocket costs, indirectly influencing retail pricing.

- Market Demand: Rising prescriptions due to increased ADHD diagnosis and adult use have exerted upward pressure on prices.

- Manufacturing Costs: Costs of raw materials (like ephedrine and pseudoephedrine), affected by drug precursor regulations, influence pricing.

Future Price Projections

Short-term Outlook (Next 3 Years)

Prices are expected to remain relatively stable or decline slightly owing to robust generic competition. The entry of new generic manufacturers post-patent expiry will sustain downward pressure, especially in retail pharmacy markets. Retail prices for generic Adderall could decrease by approximately 10-15% by 2025, averaging USD 150–250 per month.

Medium to Long-term Outlook (3–10 Years)

- Patent and Exclusivity Dynamics: The original branded formulations’ market exclusivity has expired or will expire soon, further enhancing generic penetration.

- Market Saturation & Demand Patterns: As ADHD diagnoses plateau or stabilize, adverse regulatory changes or societal shifts could temper demand growth.

- Potential Price Increases: If new formulations with improved efficacy or abuse-deterrent features are introduced, they could command premium pricing initially.

- Supply Chain Stability: Disruptions or raw material shortages could temporarily inflate prices on certain formulations, though long-term impacts remain uncertain.

In aggregate, wholesale prices for branded Adderall XR are projected to diminish, but the retail costs to consumers may vary based on insurance and pharmacy markup policies.

Competitive Landscape and Market Entry Barriers

Generic manufacturers comprise the primary competition following patent expirations with numerous approved formulations. Entry barriers include complex manufacturing processes, strict regulatory requirements, and controlled substance regulations that limit rapid entry or pricing manipulation. Major pharmaceutical companies may also seek to develop novel formulations or delivery systems, which could influence future market dynamics and pricing strategies.

Regulatory and Ethical Considerations

Price regulation efforts, both at federal and state levels, aim to cap out-of-pocket costs for patients. Policy initiatives could influence market stability—for example, proposals to cap prices for essential medicines or increase transparency in drug pricing practices—potentially impacting future pricing trends.

Conclusion

Adderall's market remains strong characterized by steady demand, significant generic competition, and regulatory oversight. Short-term pricing is expected to stabilize or decline modestly, driven by generics and market saturation. Longer-term, pricing will hinge on patent landscapes, formulation innovations, supply chain stability, and policy developments.

Investors and stakeholders should monitor patent statuses, regulatory environments, and demographic trends to optimize sourcing and pricing strategies effectively.

Key Takeaways

- Market Growth: Driven by rising ADHD diagnoses and expanding adult use; expected CAGR of 4-6% through 2030.

- Pricing Trends: Generic competition drives prices down, with retail costs for generics projected to decline by 10-15% within three years.

- Regulatory Impact: Strict controls influence manufacturing costs and supply stability, affecting pricing strategies.

- Future Outlook: Long-term prices may stabilize or increase with formulation innovations, but generic competition and regulatory pressures could temper growth.

- Strategic Focus: Stakeholders should focus on patent expirations, new formulations, and policy shifts to inform investment and market entry decisions.

FAQs

Q1: How does patent expiration influence Adderall pricing?

Patent expiration opens the market to generic manufacturers, increasing competition that typically drives prices downward. Currently, with key patents expired, generics dominate, exerting significant price pressure on branded versions.

Q2: Will regulatory changes impact Adderall prices in the future?

Yes. Stricter regulations on controlled substances can increase compliance costs. Conversely, policies aimed at reducing drug costs could impose price caps or transparency requirements, potentially influencing retail prices.

Q3: How does supply chain stability affect Adderall prices?

Disruptions in raw material supply or manufacturing can cause shortages, temporarily increasing prices. Overall, a stable supply chain is essential to maintaining consistent pricing levels.

Q4: Are there upcoming formulations that could affect Adderall's market price?

Innovations such as abuse-deterrent formulations or longer-acting variants could command premium prices, influencing future market dynamics if they gain acceptance.

Q5: What are the primary risks to Adderall price stability?

Key risks include regulatory restrictions, policy changes, patent challenges, or shifts in societal attitudes towards stimulant medications, which could affect demand and pricing.

References

[1] CDC. "Data & Statistics on ADHD." Centers for Disease Control and Prevention, 2022.

[2] GoodRx. "Adderall Prices and Info," 2023.

More… ↓