Last updated: July 27, 2025

Introduction

Zinc oxide (ZnO) is a versatile chemical compound with extensive applications across industries including skincare, rubber manufacturing, ceramics, electronics, and pigments. Its multifaceted uses position it as a crucial ingredient in consumer products and industrial processes, underpinning a resilient market with steady demand. This report provides a comprehensive analysis of the zinc oxide market, focusing on current trends, supply-demand dynamics, price drivers, and future projections up to 2030.

Industry Overview

Global Market Size and Growth Dynamics

The global zinc oxide market was valued at approximately USD 1.2 billion in 2022, with a compound annual growth rate (CAGR) estimated at 4-5% from 2023 to 2030. Market expansion is primarily driven by increased demand in the cosmetics industry (notably sunscreens and skincare products), growing rubber manufacturing in automotive applications, and expanded use in the electronics sector.

Major consuming regions include Asia-Pacific (APAC), North America, and Europe. APAC dominates due to burgeoning manufacturing and construction activity, alongside rising consumer awareness about skincare products containing zinc oxide.

Key Applications:

- Personal Care and Cosmetics: SPF formulations account for roughly 50% of zinc oxide consumption, driven by rising global demand for Sun Protection Factor products.

- Rubber Industry: Zinc oxide acts as an activator in the vulcanization process, instrumental in tire manufacturing.

- Ceramics and Glass: Used for its whitening properties and stability.

- Electronics: Employed in semiconductors, varistors, and thermistors.

Supply Chain and Market Drivers

Raw Material Availability and Production Dynamics

Zinc ore mining, predominantly in China, Australia, and Peru, supplies the primary zinc—processed into zinc oxide through various refining processes. China leads as the largest producer, accounting for over 50% of global output, influencing pricing through supply-side factors.

Driving Factors:

- Regulatory Environment: Stricter environmental regulations on zinc smelters and mining operations can constrain supply, thus impacting prices.

- Technological Advancements: Improvements in manufacturing, such as solvent extraction and electrolysis, reduce costs and improve quality.

- Environmental and Sustainability Concerns: Demand for eco-friendly, non-toxic zinc oxide grades increases, influencing market structure and pricing.

Demand Drivers:

- Increasing urbanization and construction projects in developing regions.

- Rising disposable income boosting demand for personal care products.

- Innovation in functional materials for electronics.

Market Trends and Competitive Landscape

Emerging Trends

- Expansion of Organic and Eco-Friendly Zinc Oxide: Driven by the cosmetics sector’s shift toward bio-compatible and biodegradable ingredients.

- Integration of Nano-Zinc Oxide: Enhanced UV protection and antimicrobial properties have expanded application scope.

- Vertical Integration: Major producers are acquiring upstream mining assets to control supply and optimize costs.

- Geographical Diversification: Investments in zinc production in Africa and South America aim to dilute regional supply risks.

Key Industry Players

Major manufacturers include Zinc Nacional (Mexico), EverZinc (Belgium), US Zinc (US), and China’s Xinyang Zinc Industry. These companies compete on price, purity grades, and supply reliability. Pricing strategies are influenced by raw material costs, processing efficiencies, and regional regulations.

Price Analysis and Projections

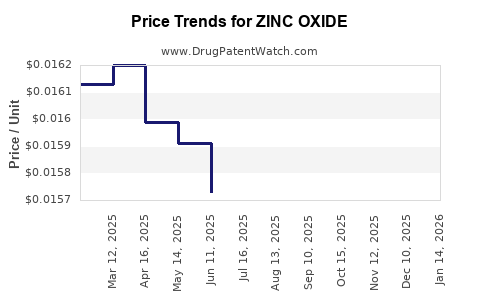

Historical Price Trends

From 2010 to 2022, zinc oxide prices fluctuated between USD 2.50 to USD 4.00 per kilogram. The median price hovered around USD 3.00/kg. Price volatility was primarily driven by zinc ore prices, regulatory changes, and demand fluctuations in end-use sectors.

Current Price Environment (2023)

As of Q1 2023, prices increased modestly to approximately USD 3.50–4.00 per kg, reflecting:

- Rising zinc ore costs amid environmental restrictions.

- Increased demand from the electronics sector.

- Supply constraints due to mine closures in certain regions.

Future Price Projections (2023–2030)

Analysts project a steady upward trajectory, with prices reaching between USD 4.50 and USD 5.00 per kg by 2030. Contributing factors include:

- Supply Constraints: Environmental regulations are likely to constrain output, especially in China, where environmental scrutiny intensifies.

- Demand Growth: Anticipated CAGR of 4-5% in demand, especially in emerging markets.

- Raw Material Costs: Zinc ore prices are expected to rise marginally, translating into higher processing costs.

- Technological Innovations: Adoption of nano-zinc oxide may command premium pricing due to enhanced properties.

Scenario-based Outlook

- Optimistic Scenario: Strong demand in electronics and cosmetics, coupled with supply tightness, could push prices beyond USD 5.00/kg.

- Pessimistic Scenario: Technological breakthroughs or increased recycling efforts may reduce raw material dependency, stabilizing or lowering prices.

Regulatory and Environmental Impact

Stringent environmental policies, especially in China and Europe, aim to reduce pollutant emissions from mining and processing plants, potentially leading to:

- Higher operating costs.

- Supply disruptions.

- Shifts towards sustainable production methods demanding investment.

These factors will influence pricing, with potential short-term volatility.

Implications for Market Participants

Producers should watch trends in raw material costs, technological innovations, and regulatory changes. Diversification into high-value niche applications, such as nano-zinc oxide for antimicrobial coatings, could buffer against price fluctuations.

Downstream manufacturers should consider raw material price hedging, supply chain resilience strategies, and research into alternative compounds or recycled zinc sources.

Key Takeaways

- The zinc oxide market is expected to grow at a CAGR of 4-5% through 2030, driven by demand in cosmetics, rubber, and electronics.

- Prices are projected to rise from approximately USD 3.50–4.00 per kg in 2023 to USD 4.50–5.00 per kg by 2030.

- Supply-side constraints, environmental regulations, and technological advancements will be the primary price drivers.

- Major industry players are expanding control over upstream raw material sources, aiming for stable supply and cost management.

- Sustainability trends and regulatory changes will likely influence both supply dynamics and price stability.

FAQs

1. What are the main applications driving demand for zinc oxide?

Primarily, zinc oxide sees high demand in personal care (sunscreens and skincare), rubber manufacturing (tire production), ceramics, and electronics.

2. How do environmental regulations impact zinc oxide prices?

Stricter regulations increase operational costs for mining and processing, leading to supply constraints and higher prices.

3. What regions are the most significant in zinc oxide production?

China dominates global output, followed by facilities in Mexico, Belgium, and the US, with emerging investments in Africa and South America.

4. Will nano-zinc oxide replace conventional grades?

Nano-zinc oxide offers enhanced properties like better UV protection and antimicrobial activity, likely expanding demand and potentially affecting pricing structures.

5. How can market participants mitigate price volatility?

Engaging in raw material procurement hedging, investing in recycling technologies, and diversifying application portfolios can reduce exposure to price swings.

References

[1] Grand View Research. (2023). Zinc Oxide Market Size, Share & Trends Analysis Report.

[2] MarketsandMarkets. (2022). Nano Zinc Oxide Market by End-Use Industry.

[3] US Geological Survey. (2022). Mineral Industry Surveys.

[4] Bloomberg Intelligence. (2023). Metal Industry Outlook.

[5] Industry Reports and Company Publications.

Disclaimer: This report is for informational purposes only and does not constitute investment advice. Market conditions can change rapidly; consult industry experts and conduct thorough due diligence before making operational or investment decisions.