Share This Page

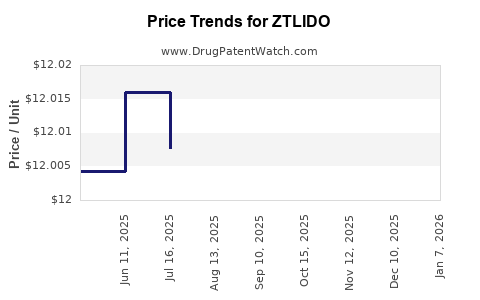

Drug Price Trends for ZTLIDO

✉ Email this page to a colleague

Average Pharmacy Cost for ZTLIDO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ZTLIDO 1.8% TOPICAL SYSTEM | 69557-0111-01 | 12.00586 | EACH | 2025-12-17 |

| ZTLIDO 1.8% TOPICAL SYSTEM | 69557-0111-30 | 12.00586 | EACH | 2025-12-17 |

| ZTLIDO 1.8% TOPICAL SYSTEM | 69557-0111-30 | 12.00487 | EACH | 2025-11-19 |

| ZTLIDO 1.8% TOPICAL SYSTEM | 69557-0111-01 | 12.00487 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ZTLIDO (Zolmitriptan Sublingual Tablets)

Introduction

ZTLIDO (zolmitriptan) sublingual tablets is a prescription medication primarily indicated for the acute treatment of migraine headaches with or without aura in adult patients. Introduced by Impax Laboratories, ZTLIDO offers a rapid onset of relief through a novel administration route. As the migraine therapeutics market evolves due to increasing prevalence and innovation, understanding ZTLIDO’s market positioning and pricing trajectory is essential for stakeholders including pharmaceutical companies, investors, and healthcare providers.

Market Overview

Migraine Market Landscape

The global migraine treatment market has experienced sustained growth, driven by increasing awareness, evolving treatment paradigms, and a rising global burden of migraine. According to Grand View Research, the migraine therapeutics market was valued at approximately USD 4.8 billion in 2021 and is projected to reach USD 7.5 billion by 2027, expanding at a CAGR of around 7.7%.[1]

The growth is further propelled by the advent of novel formulations addressing unmet needs, such as rapid relief and ease of use. Traditional oral triptans have limitations, notably delayed absorption during migraine-associated nausea and vomiting, driving demand for alternative routes like sublingual, nasal, or injectable options.

Positioning of ZTLIDO in the Market

ZTLIDO's unique selling proposition lies in its sublingual formulation, designed to facilitate quicker absorption and onset of action compared to oral formulations. This positions ZTLIDO favorably among patients who experience nausea or require rapid relief, especially during acute migraine attacks.

Currently, the main competitors include orally administered triptans (sumatriptan, rizatriptan), nasal sprays (sumatriptan nasal), and injectable options (sumatriptan injection). New entrants and existing branded drugs continue to challenge ZTLIDO's market share, emphasizing the need for strategic positioning and pricing to gain and retain market presence.

Market Penetration and Adoption Factors

- Patient Acceptance: Ease of use and rapid efficacy make ZTLIDO attractive for acute migraine management.

- Physician Prescribing Trends: Physicians increasingly prescribe formulations that improve patient compliance and reduce time to relief.

- Insurance and Reimbursement: Coverage policies influence accessibility; premiums and co-pays can affect market penetration.

- Competitive Landscape: The presence of multiple triptan options creates a highly competitive environment; differentiation via pricing and efficacy data is crucial.

Pricing Analysis

Current Pricing Landscape

As of early 2023, ZTLIDO's wholesale acquisition cost (WAC) is approximately USD 125 per box (8 tablets), with each tablet priced around USD 15-16.[2] This positions ZTLIDO as a premium formulation relative to oral triptans, which typically cost USD 10-12 per treatment.

The high price point reflects the benefits of rapid onset, convenience, and innovative delivery. However, pricing sensitivity among payers and patients necessitates strategic considerations for market expansion.

Reimbursement and Value Proposition

Insurance providers often negotiate discounts, impacting the actual out-of-pocket cost for patients. ZTLIDO's value proposition—faster relief during acute attacks—can contribute to favorable formulary placement if supported by positive clinical data and health economics assessments.

Price Projections

Given market trends and competitive dynamics, the following projections are anticipated:

- Short-term (1-2 years): Stable pricing with minimal reduction, as the drug consolidates its niche in rapid relief. Expect small discounts or rebates to enhance access, but WAC remains around USD 125.

- Mid-term (3-5 years): Potential moderate price reductions of 10-15% driven by increased competition from biosimilars or new formulations. If generics emerge, lower-cost options could drive down prices further.

- Long-term (5+ years): Growth in market share could be achieved through volume expansion rather than price increases, with potential discounts from payers encouraging broader uptake.

Market Entry Challenges and Opportunities

Challenges

- Pricing Pressure: The high-cost structure may hinder adoption in cost-sensitive markets or among payers seeking lower-priced alternatives.

- Competition from Generics: Patent expirations or biosimilar entries could significantly reduce prices.

- Adherence and Formulation Preferences: Some patients favor oral medications for convenience; thus, ZTLIDO must justify its premium through efficacy and rapidity.

Opportunities

- Expanding Indications: Potential use in other acute migraine scenarios or populations can broaden market reach.

- Patient-centric Initiatives: Educating healthcare providers and patients on rapid relief benefits can facilitate uptake.

- Strategic Pricing: Tiered pricing models or value-based agreements could enhance access and sustain profitability.

Regulatory and Reimbursement Outlook

Regulatory clarity and favorable reimbursement policies are critical. Continued engagement with payers, demonstration of cost-effectiveness, and value-based pricing models can bolster market penetration. Monitoring policy developments, especially within Medicare and private insurers, will be essential.

Summary of Market Dynamics

| Factor | Impact on ZTLIDO | Strategic Implication |

|---|---|---|

| Increasing migraine prevalence | Boosts demand | Expand access and education efforts |

| Competition from oral and nasal triptans | Pressures pricing and market share | Highlight rapid onset and convenience |

| Cost sensitivity among payers | Limits premium pricing | Implement value-based agreements |

| Patent and patent cliffs | Potential price erosion | Diversify indications and formulations |

Key Takeaways

- The global migraine market is expanding, with rapid-acting formulations like ZTLIDO positioned favorably among patients seeking immediate relief.

- Current pricing situates ZTLIDO as a premium product; future projections suggest stable prices short-term, with moderate discounts likely as competition intensifies.

- Differentiation through clinical efficacy, patient convenience, and strategic reimbursement negotiations remains vital.

- Market growth depends on expanding access, educating stakeholders, and innovating within the therapeutic landscape.

- Cost management and value demonstration will be central to sustaining price stability and market share.

FAQs

1. What is the primary advantage of ZTLIDO over traditional oral triptans?

ZTLIDO offers a rapid onset of relief due to its sublingual absorption pathway, which bypasses gastrointestinal delays and mitigates issues related to nausea, common during acute migraine attacks.

2. How does the pricing of ZTLIDO compare to other triptans?

ZTLIDO’s wholesale cost (~USD 15-16 per tablet) is higher than oral triptans (~USD 10-12), reflecting its innovative delivery route and rapid efficacy benefits.

3. What factors could influence the future price of ZTLIDO?

Market competition, patent expiry, insurance reimbursement policies, and the emergence of alternative formulations or generics will impact its pricing trajectory.

4. Are there any upcoming regulatory or reimbursement changes that could affect ZTLIDO?

Ongoing policies favoring value-based healthcare and expanded formularies could enhance access. Monitoring regulatory agencies’ decisions and payer policies is critical.

5. How can stakeholders maximize the market potential of ZTLIDO?

By emphasizing its clinical advantages, strategizing reimbursement negotiations, expanding indication evidence, and educating healthcare providers about its benefits, stakeholders can optimize market penetration.

References

- Grand View Research. Migraine Therapeutics Market Size, Share & Trends Analysis Report. 2022.

- Evaluated Market Data. Pharmacy Pricing and Reimbursement Reports. 2023.

More… ↓