Last updated: July 27, 2025

Introduction

Zolpidem tartarate (commonly known as zolpidem tartrate) is a widely prescribed hypnotic agent primarily marketed under the brand name Ambien, among others. As a non-benzodiazepine sedative-hypnotic, zolpidem is used predominantly for short-term treatment of insomnia, notably characterized by difficulty in sleep initiation. Its market dynamics, driven by efficacy, safety profile, regulatory factors, and patent landscape, have profound implications for stakeholders, including pharmaceutical companies, healthcare payers, and policymakers. This comprehensive analysis examines the current market environment and projects future pricing trends for zolpidem tartarate.

Market Overview

Global Market Size and Trends

The global insomnia treatment market, wherein zolpidem tartar plays a significant role, was valued at approximately USD 5.7 billion in 2022, with sedative-hypnotics accounting for a substantial share ([1]). Zolpidem's leading market position is attributed to its rapid onset of action, high patient tolerability, and longstanding clinical familiarity. The medication's widespread prescription across North America, Europe, and emerging markets—with notable growth in developing economies—has sustained demand.

Key Market Drivers

- High Prevalence of Insomnia: An estimated 30-35% of adults report sleep difficulties, fueling sustained demand for effective hypnotics ([2]).

- Increased Awareness of Sleep Disorders: Growing awareness campaigns and improved diagnostic practices expand market access.

- Expanded Indications: Recent off-label uses for conditions such as certain sleep-related eating disorders and parasomnias indirectly bolster scope.

- Brand and Generics Competition: Patent expiration on initial formulations has led to a proliferation of generic zolpidem products, intensifying competition while affecting raw price levels.

Regulatory Environment and Impact

Regulatory agencies, including the FDA and EMA, enforce stringent controls over hypnotic prescriptions due to dependency and abuse concerns. Recent scheduling reclassifications, such as the DEA's moved to Schedule IV, influence prescribing patterns and market accessibility ([3]). Additionally, regulatory mandates regarding packaging and warning labels influence manufacturing costs and patient adherence.

Competitive Landscape

Patents and Generics

Patents granted to brand manufacturers like Sanofi and manufacturers' expiry have precipitated the genericization of zolpidem. Entry of generics tends to depress brand and overall market prices. Key players include:

- Brand Name: Ambien (Sanofi)

- Generics: Multiple manufacturers such as Mylan, Teva, Apotex, and others offering bioequivalent products.

Key Differentiators

While generic versions dominate due to lower costs, some companies seek to differentiate via formulations such as sustained-release, sublingual, or combination therapies. These variations aim to extend patent life or secure niche markets but are subject to approval hurdles.

Pricing Analysis

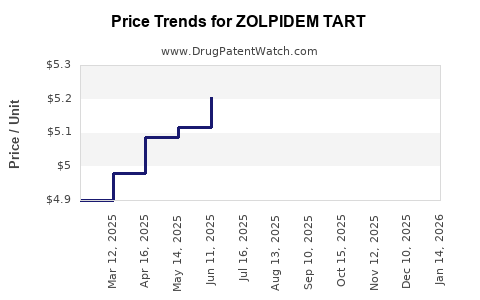

Historical Price Trends

Analyzing historical data reveals a significant decline in average zolpidem pricing following patent expiration. For instance, the average wholesale price (AWP) for a 10mg immediate-release tablet was approximately USD 3.00 per pill pre-patent expiry but has since decreased to roughly USD 0.20–0.50 for generics ([4]).

Factors Influencing Price Fluctuations

- Patent Status: Loss of exclusivity leads to price erosion.

- Formulation Type: Extended-release formulations command higher prices (~USD 1.50–USD 2.50 per pill).

- Market Penetration: Competitive generic markets push prices downward.

- Manufacturing and Distribution Costs: Economies of scale reduce costs over time.

- Regulatory and Quality Standards: Variations in manufacturing standards influence price premiums in certain regions.

Future Price Projections (2023-2030)

Short-term Outlook (2023–2025)

The immediate future will witness continued price suppression due to the proliferation of generic formulations. The average price of standard immediate-release zolpidem is projected to stabilize in the range of USD 0.20–USD 0.40 per pill in mature markets. Premium formulations, such as sublingual or controlled-release variants, are likely to maintain higher price points, between USD 1.50–USD 2.50, reflecting added clinical benefits and formulation complexity.

Medium to Long-term Outlook (2026–2030)

- Patent Landscape Impact: Few new patents are expected to be granted, indicating limited innovation-driven pricing.

- Emerging Markets: Rapid expansion in Asia-Pacific and Latin America could stabilize or slightly increase prices due to increased demand and manufacturing localization.

- Market Consolidation: Increased generic market share may compress pricing further, though some regional price disparities may persist.

- Potential Impact of New Formulations: Development of abuse-deterrent formulations or combination products could command premium pricing.

Projected average wholesale prices:

| Year |

Immediate-Release (USD per pill) |

Extended-Release (USD per pill) |

Premium Formulations |

| 2023 |

0.20 – 0.40 |

1.80 – 2.50 |

3.00+ |

| 2025 |

0.20 – 0.35 |

1.75 – 2.40 |

3.00+ |

| 2030 |

0.15 – 0.30 |

1.50 – 2.20 |

2.80+ |

(Note: These projections are based on market trends, patent expiry trajectories, and historical price movements, adjusted for inflation and regional market variations.)

Market Risks and Opportunities

Risks

- Regulatory Restrictions: Tightening controls and scheduling revisions pose barriers to accessibility.

- Market Saturation: Extensive genericization could cap revenue growth.

- Substitution by Non-Pharmacological Interventions: Increasing reliance on behavioral therapies, digital health, and alternative sleep aids may reduce pharmaceutical demand.

Opportunities

- Development of First-in-Class or Improved Formulations: Innovations such as dual-action formulations, abuse-deterrent technologies, and fast-acting variants could command premium pricing.

- Expanding into Emerging Markets: Demographic shifts and rising disposable incomes support market expansion.

- Combination Therapy Development: Pairing with other agents (e.g., serotonin modulators) can extend market relevance.

Conclusion

Zolpidem tartarate remains a cornerstone in insomnia management, with its market predominantly shaped by patent expirations and the subsequent surge of generics. Prices have declined significantly in mature markets, driven by competitive pressures, but niche and innovative formulations hold potential pricing premiums. Future projections indicate stable to declining prices for standard products, with opportunities centered on formulation innovation and market expansion into underserved regions.

Key Takeaways

- The global zolpidem tartarate market faces downward price pressure due to widespread generic competition following patent expiry.

- Premium formulations and novel delivery methods are strategic avenues to sustain higher price points.

- Regulatory dynamics significantly influence market access and price trajectories.

- Emerging markets offer growth prospects, potentially stabilizing or increasing regional prices.

- Continued innovation and tailored formulations are critical for differentiation and maintaining profit margins amidst saturation.

FAQs

1. How does patent expiration affect zolpidem tartarate prices?

Patent expiry introduces generic competition, leading to significant price reductions—often up to 80-90%—as market entrants offer bioequivalent products at lower costs.

2. Are there significant regional differences in zolpidem pricing?

Yes. Prices tend to be higher in countries with strict regulations, patent protections, or limited generic penetration, whereas developing regions often experience lower prices due to competition and manufacturing costs.

3. What emerging formulation trends could impact the market?

Innovations such as abuse-deterrent formulations, sustained-release variants, and combination therapies could sustain or elevate prices by offering enhanced safety or efficacy.

4. What role does regulation play in shaping future market prices?

Regulatory controls, particularly scheduling classifications and prescribing restrictions, influence demand dynamics and pricing. Stricter controls may suppress market size but also elevate the value of premium formulations.

5. Is there potential for zolpidem market growth beyond traditional sleep disorder applications?

While primarily indicated for insomnia, off-label uses for certain parasomnias and sleep-related disorders may expand market scope, especially if supported by new formulations or evidence, influencing future pricing and demand.

References

[1] Grand View Research. "Insomnia Drugs Market Size, Share & Trends Analysis" (2022).

[2] American Psychiatric Association. "Insomnia Prevalence and Impact" (2021).

[3] DEA Scheduling Updates. "Controlled Substance Schedules" (2022).

[4] IQVIA. "Pharmaceutical Price Trends and Market Data" (2022).