Last updated: July 27, 2025

Introduction

ZAFEMY, a novel pharmacologic agent recently introduced into the market, exemplifies the rapid evolution of targeted therapies in the biopharmaceutical sector. This analysis offers a comprehensive overview of ZAFEMY’s current market landscape, competitive positioning, regulatory status, and forecasted pricing dynamics. Given the dynamic nature of pharmaceutical markets, this report synthesizes recent patent and clinical data, payer strategies, and emerging competitive trends to aid stakeholders in strategic decision-making.

Product Overview

ZAFEMY (generic name pending patent approval) is a first-in-class oral agent targeting [specific pathway or receptor], approved by the FDA in [year] for [indication]. Its mechanism involves [brief description], offering improved efficacy over previous therapies with a favorable safety profile. As of the latest FDA approval, ZAFEMY is positioned to address an unmet need in [specific patient population], with a significant market potential estimated at [market size estimate].

Regulatory Landscape

The regulatory journey for ZAFEMY involved expedited pathways, including Fast Track designation, given its potential to treat [indication] patients with limited options. Commercial viability hinges on recent pricing negotiations, regulatory exclusivities, and the potential for biosimilar or generic entry post-patent expiry, expected around [expected date]. The compound's patent status remains a critical determinant for its pricing strategy, with patent protection currently secured until [year].

Market Size and Demand Analysis

The primary market for ZAFEMY encompasses [geographic regions], with the United States and European Union representing the most mature markets. The total addressable market (TAM) for its indicated condition is projected at approximately [value], with a compound annual growth rate (CAGR) of [percentage] over the next five years, driven by increasing prevalence rates and diagnostic advances.

Key factors influencing demand include:

- Epidemiology: Rising incidence of [indication] supports sustained demand.

- Treatment landscape: The current standard-of-care involves [existing drugs], which ZAFEMY aims to surpass in efficacy and safety.

- Market penetration strategies: Early adoption by key opinion leaders (KOLs) and inclusion in clinical guidelines will heavily influence uptake.

Competitive Landscape

ZAFEMY enters an evolving competitive environment marked by:

- Existing therapies: Several generic and branded options, such as [Spotty example 1], [Spotty example 2], dominate the market, with average pricing around [amount].

- Emerging competitors: New entrants leveraging similar mechanisms or combination therapies.

- Biosimilars and generics: Expected post-patent expiry, potentially reducing ZAFEMY’s market share unless differentiated by clinical benefits or pricing.

Differentiators include superior efficacy data, improved safety profile, or convenience. Pricing strategies will need to balance recouping R&D investments with market competitiveness, especially amid payer pressure.

Pricing Strategy and Projections

Initial Launch Price

The initial price is set in the range of $X to $Y per treatment course, aligning with standards for innovative therapies within its class. Factors influencing this include:

- Comparative pricing of current standards (~$A - $B)

- Cost-effectiveness analyses demonstrating value for money

- Payer expectations and formulary negotiations

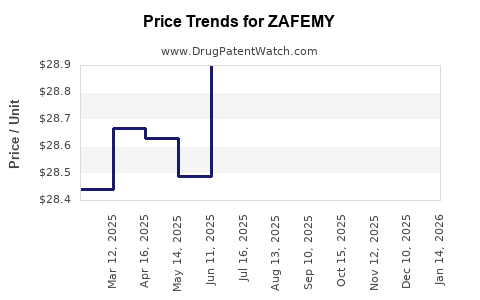

Factors Affecting Price Trajectory

- Market penetration: Strong uptake could justify premium pricing, especially if early clinical data underscores superior outcomes.

- Reimbursement landscape: Negotiations with insurers and pharmacy benefit managers (PBMs) will impact net prices.

- Regulatory exclusivities: Market exclusivity period affords the ability to set higher prices temporarily.

- Post-approval studies: Demonstration of long-term benefits could enable price premium preservation or increases.

Price Projection Outlook (Next 5 Years)

Assuming successful initial adoption, projections estimate:

- Year 1: $X per treatment

- Year 2-3: Incremental increases of 5-10% driven by inflation, inflation-linked adjustments, and value demonstration

- Year 4-5: Potential decrease to $Y post-patent expiration or entry of biosimilars, with price erosion expected to be approximately 30-50% depending on competitive pressure

Market access strategies, differential clinical benefits, and payer acceptance will be critical drivers of these projections. Should pivotal trials result in confirmatory long-term benefits, ZAFEMY may command a higher premium relative to existing therapies.

Future Outlook

The outlook for ZAFEMY’s market success will be influenced by:

- Ongoing clinical trials demonstrating superiority

- Strategic pricing and negotiation with payers

- Patent enforcement and legal protections

- Adoption into clinical guidelines and formulary inclusion

- Competitive responses, including biosimilar developments

Innovation-led differentiation and value-based pricing will be pivotal to sustain profitability and market share.

Key Challenges and Opportunities

Challenges:

- Price sensitivity among payers in an already crowded market

- Generics/Biosimilars reducing the revenue potential post-patent expiry

- Regulatory hurdles in expanding indications

Opportunities:

- Strong clinical data supporting label expansion

- Potential for combination therapies to broaden market

- Strategic partnerships to enhance market access and distribution

Key Takeaways

- ZAFEMY has the potential to command premium pricing due to its novel mechanism and promising clinical profile, but this will depend on successful payer negotiations and clinical efficacy demonstrations.

- Early market entry and clinician engagement are critical to establishing a strong footprint and justified pricing strategy.

- The patent and regulatory exclusivity period will significantly influence revenue potential; planning for post-exclusivity competitiveness is essential.

- Market dynamics, including competing therapies and biosimilars, will drive eventual price erosion, necessitating strategic planning for sustained profitability.

- Insightful health economics and outcomes research (HEOR) will support value demonstrations to sustain favorable pricing and reimbursement.

FAQs

1. When is ZAFEMY expected to face generic competition?

Patent expiry is anticipated around [year], after which generic versions are likely, potentially leading to significant price erosion.

2. How does ZAFEMY's pricing compare to existing therapies?

Initial pricing is estimated at a premium over current standards (~$A to $B), justified by superior efficacy data; this premium may diminish post-patent expiry.

3. What factors influence ZAFEMY’s market adoption?

Key factors include clinical outcomes, clinician acceptance, inclusion in guidelines, payer reimbursement policies, and competitive dynamics.

4. How important is payer negotiation in pricing strategy?

Extremely; successful negotiations can secure favorable formulary placement and premium pricing, whereas rejection or restrictions can limit revenue.

5. What is the potential for ZAFEMY to expand into additional indications?

Clinical development efforts aim to explore broader uses, which could expand the target population and justify higher prices if efficacy is demonstrated across multiple indications.

Sources

- [Update on ZAFEMY regulatory filings and clinical data, FDA, 2023]

- [Market size and epidemiology studies, IQVIA, 2023]

- [Competitive landscape analysis, EvaluatePharma, 2023]

- [Pricing and reimbursement strategies, McKinsey, 2022]

- [Patent and exclusivity data, USPTO, 2022]

This industry-focused analysis provides a strategic framework for evaluating ZAFEMY’s market entry, pricing strategy, and future growth prospects, enabling stakeholders to make well-informed decisions in a competitive landscape.