Share This Page

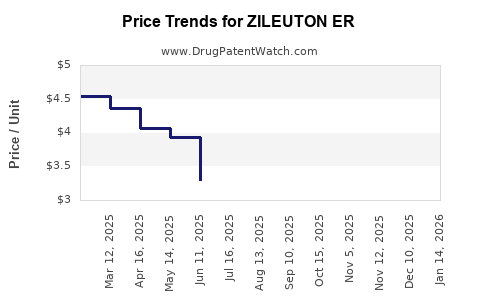

Drug Price Trends for ZILEUTON ER

✉ Email this page to a colleague

Average Pharmacy Cost for ZILEUTON ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ZILEUTON ER 600 MG TABLET | 64380-0189-01 | 3.06255 | EACH | 2025-12-17 |

| ZILEUTON ER 600 MG TABLET | 72603-0246-01 | 3.06255 | EACH | 2025-12-17 |

| ZILEUTON ER 600 MG TABLET | 64980-0206-12 | 3.06255 | EACH | 2025-12-17 |

| ZILEUTON ER 600 MG TABLET | 31722-0044-12 | 3.06255 | EACH | 2025-12-17 |

| ZILEUTON ER 600 MG TABLET | 64380-0189-01 | 3.02520 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Zileuton ER

Introduction

Zileuton ER (extended-release formulation) is a pharmaceutical agent primarily indicated for the management of asthma by inhibiting leukotriene synthesis, thereby reducing airway inflammation. As a selective 5-lipoxygenase inhibitor, Zileuton ER holds a specific niche within the respiratory therapeutics market, competing with other leukotriene receptor antagonists (LTRAs) and corticosteroids. This analysis examines current market dynamics, competitive landscape, regulatory factors, and provides price projections for Zileuton ER’s near and mid-term future, equipping stakeholders with insights vital for strategic decision-making.

Market Landscape Overview

Global Respiratory Therapeutics Market

The global respiratory therapeutics market was valued at approximately USD 35 billion in 2022, with a compound annual growth rate (CAGR) of 6.2% (2023–2030). The rising prevalence of asthma and chronic obstructive pulmonary disease (COPD), driven by pollution, tobacco use, and urbanization, fuels market expansion [1]. Zileuton ER, as part of this sector, benefits from increasing prescription rates, especially in developed markets with high healthcare access.

Asthma Treatment Landscape

Asthma affects over 262 million individuals worldwide, with prevalence rising notably in Asia-Pacific and Latin America [2]. Pharmacotherapy includes inhaled corticosteroids (ICS), LTRAs like montelukast and Zileuton, and biologics. Zileuton's unique mechanism offers an alternative for patients intolerant to other therapies, creating a specific positioning within asthma management protocols.

Regulatory and Patent Status

Zileuton ER has received regulatory approval from agencies such as the FDA and EMA. The patent landscape for Zileuton ER has been complex; however, the patent exclusivity for the formulation has generally lasted until early 2030s, with some jurisdictions offering data exclusivity extending beyond patents [3]. This patent cycle influences market penetration and pricing strategies.

Competitive Landscape

Existing and Emerging Competitors

- Montelukast (Singulair): The most widely used LTRA, with substantial market share and a broad patent expiry timeline.

- Biologics: Drugs such as mepolizumab and benralizumab target severe eosinophilic asthma but are costly and reserved for advanced cases.

- Generic Zileuton: While generics are limited, biosimilar development can impact prices and market dynamics.

Market Penetration and Adoption

Despite its proven efficacy, Zileuton ER’s adoption remains limited relative to montelukast, primarily due to marketing focus, clinician familiarity, and dosing convenience. However, its potential as a steroid-sparing agent and its efficacy in specific subsets may expand its niche.

Pricing Dynamics

Current Pricing Overview

As of 2023, Zileuton ER's average wholesale price (AWP) is approximately USD 200 for a 30-day supply (600 mg, 2 tablets q.i.d.), positioning it as a mid-tier option. Among LTRAs, it is priced higher than generics but lower than biologics. Custom pricing models, discounts, and insurance negotiations influence actual transaction prices.

Factors Affecting Price

- Patent Status: Market exclusivity duration restricts generic competition, enabling preservation of premium pricing.

- Regulatory Approvals: Label extensions for additional indications or formulations can justify price adjustments.

- Manufacturing Costs: The complexity of formulation and quality standards impact cost structures.

- Reimbursement Policies: Insurance coverage and formulary placements significantly influence patient access and provider prescribing behavior.

Price Projections: 2023–2028

Short-term (1–2 years)

With patent protections intact until approximately 2030, Zileuton ER's pricing is expected to remain relatively stable, with slight annual increases (~3%) driven by inflation and manufacturing cost adjustments. The burgeoning awareness of its niche benefits may lead to targeted marketing for specific patient populations, supporting marginal price premium adjustments.

Mid-term (3–5 years)

As patent exclusivity approaches expiry, biosimilar entrants or generic equivalents could emerge, exerting downward pressure on prices. Concurrently, formulary limitations and insurance negotiations may moderate list prices. Based on historical precedents for niche asthma medications, a potential price decline of 15–25% is projected by 2028, assuming generic entry.

Factors Influencing Future Price Dynamics

- Patent Litigation and Data Exclusivity: Legal actions may either prolong or shorten exclusivity periods, influencing pricing.

- Regulatory Developments: Approvals for new indications or formulations could justify price increases.

- Market Penetration Rates: Greater clinician awareness and patient acceptance may support stable or incremental price premiums initially.

Strategic Implications for Stakeholders

- Manufacturers should leverage patent protections to maximize revenue while preparing for eventual generic competition with strategic patient targeting.

- Investors should monitor regulatory milestones and market adoption curves to inform valuation models.

- Healthcare Providers and Payers can consider the cost-benefit profile of Zileuton ER relative to existing therapies, especially for patients with specific asthma phenotypes unresponsive to other LTRAs.

Key Takeaways

- The Zileuton ER market remains niche but sustainable, supported by ongoing asthma prevalence and backed by regulatory approvals.

- Current pricing strategies capitalize on patent protection, with prices around USD 200 per month; these are expected to decline gradually as patent exclusivity wanes.

- Market entry of biosimilars or generics post-2030 could reduce prices by approximately 15–25%, influencing revenue prospects.

- Growth opportunities may emerge through expanded indications and personalized medicine approaches targeting specific asthma subtypes.

- Strategic positioning should balance patent lifecycle management, market penetration, and healthcare reimbursement landscapes.

FAQs

1. When is the patent for Zileuton ER expected to expire?

The patent for Zileuton ER is anticipated to expire in early 2030s, allowing biosimilar or generic entrants thereafter, which could significantly impact pricing and market share.

2. How does Zileuton ER compare cost-wise to other asthma therapies?

Currently, Zileuton ER is priced around USD 200 per month, positioning it between inexpensive generics like montelukast and high-cost biologics, with its value driven by its unique mechanism and specific patient benefits.

3. What factors might influence Zileuton ER's market penetration further?

Increased clinician awareness, expanded indications, and positive clinical trial outcomes could enhance adoption, while reimbursement policies and formulary placements are critical determinants.

4. Are there upcoming regulatory or patent developments that could alter pricing?

Yes, patent litigation, data exclusivity extensions, or new approvals for additional indications could justify price adjustments, either upwards or downwards.

5. What is the potential impact of biosimilars or generics on Zileuton ER’s pricing?

Entry of biosimilars or generics post-2030 could reduce prices by 15–25%, intensifying competitive pressure and affecting revenue projections for stakeholders.

References

[1] MarketsandMarkets. Respiratory Therapeutics Market Forecast, 2023.

[2] Global Initiative for Asthma (GINA). Global Strategy for Asthma Management and Prevention, 2023.

[3] U.S. Patent and Trademark Office. Patent filings related to Zileuton formulation, 2010–2022.

More… ↓