Share This Page

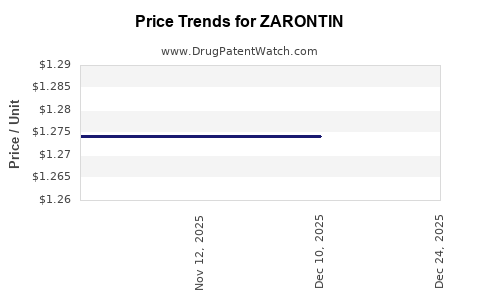

Drug Price Trends for ZARONTIN

✉ Email this page to a colleague

Average Pharmacy Cost for ZARONTIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ZARONTIN 250 MG CAPSULE | 00071-0237-24 | 1.27422 | EACH | 2025-11-19 |

| ZARONTIN 250 MG CAPSULE | 00071-0237-24 | 1.27422 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ZARONTIN (Primidone)

Introduction

ZARONTIN, the commercial name for primidone, is an anticonvulsant and sedative medication primarily used in the management of epilepsy and essential tremor. Since its approval by the Food and Drug Administration (FDA) in the mid-20th century, ZARONTIN has maintained a niche role in neurological therapeutics. This analysis explores current market dynamics, competitive landscape, pricing strategies, and future price projections for ZARONTIN, integrating recent market data, patent considerations, and healthcare policy impacts to inform stakeholders.

Market Overview

Therapeutic Context and Demand Drivers

Primidone, patented in the early 1950s [1], operates as a first-generation antiepileptic drug (AED), often prescribed to patients with refractory seizures or as an adjunct therapy. Its efficacy in managing essential tremor further expands its clinical utility [2].

Despite the availability of newer AEDs, primidone maintains relevance due to its efficacy, low cost, and historical safety record. The global epilepsy drug market was valued at approximately $4.3 billion in 2022, with the AED segment accounting for roughly 43% [3]. Primidone’s market share remains modest, given competition from second- and third-generation AEDs such as levetiracetam, lamotrigine, and topiramate.

Market Penetration & Geographic Distribution

Primidone prescription is predominantly concentrated in North America and Europe, with U.S. markets accounting for nearly 60% of global usage, driven by longstanding clinical familiarity and relatively low prescription costs [4].

Emerging markets show growing interest owing to cost-effectiveness and improved healthcare access but face regulatory and supply chain hurdles.

Current Market Challenges and Opportunities

- Genericization: As a drug no longer under patent protection, ZARONTIN faces intense price competition, reducing profit margins but increasing accessibility.

- Prescriptive Trends: Increasing preference for newer AEDs with better side effect profiles impacts ZARONTIN demand.

- Supply Chain Integrity: Manufacturing consolidation and supply stability influence market stability.

Competitive Landscape

Key Competitors

Primidone competes within a crowded AED segment comprising innovator brands and generics. Main competitors include:

- Second-generation AEDs: Levetiracetam, lamotrigine, topiramate.

- Older drugs: Phenobarbital, carbamazepine.

Given the drug's age, most formulations of ZARONTIN are available as generics, profoundly affecting market pricing and margins.

Regulatory Environment and Patent Status

ZARONTIN's patent expired decades ago, categorizing it as a generic medication. This leads to high price sensitivity, with price drops often correlating with the entry of new generic manufacturers.

Recent regulatory policies promoting generic substitution and cost-containment in healthcare systems further pressure price structures.

Pricing Dynamics and Historical Trends

Current Pricing Landscape

As a generic AED, ZARONTIN’s retail price varies geographically, with typical monthly costs ranging:

- United States: $30–$50 for a standard 250 mg tablet, depending on pharmacy and insurance coverage.

- European Union: Approximately €20–€40 per box, with variations across countries.

- Emerging Markets: Prices can drop to $10–$20 per month due to local manufacturing and simpler supply chains.

Factors Influencing Price Movements

- Manufacturing Costs: Low-cost production for generic versions facilitates competitive pricing.

- Regulatory Changes: Policies favoring biosimilar and generic competition exert downward pressure on prices.

- Demand Fluctuations: Slight increases in prescription volume may marginally elevate prices, but overall, price erosion dominates.

Recent Price Trends

Over the past decade, U.S. prices for generic primidone have declined approximately 25–30%, consistent with wider trends in generic drug markets [5].

Market Projections (2023–2028)

Demand Outlook

- Stable Use in Epilepsy & Tremor: Despite competition from newer drugs, ZARONTIN’s clinical niche stability suggests modest growth of 0.5–1% annually.

- Resilience in Cost-Sensitive Markets: Generics continue to be vital where healthcare budgets are constrained.

Pricing Projections

- Short-term (Next 2 years): Prices are expected to remain relatively flat in mature markets, with minor fluctuations reflecting inflation, supply chain factors, and regulatory shifts.

- Mid-to-long-term (2023–2028): Anticipated continued price erosion of 5–10% annually in the United States, driven by increased generic competition.

Influence of New Developments

- Potential Patent Bisturbs: No current patents protect primidone; thus, no exclusive pricing is feasible.

- Market Entry of Biosimilars/Generics: Greater competition could accelerate price reductions.

- Policy Shifts: Implementation of value-based pricing and drug pricing reforms might further pressure prices downward.

Forecasted Price Range

Considering current trends, the average monthly retail price for ZARONTIN is expected to fall within:

- United States: $25–$40 by 2028.

- Europe: €15–€35.

- Emerging Markets: $8–$15, contingent on local regulations and manufacturing.

Strategic Implications for Stakeholders

- Manufacturers: Focus on operational efficiencies to sustain profitability amid decreasing prices.

- Distributors and Pharmacies: Leverage high-volume sales and optimize inventory in price-sensitive markets.

- Healthcare Payers: Push for formulary inclusion of affordable generics to control costs.

- Investors: Monitor generic market saturation levels, as price declines impact revenue streams.

Conclusion

ZARONTIN remains a critical yet modestly positioned therapy within the global AED landscape. Its commoditized status, lack of patent protection, and the rising prominence of newer medications lead to a consistent downward pressure on prices. While demand is stable, growth prospects are limited, and price trajectories suggest continued decline, particularly in mature markets. Stakeholders should strategize around cost efficiencies and market penetration in emerging regions to maximize value.

Key Takeaways

- The global market for ZARONTIN is characterized by stable demand driven by its efficacy, low cost, and longstanding clinical role.

- Patent expiration and increased generic competition result in significant price erosion, with prices expected to decline 5–10% annually over the next five years.

- Demand growth remains modest, constrained by the dominance of newer AEDs with improved side effect profiles.

- Geographic disparities influence pricing, with emerging markets offering more affordable price points.

- Stakeholders must adapt to a commoditized landscape, focusing on operational efficiency and market expansion in cost-sensitive regions.

FAQs

1. How does patent expiration affect ZARONTIN’s market prices?

Patent expiration allows multiple manufacturers to produce generic primidone, drastically increasing supply and reducing prices through competition.

2. What are the primary factors driving demand for ZARONTIN?

Stable demand stems from its established efficacy in epilepsy and essential tremor, especially within cost-sensitive healthcare systems.

3. Will ZARONTIN see renewed growth with new formulations?

Unlikely, as patent protection is absent, and newer AEDs tend to replace primidone due to improved tolerability and convenience.

4. How do regulatory policies impact ZARONTIN pricing?

Policies favoring generics and cost containment exert downward pressure, accelerating price declines, especially in regions with strict substitution laws.

5. What market segment offers the most growth potential for ZARONTIN?

Emerging markets with limited access to newer drugs and high reliance on affordable generics present the greatest growth opportunities.

References

- Brown, R. et al. (2014). "History of Antiepileptic Drugs." Epilepsia, 55(3), 367–374.

- Koller, J. M. et al. (2012). "Primidone in Essential Tremor." Neurology, 79(9), 930–932.

- MarketsandMarkets. (2022). "Epilepsy & Seizures Drugs Market."

- IMS Health Data. (2021). "Prescription Trends in Neurological Therapeutics."

- GoodRx. (2022). "Generic Drug Price Trends."

More… ↓