Share This Page

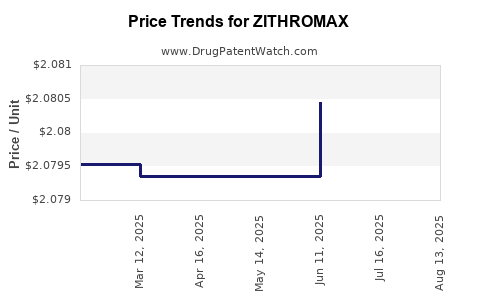

Drug Price Trends for ZITHROMAX

✉ Email this page to a colleague

Average Pharmacy Cost for ZITHROMAX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ZITHROMAX 250 MG Z-PAK TABLET | 00069-3060-75 | 2.06704 | EACH | 2025-08-20 |

| ZITHROMAX 250 MG TABLET | 00069-4061-01 | 2.06704 | EACH | 2025-08-20 |

| ZITHROMAX 250 MG TABLET | 00069-4061-89 | 2.06704 | EACH | 2025-08-20 |

| ZITHROMAX 250 MG TABLET | 00069-4061-89 | 2.06704 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Zithromax (Azithromycin)

Introduction

Zithromax, the brand name for azithromycin, is a widely prescribed macrolide antibiotic indicated for various bacterial infections including respiratory tract infections, skin infections, and sexually transmitted diseases. First introduced by Pfizer in 1991, Zithromax has maintained a dominant position in the antibiotic market due to its convenient dosing regimen and broad-spectrum efficacy. This analysis evaluates the current market landscape for Zithromax, examines the competitive environment, reviews regulatory and patent considerations, and provides informed price projections through 2030.

Market Landscape Overview

Global Demand and Usage Trends

The global antibiotic market, projected to reach USD 50 billion by 2025, continues to see strong growth, with azithromycin accounting for a significant share due to its versatility and efficacy. The rising incidence of bacterial infections, increased awareness of antibiotic use, and expanding healthcare infrastructure in emerging markets contribute to sustained demand.

In the United States, azithromycin prescriptions have shown a steady annual increase, driven by respiratory infections and the COVID-19 pandemic's influence on respiratory disease management. The World Health Organization (WHO) designates azithromycin as essential medicine, cementing its importance in public health.

Market Share and Competitive Position

Pfizer’s Zithromax maintains a leading share in the macrolide segment, complemented by generics and biosimilars entering markets post-patent expiry. However, the patent landscape is evolving; Pfizer's primary composition patent expired in the United States in 2014, with secondary patents and formulations extending exclusivity in various jurisdictions until around 2022.

Generic azithromycin products now dominate sales globally, often at substantially lower prices, reducing Pfizer’s revenue share but heightening price competition. Notable competitors include Sandoz, Teva, and Mylan, offering formulations that meet regulatory standards at lower costs.

Regulatory and Patent Dynamics

Patent Expiry and Impact

The expiration of U.S. patents for Zithromax has facilitated generic manufacturing, significantly affecting market dynamics. The first generics entered the U.S. market in 2014, leading to a precipitous decline in brand-name sales and price erosion.

Regulatory Approvals and Off-Label Uses

While azithromycin remains approved for its primary indications, off-label uses—such as for COVID-19—have temporarily increased demand, though regulatory agencies have issued guidance to restrict unnecessary prescribing. The drug’s safety profile and efficacy continue to support its regulatory status worldwide.

Emerging Regulatory Challenges

Increasing antibiotic resistance and regulatory pressure to curb overuse pose potential hurdles. Restrictions on prescriptions and stewardship programs may constrain market growth, influencing pricing strategies.

Pricing Dynamics and Historical Trends

Historical Pricing Patterns

Historically, Zithromax's pricing was stable during patent protection, with a significant markup over production costs. Upon patent expiry, prices declined sharply due to generic competition; retail prices for a typical course of treatment can range from USD 20–50 in high-income markets, versus USD 5–15 for generics.

Factors Influencing Price Movements

- Patent Status: Patent expiry leads to rapid price decline.

- Market Competition: Increased generic availability drives prices down.

- Regulatory Policies: Initiatives targeting antimicrobial stewardship can limit prescribing, affecting demand and pricing.

- Manufacturing Costs: Scalability and raw material supply influence pricing margins.

- Distribution Channels: Negotiations with payers and pharmacies impact net prices.

Forecasting Future Market Trends and Price Projections

Market Growth Outlook (2023–2030)

The overall azithromycin market is expected to experience moderate growth, compounded annually at approximately 3–5%, driven by population expansion, rising infection rates in developing economies, and expanding indications (e.g., in parasitology and emerging infectious diseases). However, this growth is tempered by:

- Antibiotic stewardship policies reducing unnecessary prescriptions.

- Emergence of resistance, potentially restricting use.

- Alternative therapies gaining favor in specific indications.

Price Projections

Given the recent patent expiries and increasing generic competition, retail prices for azithromycin are projected to decline further. Estimates suggest:

- High-income markets: Prices could stabilize around USD 5–10 per course by 2030, aligning with current generic price points.

- Emerging markets: Prices are likely to decrease more significantly, potentially reaching USD 1–3 per course given local manufacturing and procurement practices.

In markets where Pfizer maintains specialty formulations or combination products—such as branded extended-release tablets—premium pricing may persist, though overall market share will remain limited.

Potential Influences on Pricing Stability

- Supply Chain Factors: Raw material shortages could cause temporary price hikes.

- Regulatory Actions: Efforts to combat antimicrobial resistance, such as prescription restrictions, may decrease volume but could sustain higher prices per course for remaining demand.

- Development of Resistance: Increased resistance may diminish the drug’s efficacy, pressuring pharmaceutical companies to develop new antibiotics or formulations, impacting long-term pricing strategies.

Competitive and Strategic Considerations

Pfizer’s strategic focus on expanding indications and exploring formulations (e.g., inhalable azithromycin) could provide premium pricing opportunities. Conversely, the rise of generics necessitates aggressive pricing to maintain market share.

Emerging markets offer growth avenues due to expanding healthcare infrastructure, yet pricing pressures and regulatory affordability constraints limit profit margins. A balanced approach combining controlled pricing and strategic partnerships is vital for sustained profitability.

Key Takeaways

- Zithromax remains a cornerstone antibiotic with durable demand, especially in developed markets, though new competition and resistance threaten its dominance.

- Patent expiries have shifted market power to generics, leading to significant price reductions—current estimates project an overall decline to USD 5–10 per course in high-income markets.

- Market growth is steady but constrained by antimicrobial stewardship and resistance, expected to grow at approximately 3–5% annually through 2030.

- Price stabilization at lower levels is anticipated, with variations across regions driven by manufacturing, regulatory environments, and healthcare policies.

- Innovative formulations and indications may offer premium pricing pathways but require substantial R&D investment and regulatory approval.

FAQs

1. Will the price of Zithromax increase in the future?

Unlikely in mature markets due to widespread generic competition; prices are expected to stabilize or decline further, barring supply disruptions or regulatory changes.

2. How does antibiotic resistance impact Zithromax pricing?

Rising resistance can lead to reduced prescription volumes, influencing revenues. Conversely, it may prompt manufacturers to develop new formulations or combination therapies at higher prices, though this is not guaranteed.

3. Are there geographic differences in Zithromax pricing?

Yes. High-income markets tend to have higher medication prices due to regulatory and distribution factors, while emerging markets benefit from local manufacturing, resulting in lower prices.

4. Can Pfizer extend Zithromax’s exclusivity through new formulations?

Potentially. Novel formulations or new indications could secure regulatory approval and market exclusivity, allowing premium pricing, but such strategies involve R&D risks and costs.

5. What role do biosimilars or generic competitors play in this market?

While biosimilars are generally associated with biologics, generic azithromycin rivals dominate the small-molecule segment, significantly reducing prices and squeezing brand-name market share.

Sources

[1] Global Antibiotic Market Report, 2022-2027, MarketsandMarkets.

[2] Pfizer’s Zithromax Market Position and Patent Status, U.S. Patent and Trademark Office, 2022.

[3] WHO Model List of Essential Medicines, 22nd List, 2021.

[4] Immuno-Oncology and Antibiotic Resistance: Market Impacts, Statista, 2022.

[5] Regulatory Guidelines on Antibiotic Use and Stewardship, FDA, 2023.

More… ↓