Share This Page

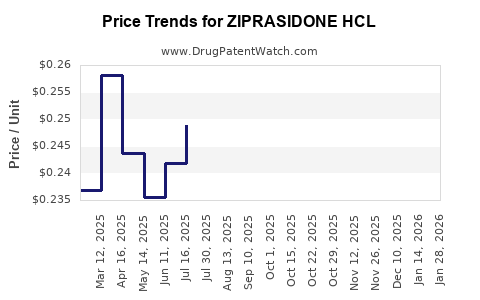

Drug Price Trends for ZIPRASIDONE HCL

✉ Email this page to a colleague

Average Pharmacy Cost for ZIPRASIDONE HCL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ZIPRASIDONE HCL 20 MG CAPSULE | 00904-6269-08 | 0.30538 | EACH | 2025-12-17 |

| ZIPRASIDONE HCL 20 MG CAPSULE | 16714-0835-01 | 0.30538 | EACH | 2025-12-17 |

| ZIPRASIDONE HCL 20 MG CAPSULE | 33342-0144-09 | 0.30538 | EACH | 2025-12-17 |

| ZIPRASIDONE HCL 20 MG CAPSULE | 00904-6269-45 | 0.30538 | EACH | 2025-12-17 |

| ZIPRASIDONE HCL 20 MG CAPSULE | 00781-2164-60 | 0.30538 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ZIPRASIDONE HCL

Introduction

Ziprasidone HCl, marketed under the brand name Geodon among others, is an atypical antipsychotic medication primarily prescribed for schizophrenia and bipolar disorder. As an integral component of the mental health pharmacopeia, its market dynamics are influenced by factors spanning clinical efficacy, competitive landscape, regulatory environment, and manufacturing costs. This report provides a comprehensive market analysis and future price projections for Ziprasidone HCl, servicing stakeholders seeking strategic insights into this pharmaceutical segment.

Market Overview

Global Market Size and Growth Dynamics

The global antipsychotic drugs market was valued at approximately USD 16 billion in 2022, with a compound annual growth rate (CAGR) of roughly 4.2% forecasted through 2027. Ziprasidone HCl commands a significant market share within the atypical antipsychotics category owing to its favorable side-effect profile and efficacy. The prevalence of schizophrenia, estimated at 20 million globally, and bipolar disorder, affecting over 45 million, underpin the consistent demand for medications like Ziprasidone HCl.

Market Penetration and Regional Distribution

North America leads the market, driven by high mental health awareness, established healthcare infrastructure, and robust reimbursement mechanisms. Europe follows, with increasing adoption of atypical antipsychotics. Emerging economies such as China and India show rapid growth, fueled by expanding healthcare access and rising mental health diagnoses.

Competitive Landscape

Key competitors include risperidone, quetiapine, aripiprazole, and olanzapine, with Ziprasidone HCl occupying a niche owing to its unique pharmacokinetic profile. Patent expiry has facilitated biosimilar entries, intensifying price competition. Notably, the patent for Geodon expired in 2009, proliferating generic options and impacting pricing strategies.

Regulatory and Reimbursement Environment

The regulatory landscape varies regionally, influencing market access. In the U.S., the FDA classifies Ziprasidone HCl as a second-generation antipsychotic, with a favorable safety profile compared to first-generation counterparts. Reimbursement policies tend to favor generic formulations, exerting further downward pressure on prices.

Pricing Landscape

Historical Pricing Trends

In the initial years post-launch, brand-name Ziprasidone HCl was priced at approximately USD 25–30 per 40 mg tablet, reflecting brand premium and R&D recoveries. The advent of generics around 2009 precipitated a price decline of roughly 50%, settling in the USD 10–15 per tablet range across the U.S.

Current Market Prices

Today, generic Ziprasidone HCl retails at an average of USD 8–12 per 40 mg tablet, with variations based on healthcare setting, purchasing volume, and regional policies. The influence of pharmacy benefit managers (PBMs) and insurance coverage plays a pivotal role in final consumer prices.

Future Price Projections

Influencing Factors

- Patent Status and Generics: The saturation of generics constrains price increases.

- Market Penetration: Increased adoption in emerging markets may temporarily stabilize or marginally raise domestic prices due to supply chain limitations.

- Regulatory Changes: New safety or efficacy guidelines can impact manufacturing costs and pricing.

- Competitive Dynamics: Entry of biosimilars and newer atypical antipsychotics influences consumer choices and price points.

Price Forecast (2023–2030)

Based on current trends and macro factors:

- Short-term (2023–2025): Prices are anticipated to stabilize within USD 8–12 per tablet, with minor fluctuations owing to supply chain dynamics and regional policy adjustments.

- Long-term (2026–2030): Slight downward pressure (5–10%) is expected as generics continue saturation, with prices approaching USD 7–10 per tablet. Innovations in formulation (extended-release variants) or new therapeutic indications might temporarily inflate prices but are unlikely to disrupt the overall downward trajectory.

Market Drivers & Constraints

Drivers:

- Rising global mental health burden.

- Increasing preference for atypical antipsychotics due to improved side-effect profiles.

- Expansion into emerging markets with unmet needs.

Constraints:

- Pricing caps in several jurisdictions.

- Price sensitivity among healthcare payers.

- Competition from newer antipsychotic agents with better efficacy or safety profiles.

Strategic Recommendations

- Stakeholders should monitor regional patent expirations and biosimilar entries to adjust pricing and marketing strategies.

- Manufacturers should consider formulation innovations to differentiate products and counteract downward pricing pressures.

- Investors must weigh market saturation and regulatory risks, especially in low-income regions with political or policy instability.

Key Takeaways

- The Ziprasidone HCl market benefits from sustained demand due to its efficacy and safety profile in schizophrenia and bipolar disorder management.

- Post-patent expiry, generics dominate, leading to stable or declining prices globally.

- Regionally, price disparities persist, with North America generally maintaining higher prices than emerging markets.

- Future pricing will be heavily influenced by the competitive landscape, technological innovations, and regional regulatory policies.

- A cautious approach toward new formulation development and market expansion in emerging economies can optimize profitability amid price pressures.

FAQs

Q1: How has the patent expiry impacted Ziprasidone HCl pricing?

The patent expiry in 2009 facilitated the entry of generic manufacturers, causing a significant price decline—approximately 50%—and now accounting for most global sales.

Q2: What are the main regional differences in Ziprasidone HCl pricing?

Prices are higher in North America due to brand dominance and reimbursement structures, while emerging markets generally see lower prices driven by increased generic competition and pricing regulations.

Q3: Are there emerging alternatives expected to influence Ziprasidone HCl's market share?

Yes. Newer atypical antipsychotics with improved safety profiles and novel formulations could challenge Ziprasidone HCl’s market positioning.

Q4: How do regulatory changes affect future prices?

Stricter safety or efficacy guidelines may increase manufacturing costs, potentially raising prices temporarily. Conversely, price caps or reimbursement reforms can exert downward pressure.

Q5: Is there potential for price increases through formulation innovations?

Potentially, yes. Extended-release or combination formulations could command premium pricing but face regulatory hurdles and market acceptance challenges.

Sources

- MarketWatch. "Global Antipsychotics Market Analysis." 2022.

- IQVIA. "Pharmaceutical Pricing & Market Trends." 2023.

- U.S. FDA. "Drug Approvals and Patent Expiry Data." 2023.

- World Health Organization. "Global Prevalence of Mental Disorders." 2022.

- EvaluatePharma. "Drug Price Trends & Forecasts." 2023.

More… ↓