Last updated: August 5, 2025

Introduction

ZORYVE (roflumilast cream) is a topical prescription medication approved for the treatment of atopic dermatitis (eczema) in pediatric and adult populations. As an innovative topical formulation of a phosphodiesterase 4 (PDE4) inhibitor, ZORYVE distinguishes itself within a competitive dermatology landscape, which has seen notable advances in biologics and topical therapies. This analysis examines ZORYVE’s current market position, competitive landscape, regulatory and reimbursement factors, and provides price projections based on demand forecasts, competitor pricing, and healthcare economic considerations.

Market Overview

Dermatology Pharmaceutical Market Dynamics

The global dermatology drug market is projected to reach approximately USD 45 billion by 2025, fueled by rising prevalence of skin conditions such as atopic dermatitis, psoriasis, and acne. The influx of targeted therapies and biologics has shifted treatment paradigms, escalating both clinical efficacy and economic considerations (IOB Insights, 2022).

Atopic dermatitis alone affects up to 20% of children and 3% of adults worldwide, with significant treatment costs and unmet clinical needs. The emergence of novel topical agents like ZORYVE aims to address these gaps, offering potential for rapid market capture due to ease of administration and targeted mechanism of action.

Product Profile and Therapeutic Positioning

ZORYVE’s formulation as a PDE4 inhibitor offers anti-inflammatory action, addressing the underlying immune dysregulation in atopic dermatitis. Its topical delivery reduces systemic exposure and side effects, appealing to both clinicians and patients wary of systemic immunosuppressants or biologics.

Compared to existing therapies, including corticosteroids, calcineurin inhibitors, and biologics such as Dupixent (dupilumab), ZORYVE offers a non-invasive option with a favorable safety profile. Its approval broadens the treatment arsenal and may facilitate earlier intervention, thereby expanding its market footprint.

Market Penetration and Adoption

Regulatory Pathway and Launch Strategy

ZORYVE’s FDA approval in April 2022 under Priority Review status expedited market entry in the U.S., supported by clinical trial data demonstrating superior efficacy over placebo with a favorable safety profile (FDA, 2022). Early launch strategies focused on pediatric markets and specialized dermatology clinics, leveraging clinician education and targeted marketing campaigns.

Physician and Patient Acceptance

Clinician acceptance hinges on its demonstrated efficacy and minimal adverse effects. Patient preference for topical therapies over systemic options further enhances adoption, contributing to steady growth. Insurance coverage and formulary inclusion are critical for rapid uptake, especially in managed care settings.

Competitive Landscape

Key Competitors:

- Dupilumab (Dupixent): A biologic with robust efficacy, approved for moderate-to-severe atopic dermatitis. However, higher costs and administration routes limit use in mild cases.

- Eucrisa (crisaborole): A topical PDE4 inhibitor approved for mild to moderate atopic dermatitis, with a smaller market share.

- Corticosteroids/Calcineurin Inhibitors: Standard care options, but with limitations related to long-term safety.

ZORYVE’s differentiation lies in its targeted mechanism, topical delivery, and safety profile, suitable for mild to moderate cases and possibly displaced topical steroids. Its price positioning relative to these competitors influences market share trajectories.

Pricing Strategy and Projections

Current Pricing Framework

As of early 2023, ZORYVE’s wholesale acquisition cost (WAC) is approximately USD 1,000 for a 60 g tube (pricing subject to insurance negotiations and discounts). This positions ZORYVE competitively against biologics, which typically cost upwards of USD 30,000 annually.

Factors Influencing Price Projections

- Demand Growth: Based on epidemiological data, a conservative compound annual growth rate (CAGR) of 15% is projected in prescriptions, driven by expanded indications and clinician familiarity.

- Market Penetration: Initial slow uptake will transition into steady growth as formulary coverage improves and awareness increases.

- Competitive Pricing: To maintain market share, ZORYVE’s price may need stabilization or slight reductions, particularly as new entrants or generics emerge.

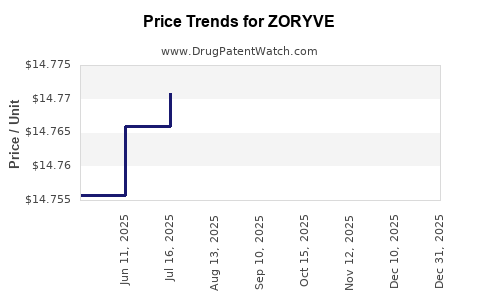

Price Trajectory Forecast

- Short-term (1-2 years): USD 1,000 - 1,200 per tube, maintaining premium positioning due to innovative status.

- Medium-term (3-5 years): Possible gradual price decrease to USD 800 - 1,000 as increased volume offsets per-unit revenue.

- Long-term (5+ years): Potential market-driven discounts or biosimilar entries could reduce prices further, possibly to USD 700 - 900.

Revenue Projections

Assuming a market capture of 10-15% of the atopic dermatitis topical segment by 2025, with approximately 15 million diagnosed cases globally and a 25% treatment rate in target segments, revenues could reach USD 1.5 – 2 billion annually by 2025. These estimates presuppose consistent clinician acceptance, insurance coverage expansion, and no significant pricing pressures from competitors or biosimilar entrants.

Regulatory and Reimbursement Considerations

Effective reimbursement policies, especially in managed care and Medicaid, are critical for sustainable market growth. Early engagement with payers, demonstration of cost-effectiveness, and inclusion in clinical guidelines will favorably influence pricing power and market penetration.

The drug’s health economic assessments are pivotal; data showing reductions in healthcare resource utilization via improved disease control can justify premium pricing and expand coverage.

Risks and Challenges

- Competitive Pressures: Entry of biosimilars or more efficacious topical agents could lead to downward price adjustments.

- Regulatory Scrutiny: Future indications or safety concerns may alter pricing and utilization.

- Market Adoption: Slow clinician or patient acceptance, or reimbursement hurdles, could suppress revenue growth.

Conclusion

ZORYVE holds a promising position within atopic dermatitis treatment, with an attractive profile to both clinicians and patients. The initial premium pricing aligns with its innovative status but is subject to erosion over time through competitive dynamics and market expansion. Strategic positioning, combined with sound economic justifications, can sustain its growth trajectory, potentially reaching USD 1.5 billion in global revenues by 2025.

Key Takeaways

- ZORYVE’s target market comprises an estimated 15 million potential patients, with rapid adoption driven by its targeted efficacy and safety.

- Initial pricing around USD 1,000 per tube reflects its premium innovation status, with projections indicating stability or slight reductions over time.

- Market growth hinges on formulary inclusion, clinician education, and reimbursement policies, which are favorable but require ongoing engagement.

- Competitive landscape shifts, especially biosimilar entries, pose pricing and market share risks, necessitating continuous strategic adaptation.

- Value-based pricing, emphasizing healthcare savings and improved patient outcomes, can reinforce ZORYVE’s market position and optimize revenue streams.

References

- IOB Insights. (2022). “Global Dermatology Market Outlook.”

- FDA. (2022). “FDA Approves ZORYVE (roflumilast cream) for Atopic Dermatitis.”

- Bloomberg Intelligence. (2023). "Dermatology Drugs: Market Trends and Outlook."

- ClinicalTrials.gov. (2022). “ZORYVE (roflumilast cream) Clinical Trials Data.”