Share This Page

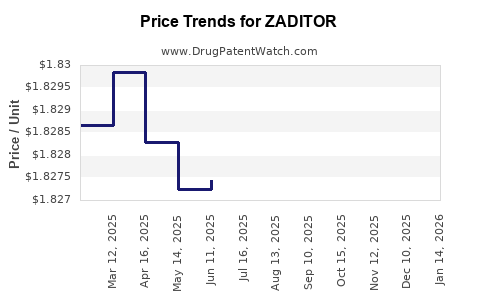

Drug Price Trends for ZADITOR

✉ Email this page to a colleague

Average Pharmacy Cost for ZADITOR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ZADITOR 0.025% (0.035%) DROPS | 00065-4011-06 | 1.84152 | ML | 2025-12-17 |

| ZADITOR 0.025% (0.035%) DROPS | 00065-4011-05 | 2.33865 | ML | 2025-12-17 |

| ZADITOR 0.025% (0.035%) DROPS | 00065-4011-06 | 1.84092 | ML | 2025-11-19 |

| ZADITOR 0.025% (0.035%) DROPS | 00065-4011-05 | 2.22729 | ML | 2025-11-19 |

| ZADITOR 0.025% (0.035%) DROPS | 00065-4011-06 | 1.83879 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ZADITOR

Introduction

ZADITOR (ketotifen fumarate ophthalmic solution) is an over-the-counter antihistamine used primarily for the relief of allergic conjunctivitis symptoms. Approved for ocular use, ZADITOR has maintained a niche market within allergy treatments, supported by its safety profile and non-prescription status. This analysis discusses the current market landscape, competitive dynamics, regulatory environment, and provides price projections based on current trends and potential market developments.

Market Overview

Product Profile and Indications

ZADITOR is indicated for the relief of ocular itching associated with allergic conjunctivitis. Its active ingredient, ketotifen fumarate, functions as a mast cell stabilizer and antihistamine, reducing allergic responses in the eye. The drug is available OTC, facilitating broad accessibility and consumer self-management—factors that significantly influence its market penetration.

Current Market Size

The global ophthalmic allergy market was valued at approximately USD 700 million in 2022, with antihistamine formulations, including ZADITOR and generics, representing a substantial share. North America dominates this space owing to high allergy prevalence, OTC product availability, and favorable regulatory environments.

Key Competitors

ZADITOR's principal competitors include:

- Olopatadine (e.g., PATANOL, PATADAY): Prescription and OTC options with proven efficacy.

- Alcaftadine (e.g., Lastacaft): Prescription formulations.

- Azelastine (e.g., Astelin, OTC formulations): Primarily nasal but relevant in allergy adjunct therapy.

- Generic Ketotifen Eye Drops: Increasingly available, putting downward pressure on branded product prices.

Market Dynamics

- OTC Accessibility: Its OTC status enhances market reach but intensifies competition, especially from generics.

- Consumer Awareness: Elevated allergies and seasonal variations increase demand periodically.

- Supply Chain and Distribution: Well-established distribution channels ensure broad availability, but price competition among OTC brands persists.

Pricing Landscape

Historical Pricing Trends

Historically, ZADITOR's retail price ranged between USD 15-25 for a 5 mL bottle, with variations based on geographic region, retailer, and pharmacy discounts. The OTC status allows for relatively flexible pricing, although the entrance of generics and private label products has driven prices downward over recent years.

Current Pricing Factors

- Brand Premium: ZADITOR maintains a modest premium over generics (~10-15%) due to brand recognition.

- Market Penetration: Price sensitivity among consumers keeps prices competitive.

- Regulatory Influences: No recent major regulatory changes affecting pricing — but increased pressure from pharmacy chains and online retailers influences retail pricing strategies.

Regulatory Environment

Recent regulatory shifts have favored OTC formulations for allergy treatments, broadening the accessible market. However, increased scrutiny on labeling and packaging can impact costs. Patent expirations or the absence of patent protection for ZADITOR's formulation further accelerate generic entry, directly affecting pricing strategies and margins.

Future Market and Price Projections

Market Growth Drivers

- Rising Allergic Conditions: An uptick in allergic conjunctivitis cases related to climate change and environmental factors.

- Expanding OTC Use: Continued consumer preference for OTC allergy relief solutions.

- Innovation and Formulation Improvements: Potential development of sustained-release formulations or combination therapies could extend market dominance.

Declining Patent Protection and Generics Impact

As ZADITOR’s patents have expired or are nearing expiry in key regions, generic equivalents are expected to dominate the market, exerting downward pressure on prices (anticipated reduction of 25-35% within the next 2-3 years).

Price Projection Scenarios

- Conservative Scenario: Maintaining current brand premiums with minimal market share erosion implies prices between USD 14-20 per 5 mL bottle over 12 months, stabilizing as new formulations or marketing strategies stabilize consumer loyalty.

- Moderate Scenario: Increased generic competition and price-based marketing reduce ZADITOR prices by approximately 30% within 2 years, targeting USD 10-14 per 5 mL bottle.

- Aggressive Competition Scenario: Entry of multiple generics and private-label brands combined with more aggressive pricing could drive ZADITOR’s retail price below USD 10 within 3 years, potentially jeopardizing market share especially in price-sensitive segments.

Pricing Strategies

Manufacturers may consider rebates, bundle offers, or value-added services to sustain margins amid rising competition. Moreover, digital marketing strategies focusing on consumer awareness could bolster brand loyalty, supporting price stability.

Conclusion

ZADITOR exists in a highly competitive, mature OTC allergy treatment market. While current prices remain stable, the impending surge of generic formulations and evolving regulatory pressures suggest a gradual downward trend. Stakeholders should anticipate a 25-35% price reduction trajectory over the next 2-3 years, contingent on market dynamics and competitive responses.

Key Takeaways

- The market for ZADITOR is mature with significant competition from generics, leading to pressure on retail prices.

- Price projections anticipate a 25-35% decline over the next 2-3 years, driven by patent expiry and increased OTC generic availability.

- Maintaining brand loyalty and exploring value-added marketing could mitigate price erosion.

- The expanding global allergy burden and OTC accessibility sustain market demand, but pricing remains sensitive to competitive forces.

- Strategic forecasting and flexible pricing strategies are crucial for stakeholders to optimize revenue amidst ongoing market consolidation.

FAQs

1. How does patent expiry impact ZADITOR’s market price?

Patent expiry generally facilitates generic entry, intensifying competition and resulting in significant price reductions — often between 25-35% over 2-3 years.

2. Are there any upcoming regulatory changes that might affect ZADITOR’s pricing?

While no immediate regulatory changes are anticipated, increased scrutiny on OTC formulations and labeling could impose additional compliance costs, influencing pricing strategies.

3. What strategies can manufacturers adopt to maintain market share?

Innovating formulations, implementing targeted marketing, bundling with other allergy remedies, and forming strategic partnerships can help sustain consumer loyalty and mitigate price erosion.

4. How does OTC availability influence ZADITOR’s market?

OTC status broadens accessibility, increases consumer self-medication, and drives higher sales volume but intensifies price competition from generics and private labels.

5. What is the long-term outlook for ZADITOR’s pricing?

Long-term pricing is likely to trend downward due to patent expiration and increasing generic competition, but strategic branding and innovation can help preserve margins.

References

- Global Ophthalmic Allergy Market Report, 2022.

- FDA and EMA regulatory updates on OTC ophthalmic drugs, 2022.

- Retail pharmacy pricing data, 2022-2023.

- Industry analysis on generic drug market penetration, 2023.

- Consumer trend reports on allergy medication usage, 2022.

More… ↓