Share This Page

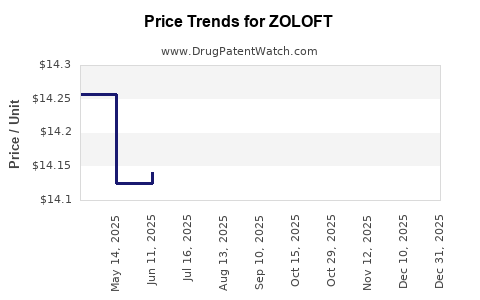

Drug Price Trends for ZOLOFT

✉ Email this page to a colleague

Average Pharmacy Cost for ZOLOFT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ZOLOFT 100 MG TABLET | 00049-4910-30 | 14.23448 | EACH | 2025-12-17 |

| ZOLOFT 100 MG TABLET | 58151-0576-32 | 14.23448 | EACH | 2025-12-17 |

| ZOLOFT 50 MG TABLET | 00049-4900-30 | 14.21520 | EACH | 2025-12-17 |

| ZOLOFT 50 MG TABLET | 58151-0575-93 | 14.21520 | EACH | 2025-12-17 |

| ZOLOFT 100 MG TABLET | 00049-4910-41 | 14.23448 | EACH | 2025-12-17 |

| ZOLOFT 100 MG TABLET | 58151-0576-93 | 14.23448 | EACH | 2025-12-17 |

| ZOLOFT 100 MG TABLET | 58151-0576-88 | 14.23448 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ZOLOFT (Sertraline)

Introduction

ZOLOFT (sertraline) is a selective serotonin reuptake inhibitor (SSRI) primarily prescribed for depression, anxiety disorders, obsessive-compulsive disorder (OCD), and post-traumatic stress disorder (PTSD). Since its approval by the FDA in 1991, ZOLOFT has established a robust market presence, benefiting from its efficacy, safety profile, and brand recognition. However, shifts in regulatory policies, generic competition, healthcare trends, and emerging therapeutic alternatives significantly influence its market dynamics and pricing strategies.

This report offers a comprehensive analysis of the current ZOLOFT market landscape, evaluates key drivers affecting its demand, and projects pricing trends over the next five years, providing actionable insights for stakeholders.

Market Overview

Historical Context and Market Position

Initially launched by Pfizer, ZOLOFT gained rapid acceptance owing to its favorable side effect profile and efficacy in treating diverse psychiatric conditions. Its patent protection expired in 2006, catalyzing generic entries, which exerted downward pressure on prices. Despite competition from generics, ZOLOFT maintains a strong market position due to brand loyalty, physician prescribing habits, and established efficacy data.

Current Market Size and Revenue

The global antidepressant market was valued at approximately USD 15 billion in 2022, with SSRIs constituting a significant share — over 50% — of prescriptions for depression and related conditions [1]. ZOLOFT remains among the top prescribed SSRIs in the United States and key European markets. In 2022, Pfizer’s ZOLOFT generated approximately USD 700 million in global sales, with the U.S. accounting for the majority.

Competitive Landscape

Post-patent expiry, ZOLOFT faces stiff competition primarily from generic sertraline, along with other SSRIs such as fluoxetine (Prozac), citalopram (Celexa), and escitalopram (Lexapro). In recent years, novel antidepressants and augmentation therapies have entered the scene, potentially impacting ZOLOFT’s market share.

Key Market Drivers and Challenges

Drivers

- Clinical efficacy and safety profile: Recognized as a first-line treatment for depression, driving consistent demand.

- Brand loyalty: Long-standing prescribing habits favor ZOLOFT among psychiatrists.

- Expanding indications: Off-label use in anxiety and trauma-related disorders sustains demand.

- Global healthcare access: Growing awareness and infrastructure improvements in emerging markets boost prescriptions.

Challenges

- Generic competition: The proliferation of low-cost generic sertraline significantly reduces brand premium.

- Pricing pressures: Payer efforts to negotiate discounts and formulary restrictions curb revenue.

- Emerging therapies: Novel drugs with faster onset and fewer side effects influence prescribing patterns.

- Regulatory and social factors: Increased scrutiny of medication safety and mental health policy shifts affect market dynamics.

Price Trends and Projections (2023–2028)

Historical Pricing Trends

Pre-patent expiry, ZOLOFT's wholesale price in the U.S. ranged between USD 3–4 per 50 mg tablet. Post-generic entry, pharmacy acquisition costs for generics plummeted to below USD 0.10 per tablet, leading to a sharp decline in retail prices of the brand—from approximately USD 1.50–2.00 in 2006 to less than USD 0.50 by 2010.

Current Pricing Landscape

- Brand ZOLOFT: Average retail price around USD 1.20–1.50 per 50 mg tablet.

- Generic sertraline: Approximate retail price of USD 0.10–0.20 per 50 mg tablet.

- Reimbursement trends: Insurers typically prefer generics, limiting revenue opportunities for brand ZOLOFT.

Projections for 2023–2028

Short-term (2023–2025)

- Stable pricing: Because of high competition and widespread generic penetration, ZOLOFT's retail price is expected to remain around USD 1.20 per tablet.

- Potential premium attributable to brand loyalty: Slight premium (up to 10–15%) may persist in certain jurisdictions due to prescriber familiarity.

Mid to Long-term (2025–2028)

- Gradual decline in brand pricing: Anticipated to decrease by 5–10% annually, driven by intensified generic competition and payer negotiations.

- Market share impact: The importance of brand ZOLOFT may diminish further unless new formulations, delivery mechanisms, or indications are introduced.

- Impact of biosimilars and improved formulations: While more relevant to biologics, innovative delivery methods (e.g., once-daily extended-release formulations) could stabilize prices if FDA approvals occur.

Influencing Factors

- Regulatory Environment: Price regulation policies, including caps on sales prices and reimbursement rates.

- Market Entry of Biosimilars and Alternatives: Although less relevant for small-molecule drugs like sertraline, novel compound developments could impact the future landscape.

- Healthcare Policies: Increased emphasis on mental health awareness may sustain demand, but cost-saving measures could pressure prices downward.

Strategic Insights for Stakeholders

- Pharmaceutical Companies: Focus on differentiating formulations, expanding indications, or developing combination therapies to sustain revenue.

- Investors: Expect declining brand margins but steady demand due to persistent need for depression treatment.

- Healthcare Providers and Payers: Prioritize cost-effective generic options; however, recognize brand loyalty’s persistence in certain settings.

- Policy Makers: Monitor drug affordability; consider policies to balance innovation incentives with access.

Key Takeaways

- Market maturity: Post-patent expiration, ZOLOFT faces significant downward pricing pressure because of widespread generic availability, with minimal room for brand premium.

- Pricing outlook: Over the next five years, expect a gradual decline in ZOLOFT’s retail prices, driven by aggressive generic competition and payer policies.

- Market demand: Steady demand persists due to the drug’s proven efficacy and central role in treating depression and anxiety disorders.

- Innovation potential: To retain market relevance and pricing power, the industry must explore new formulations or expand indications.

- Global variability: Emerging markets offer growth opportunities, although price sensitivity remains high, further compressing margins.

FAQs

1. How has generic entry affected ZOLOFT’s market share and pricing?

Generic sertraline entered the market in 2006, leading to a sharp decline in ZOLOFT’s retail prices—down to approximately USD 0.10–0.20 per tablet—while eroding its market share as prescribers shifted to lower-cost generics.

2. What are the main competitors to ZOLOFT today?

Generic sertraline remains the primary competitor, supplemented by other SSRIs like fluoxetine, citalopram, and escitalopram. Emerging antidepressants and augmentation therapies also pose future threats.

3. Could ZOLOFT regain pricing power?

Unlikely in the short term due to entrenched generic competition. However, new formulations or expanded indications might offer opportunities to sustain or improve pricing in niche markets.

4. How do healthcare policies impact ZOLOFT’s pricing trajectory?

Payers’ emphasis on cost containment and formulary restrictions favor generics, compressing prices. Policy interventions such as price caps could further influence trends.

5. What strategies should stakeholders adopt moving forward?

Investing in innovative drug delivery, exploring new applications, and leveraging brand loyalty in specific markets can help maintain relevance and revenue streams amid price pressures.

References

[1] MarketsandMarkets. "Antidepressants Market." 2022.

[2] Pfizer Inc. Financial Reports. 2022.

[3] IQVIA National Prescription Audit. 2022.

[4] U.S. Food and Drug Administration. "Sertraline Hydrochloride (Zoloft) NDA Approval". 1991.

[5] EvaluatePharma. "Pharmaceutical Price Trends." 2022.

Disclaimer: The provided projections are based on current data and trends; actual future prices may vary due to regulatory, economic, and scientific developments.

More… ↓