Last updated: July 31, 2025

Introduction

ZOCOR (simvastatin) remains a leading statin medication used globally for the management of hypercholesterolemia and cardiovascular risk reduction. As a widely prescribed lipid-lowering agent, understanding its market dynamics and price trajectory is critical for stakeholders, including pharmaceutical companies, healthcare providers, investors, and policymakers.

This report provides a comprehensive analysis of ZOCOR's current market position, competitive landscape, regulatory influences, and future price projections, incorporating recent trends, patent considerations, and clinical developments.

Market Overview

Historical Market Position

Introduced in 1991 by Merck & Co., ZOCOR became one of the first potent statins to significantly reduce serum cholesterol levels and cardiovascular events. Its early market dominance was underscored by robust efficacy, safety profile, and widespread physician acceptance.

The global statins market reaches approximately USD 15 billion annually, with ZOCOR historically capturing a substantial share, especially in North America and Europe. However, patent expirations and the advent of generics have eroded its market share but sustained demand owing to its established efficacy and healthcare provider familiarity.

Current Market Landscape

The current landscape features an extensive portfolio of statins, including atorvastatin, rosuvastatin, pravastatin, and generic simvastatin formulations. ZOCOR's brand status has diminished after patent losses in key markets, primarily due to increased generic competition.

In the United States, the patent for ZOCOR expired in 2006, with generic versions flooding the market afterward. Despite this, ZOCOR persists as a prescription choice where brand loyalty, formulary coverage, and physician preference favor it, especially in specific regions or patient populations.

Key Market Dynamics

-

Patent and Regulatory Status:

The original patent for ZOCOR lapsed over a decade ago; however, Merck and other manufacturers have explored patent extensions related to formulation or delivery mechanisms. To date, no recent patent extensions have been granted specifically for ZOCOR, resulting in significant generic competition.

-

Generic Penetration:

Generics dominate the market, capturing approximately 75-85% of statin prescriptions in major markets (e.g., US, EU). Pricing differentials favor generics, pressuring brand-name prices downward.

-

Clinical Guidelines:

Updated guidelines from the American College of Cardiology/American Heart Association (ACC/AHA) continue to endorse statins as first-line therapy, supporting ongoing demand. However, newer agents like PCSK9 inhibitors may impact statin utilization in high-risk cohorts.

-

Competitive Strategies:

Merck and other stakeholders focus on formulary exclusivity, medication adherence programs, and positioning ZOCOR within combination therapies to sustain relevancy.

Market Forecast and Price Projections

Factors Influencing Price Dynamics

-

Generic Competition:

Generics typically lead to price erosion; in the US, the average retail price for a 30-day supply of generic simvastatin ranges from USD 4-10. The brand ZOCOR’s price has declined correspondingly.

-

Regulatory and Patent Strategies:

Although no recent patent protections exist, ongoing patenting of specific formulations or delivery systems might temporarily influence pricing and exclusivity in certain regions.

-

Healthcare Policy and Reimbursement:

Price negotiations, formulary placement, and insurance coverage significantly impact effective patient costs, with payers favoring the most cost-effective options.

-

Market Penetration of Alternatives:

The rising use of other statins, such as generic atorvastatin and rosuvastatin, affects share and pricing strategies for ZOCOR.

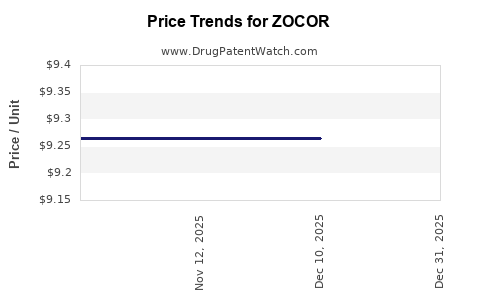

Price Projection for the Next 5-10 Years

Given current trends, ZOCOR's brand-price is expected to continue declining unless targeted for niche markets or specific formulations.

-

Short-term outlook (1-3 years):

- Brand prices are expected to stabilize temporarily owing to limited prescriber switching or formulary restrictions.

- The average retail price for ZOCOR (brand) will likely hover between USD 40-70 for a 30-day supply, reflecting a significant discount compared to pre-generic eras.

-

Medium-term outlook (4-7 years):

- Price erosion will persist due to newer generic simvastatin offerings, with average prices falling below USD 20 per month in regions with aggressive price competition.

- The brand may adopt strategic premium pricing for specific formulations or delivery systems, but overall, competitive pressures will suppress prices.

-

Long-term outlook (8-10 years):

- As generics become the standard, ZOCOR’s brand price may diminish further or become marginally relevant, primarily in regions lacking extensive generic penetration.

- Price projections indicate stabilization near USD 10-15 per month in advanced markets, with some regions possibly observing lower prices.

Revenue Impact

The combination of declining prices and market share erosion suggests that ZOCOR’s revenue contribution will diminish unless new indications or formulations are introduced. The overall statins market growth, driven by an aging population and increasing cardiovascular disease prevalence, provides some revenue resilience, but brand-specific premiums will diminish.

Emerging Trends and Innovations

-

Formulation and Delivery Advances:

Patents on fixed-dose combinations (FDCs) or new formulations could temporarily enhance ZOCOR’s marketability and pricing.

-

Pharmacogenomics and Personalization:

Enhanced understanding of genetic factors influencing statin response may shape future prescribing practices, potentially affecting ZOCOR's demand.

-

Market Expansion in Developing Regions:

While mature markets decline in brand value, emerging economies with increasing healthcare access could temporarily sustain higher prices.

Regulatory Landscape and Impact

Regulatory agencies, including the FDA and EMA, continually evaluate statin safety profiles. Recent updates emphasize the importance of monitoring for adverse effects, marginally influencing prescribing habits.

Patent litigation and exclusivity strategies, though limited for ZOCOR today, will influence its price if new patents are granted or if formulations are changed.

Key Takeaways

-

Generic competition has profoundly driven down ZOCOR’s price, with future projections indicating continued decline in the absence of novel formulations or indications.

-

Market share remains influenced by healthcare policies and formulary preferences, favoring generics over brand-name drugs, including ZOCOR.

-

Emerging market opportunities in developing regions could offer marginal pricing stability, but overall industry trends favor price erosion.

-

Innovative formulation strategies may temporarily bolster ZOCOR's market value but face diminishing returns without substantial clinical breakthroughs.

-

Stakeholders should focus on cost-effective prescribing, strategic formulary placements, and exploring new formulations to sustain profitability.

FAQs

Q1: Will ZOCOR regain market share post-generic erosion?

Unlikely, unless Merck or other manufacturers introduce novel formulations, combination therapies, or indications that justify premium pricing.

Q2: How does ZOCOR’s price compare to other statins?

Generic simvastatin, including ZOCOR, is among the most affordable statins. Brand ZOCOR’s price remains higher but is declining due to generic competition.

Q3: Are there specific niches where ZOCOR maintains higher pricing?

Yes, in regions with limited generic availability or for formulations with unique delivery systems, ZOCOR’s price may remain relatively higher temporarily.

Q4: How might upcoming regulatory changes impact ZOCOR’s pricing?

Regulatory shifts emphasizing biosimilars or generic substitutions could accelerate price declines, especially if additional patent protections are not obtained.

Q5: What strategic moves can stakeholders adopt to enhance ZOCOR’s competitiveness?

Investing in formulations with patent protection, targeting niche markets, and leveraging clinical guidelines for targeted populations are potential strategies.

References

- [1] European Medicines Agency. (2022). Simvastatin: Summary of Product Characteristics.

- [2] US Food and Drug Administration. (2023). Approved Drugs: Simvastatin.

- [3] MarketWatch. (2023). Global Statins Market Size & Share Analysis.

- [4] IMS Health (2022). Pharmaceutical Market Data.

- [5] American College of Cardiology/American Heart Association. (2019). Guidelines on the Management of Blood Cholesterol.

By maintaining a vigilant view of market trends, regulatory developments, and competitive strategies, stakeholders can effectively navigate ZOCOR’s evolving market landscape and optimize pricing strategies accordingly.