Last updated: July 27, 2025

Overview of Zegalogue

Zegalogue (sesamolumab-xtgq) is a novel therapeutic approved by the FDA for the treatment of hypoglycemia in adult and pediatric patients aged 2 years and older with diabetes mellitus. Developed by Xeris Pharmaceuticals, Zegalogue is a novel glucagon receptor agonist formulated for intranasal administration, offering an alternative to traditional injectable glucagon for severe hypoglycemia episodes. Its innovative delivery method aims to improve patient compliance, reduce administration time, and mitigate the discomfort associated with injectable formulations.

Market Landscape

Unmet Medical Need and Market Drivers

Hypoglycemia remains a critical complication in diabetes management, with an estimated annual incidence of over 200,000 emergency hypoglycemic events in the U.S., often requiring prompt intervention with glucagon. Current standard-of-care options include injectable glucagon kits (e.g., GlucaGen, Baqsimi), but these face barriers such as administration complexity and patient reluctance, leading to under-treatment during emergencies.

Zegalogue fills a crucial gap by providing a non-injectable, rapidly acting, and easy-to-administer solution, especially beneficial for caregivers, school settings, and emergency responders. Its user-friendly intranasal formulation positions it competitively within the emergency hypoglycemia treatment market, which is projected to expand given the rising prevalence of diabetes worldwide.

Market Size and Segmentation

The global diabetes population exceeds 530 million, with approximately 34 million in the U.S. alone. The U.S. accounts for a significant share of the hypoglycemic emergency treatment market, projected to reach USD 2.5 billion by 2027[1].

Segments include:

- Emergency Treatment Market: Acute hypoglycemia episodes requiring immediate intervention.

- Preventive Needle-Free Devices: Adoption of intranasal or nasal spray medications.

- Pediatric and Adult Population: Both groups significantly benefit from user-friendly formulations.

Competitive Landscape

Zegalogue's primary competitors include:

- Baqsimi (nasal glucagon): Marketed by Eli Lilly, approved in 2019. It is a nasal powder formulation.

- Glucagon Emergency Kits: Injectable but less preferred due to complexity.

- Other formulations: Evoke Pharma's Gvoke (liquid glucagon), designed for less severe hypoglycemia management.

Zegalogue's distinct advantages are its rapid onset, intranasal route, and stable formulation, offering a competitive edge over existing options.

Market Penetration and Adoption Challenges

The adoption of Zegalogue hinges on factors such as:

- Physician prescribing habits: Requires convincing healthcare providers of efficacy equivalence or superiority.

- Insurance coverage and reimbursement: Critical for accessibility, influencing patient acceptance.

- Caregiver education: Ensuring proper usage to maximize its medical benefit.

Barriers include the dominance of established products, regulatory approval timelines in other markets, and manufacturing capacity.

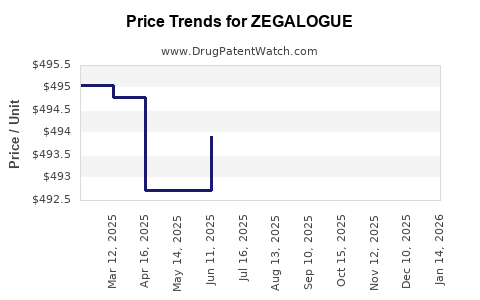

Price Trends and Projections

Current Pricing Dynamics

The price point for Zegalogue is approximated at USD 250 per dose, aligning with recent nasal glucagon products. This pricing reflects the novel delivery, manufacturing complexity, and competitive positioning.

Insurance coverage varies; Medicare Part D and commercial insurers have begun including Zegalogue in formularies. Despite high list prices, patient co-pay programs and rebates are expected to offset costs, fostering market uptake.

Price Projection Factors

Key factors influencing future pricing include:

- Manufacturing scale-up: Increased production efficiency may reduce costs, enabling price adjustments.

- Market competition: Entry of biosimilars or generics could exert downward pressure.

- Regulatory developments: Approval for additional indications or broader age ranges could boost volume and influence pricing strategies.

- Reimbursement policies: CMS, private payers, and hospital formularies' reimbursement rates will impact consumer prices.

Forecasted Trends

Based on current market dynamics, Zegalogue's price trend is expected to stabilize around USD 250–300 per dose over the next three years. Economies of scale may permit marginal reductions to USD 200–230, particularly if biosimilar competitors emerge.

If uptake accelerates due to increased awareness, coverage expansion, and caregiver training, equilibrium pricing could adjust downward by approximately 10–15%. Conversely, supply chain disruptions or regulatory delays might sustain higher prices.

Future Market Opportunities and Strategic Recommendations

- Global Expansion: Entering European and Asia-Pacific markets, which represent burgeoning diabetes populations, could significantly enhance revenue streams.

- Population-specific marketing: Targeted campaigns for pediatric and elderly demographics with tailored educational programs.

- Partnerships and Alliances: Collaborations with healthcare providers, emergency services, and insurers will facilitate market penetration.

- Pricing Strategies: Implement tiered pricing and rebate programs to improve affordability and adoption.

Conclusion

Zegalogue is positioned as a disruptive innovation within the hypoglycemia emergency treatment landscape, addressing unmet needs associated with ease of use and rapid action. Its market growth potential is substantial given rising diabetes prevalence, particularly if strategic pricing, reimbursement navigation, and global expansion are effectively managed. While current pricing remains robust, anticipated scale efficiencies and market competition could moderate prices, benefiting broader patient access and driving volume.

Key Takeaways

- Zegalogue's intranasal glucagon formulation offers a significant advancement over injectable options, targeting unmet needs for rapid, user-friendly hypoglycemia treatment.

- The US hypoglycemia management market is projected to reach USD 2.5 billion by 2027, with Zegalogue positioned to capitalize on considerable demand.

- Current pricing around USD 250 per dose is competitive, but future reductions to USD 200–230 are plausible with increased scale and market competition.

- Adoption depends heavily on reimbursement policies, physician acceptance, and caregiver education.

- Strategic global expansion and partnerships will be essential for maximizing market reach and profitability.

FAQs

1. How does Zegalogue differ from existing nasal glucagon products?

Zegalogue is formulated for intranasal administration with rapid absorption, potentially providing faster onset of action and easier administration compared to earlier nasal powders like Baqsimi, enhancing usability during emergency hypoglycemia episodes.

2. What are the primary barriers to Zegalogue’s market penetration?

Key barriers include competition from established products, reimbursement complexities, physician prescriber inertia, and caregiver training needs.

3. What pricing strategies could influence Zegalogue's market share?

Tiered pricing, rebate programs, and strategic partnerships can improve affordability, encouraging broader adoption and expanding payer coverage.

4. What is the potential global market for Zegalogue?

Growing diabetes prevalence worldwide, especially in Europe and Asia, presents substantial growth opportunities. Regulatory approval processes in these regions will determine the timeline for market entry.

5. How might future market trends impact Zegalogue’s pricing?

Market competition, scale efficiencies, and regulatory developments could lead to price reductions, increasing access but potentially impacting margins.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th Edition, 2019.