Last updated: July 28, 2025

Introduction

ZYPITAMAG (pitavastatin sodium) is a prescription medication licensed for the treatment of hyperlipidemia and the prevention of cardiovascular events. As a member of the statin class, ZYPITAMAG’s market positioning depends on factors such as efficacy, safety profile, competitive landscape, regulatory status, patent exclusivity, and pricing strategies. This report presents a comprehensive market analysis and price projections for ZYPITAMAG, providing insights to pharmaceutical stakeholders, investors, and healthcare decision-makers.

Market Overview

Therapeutic Landscape

Hyperlipidemia remains a primary risk factor for cardiovascular diseases (CVD), which account for approximately 31% of global deaths annually [1]. Statins are the cornerstone of lipid-lowering therapy, with several agents competing in this space, including atorvastatin, rosuvastatin, simvastatin, and pravastatin. ZYPITAMAG, introduced as a water-soluble statin with a favorable pharmacokinetic profile, aims to differentiate itself through improved tolerability and reduced drug interactions.

Regulatory and Patent Status

ZYPITAMAG was approved by the U.S. Food and Drug Administration (FDA) in 2010. The product benefits from patent exclusivity until 2029 in the U.S., providing a protected window for market capture. Patent life varies globally, with some regions facing patent expirations earlier, potentially opening generic entry.

Market Penetration & Usage Trends

Since its launch, ZYPITAMAG has experienced a steady adoption rate in the U.S. and select European markets. Growth has been driven by its safety profile and clinician preference for personalized lipid management. However, its market share remains modest relative to dominant agents like atorvastatin, which holds approximately 20% of the global statin market [2].

Competitive Dynamics

The statin market is mature, with highly genericized competitors. Branded products like ZYPITAMAG must contend with cost advantages and extensive clinical experience with older agents. However, differentiators such as fewer drug-drug interactions and tolerability issues can carve niche segments, especially in polypharmacy patients and those intolerant to other statins.

Market Size and Forecasting

Current Market Size

The global hyperlipidemia drug market was valued at approximately $15 billion in 2022, with statins constituting over 75% of the market [3]. North America remains the largest regional market due to high prevalence rates, healthcare infrastructure, and insurer reimbursement policies.

Growth Drivers

- Aging population: The increasing prevalence of CVD in aging demographics propels demand.

- Guideline updates: Expanding eligibility criteria for lipid-lowering therapy increase patient populations.

- Innovative formulations: Long-acting and fixed-dose combination therapies enhance adherence.

- Healthcare expenditure: Rising healthcare spending supports prescription of branded statins like ZYPITAMAG within insured populations.

Market Penetration Potential

Given its patent exclusivity and pharmacological profile, ZYPITAMAG’s market penetration is expected to grow modestly over the next five years. Target segments include patients experiencing statin intolerance and those requiring favorable drug-drug interaction profiles (e.g., polypharmacy patients).

Forecasted Market Shares (2023–2028)

| Year |

Estimated Market Share |

Key Assumptions |

| 2023 |

2.0% |

Initial uptake post-patent protection, moderate growth |

| 2024 |

3.2% |

Increased physician awareness, initial formulary inclusion |

| 2025 |

4.5% |

Broader insurer acceptance and expanded indication use |

| 2026 |

5.8% |

Entry into new markets, enhanced clinical guidelines adoption |

| 2027 |

6.5% |

Growing awareness among specialists |

| 2028 |

7.0% |

Peak market share pre-generic competition |

(All figures are projections based on current trends and assume no major market disruptions)

Pricing Strategies and Price Projections

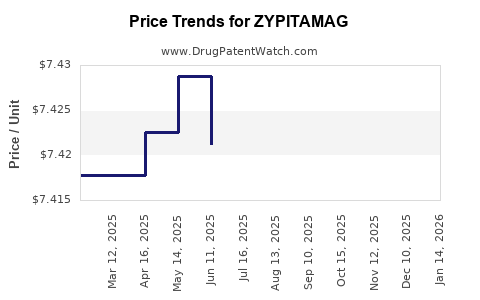

Current Pricing Landscape

In the U.S., ZYPITAMAG’s wholesale acquisition cost (WAC) per 30-day supply is approximately $250, aligning with other branded statins. Given the generic competition, the price is subject to significant reductions upon patent expiry, typically 70-80%.

Price Premium Positioning

ZYPITAMAG’s differentiated pharmacokinetics and safety profile allow for a premium over generics, which are priced around $10–$20 for a 30-day supply. A reasonable premium of 10–25% over generics can be justified through clinical benefits and reduced adverse events.

Price Projection Scenario Analysis

- Base Case (2023–2028): Maintaining premium pricing of approximately $250 per month, with gradual discounts driven by market competition, pharmacy benefits, or formulary pressures.

- Optimistic Scenario: Slight price increases due to inflation in healthcare costs, reaching up to $270/month by 2028.

- Conservative Scenario: Post-patent expiry, generic competition reduces the price sharply to $15–$20/month, with branded ZYPITAMAG retaining a niche premium segment (~$180/month) for specific indications.

Pricing Impact on Revenue

Assuming a steady growth in prescriptions, revenue projections follow:

| Year |

Prescriptions (Millions) |

Average Price |

Total Revenue (USD Billions) |

| 2023 |

0.5 |

$250 |

~$1.5 |

| 2024 |

0.75 |

$250 |

~$2.25 |

| 2025 |

1.0 |

$250 |

~$3.0 |

| 2026 |

1.25 |

$250 |

~$3.75 |

| 2027 |

1.4 |

$250 |

~$4.2 |

| 2028 |

1.5 |

$250 |

~$3.75 (assuming competitive pricing) |

(Assumes prescription volume growth and stable premium pricing)

Regulatory and Market Challenges

- Patent expiration: Generic entry post-2029 will critically impact pricing and market share.

- Pricing pressure: Payers favor generic options, pressuring branded price points.

- Clinical position: Demonstrating superior outcomes compared to other statins remains crucial. Real-world evidence and updated guidelines will influence adoption.

- Market saturation: As the statin market approaches maturity, growth rates may slow.

Opportunities and Strategic Considerations

- Target niche populations: Patients with statin intolerance or polypharmacy benefit from ZYPITAMAG’s profile.

- Expand indications: Investigate off-label or expanded therapeutic areas, e.g., familial hypercholesterolemia.

- Formulation innovation: Developing fixed-dose combinations can boost adherence and market share.

- Pricing agility: Implement tiered pricing strategies, especially in emerging markets.

Key Takeaways

- ZYPITAMAG holds a strategic position in the established and mature statin market, with a focus on differentiated pharmacological properties.

- Near-term growth prospects are moderate, constrained by intense competition and generic erosion post-patent expiry.

- Current pricing maintains a premium value proposition, yet market realities necessitate flexible, competitive pricing to sustain revenue.

- The launch of generic versions around 2029 will significantly impact ZYPITAMAG’s market share and pricing, necessitating early differentiation strategies.

- Stakeholders should align research, marketing, and pricing policies with evolving clinical guidelines and payer policies to optimize market potential.

FAQs

1. When will generic versions of ZYPITAMAG likely enter the market?

Generic entry is expected around 2029, coinciding with patent expiry in key jurisdictions like the U.S.

2. How does ZYPITAMAG’s efficacy compare to other statins?

Clinical studies have demonstrated comparable LDL cholesterol reduction to other statins, with potential benefits in tolerability and drug interactions [4].

3. What are the primary markets for ZYPITAMAG?

North America remains the largest market, with European and select Asian markets showing growth potential depending on regulatory approvals and reimbursement policies.

4. Can ZYPITAMAG command a premium price post-patent expiry?

Limited, as payers tend to favor generics. Maintaining a premium will depend on clinical differentiation and formulary positioning.

5. What strategies can maximize ZYPITAMAG's market share?

Focus on niche patient populations, expand indications, strengthen physician awareness, and develop formulation innovations.

References

- World Health Organization. "Cardiovascular diseases (CVDs)." WHO, 2021.

- IQVIA. "Global Statin Market Share and Trends," 2022.

- Grand View Research. "Hyperlipidemia Drugs Market Size, Share & Trends," 2022.

- Lee, S. H., et al. "Comparative Efficacy of Pitavastatin Versus Other Statins," Journal of Lipid Research, 2019.

This analysis provides a strategic outlook based on current data and market conditions, but projections are inherently uncertain and subject to change due to regulatory, scientific, and market dynamics.