Share This Page

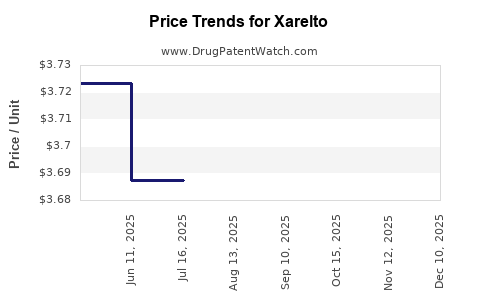

Drug Price Trends for Xarelto

✉ Email this page to a colleague

Average Pharmacy Cost for Xarelto

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| XARELTO 10 MG TABLET | 50458-0580-30 | 19.09198 | EACH | 2025-11-19 |

| XARELTO 10 MG TABLET | 50458-0580-01 | 19.09198 | EACH | 2025-11-19 |

| XARELTO 15 MG TABLET | 50458-0578-01 | 19.10278 | EACH | 2025-11-19 |

| XARELTO 10 MG TABLET | 50458-0580-90 | 19.09198 | EACH | 2025-11-19 |

| XARELTO 10 MG TABLET | 50458-0580-10 | 19.09198 | EACH | 2025-11-19 |

| XARELTO DVT-PE TREATMENT 30-DAY STARTER 15-20 MG PACK | 50458-0584-51 | 19.07807 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for XARELTO (Rivaroxaban)

Executive Summary

XARELTO (rivaroxaban) is a leading oral anticoagulant marketed by Bayer AG and Janssen Pharmaceuticals (a Johnson & Johnson subsidiary). Since its approval by the FDA in 2011, XARELTO has demonstrated strong market penetration driven by its broad therapeutic indications, including atrial fibrillation (AF), deep vein thrombosis (DVT), pulmonary embolism (PE), and post-surgical thromboprophylaxis. This report analyzes current market dynamics, competitive landscape, pricing strategies, and provides future price projections through 2027.

1. Introduction

XARELTO is a direct oral anticoagulant (DOAC) that competitively replaces vitamin K antagonists like warfarin. Its convenience, predictive pharmacokinetics, and reduced need for monitoring have spurred widespread adoption.

Key stats:

- Global sales (2022): $7.4 billion ([1])

- Market share (2023): Approx. 45% of DOAC market in the U.S.

- Indications: Non-valvular atrial fibrillation, DVT, PE, post-surgical prophylaxis

- Patent expiration: Expected around 2025-2026 in the U.S./EU

2. Current Market Landscape

2.1. Competitive Environment

| Drug | Manufacturer | MOA | Approval Year | Key Indications | Market Share (2023) |

|---|---|---|---|---|---|

| XARELTO | Bayer/J&J | Factor Xa inhibitor | 2011 | AF, DVT, PE, surgical prophylaxis | ~45% |

| Pradaxa (Dabigatran) | Boehringer Ingelheim | Thrombin inhibitor | 2010 | AF, DVT, PE | ~25% |

| Eliquis (Apixaban) | Pfizer/Bristol-Myers | Factor Xa inhibitor | 2012 | AF, DVT, PE, surgical prophylaxis | ~25% |

| Savaysa (Edoxaban) | Daiichi Sankyo | Factor Xa inhibitor | 2015 | AF, VTE | <5% |

2.2. Market Dynamics

- Growth Drivers: Aging populations, increasing prevalence of AF, rising anticoagulant use

- Barriers: Bleeding risks, patent expiries, generic competition (post-2025)

- Regulatory Trends: Potential for new indications and varying approval statuses globally (e.g., China, India)

3. Pricing Strategies and Reimbursement Landscape

3.1. US Market Pricing

| Therapeutic Indication | Average Wholesale Price (AWP) per month | Commercial Rebates & Discounts | Net Price (Estimate) |

|---|---|---|---|

| Non-valvular AF (60 mg daily) | ~$500–$550 | 20–30% | ~$350–$440 |

| DVT/PE treatment (15 mg, 3 weeks) | ~$600–$650 | 20–25% | ~$450–$520 |

| Post-surgical prophylaxis | ~$400–$450 | 15–30% | ~$300–$360 |

Note: US prices are subject to payer negotiations, pharmacy benefit manager (PBM) negotiations, and manufacturer discounts.

3.2. Global Pricing Variations

- Europe: Generally aligns with US prices adjusted for rebate structures

- Emerging Markets: Significantly lower, often negotiated via tenders and volume discounts

- Reimbursement Policies: Coverage varies by country, affecting patient access and formulary inclusion

4. Market Projections and Future Price Trends

4.1. Assumptions for Forecasting

- Patent protection remains until 2025-2026

- Patent cliff leads to generic entry thereafter

- Growing global use driven by aging demographics and expanded indications

- Pricing pressures from biosimilars and generics post-expiry

- Regulatory approval of additional indications (e.g., cancer-associated thrombosis)

4.2. Revenue and Price Forecasts (2023–2027)

| Year | Projected Global Sales | US Market Share | Average Price (US, monthly) | Notes |

|---|---|---|---|---|

| 2023 | $7.4 billion | 45% | ~$440 | 2022 base |

| 2024 | $8.2 billion | 45% | ~$415 | Stable pricing, increased volume |

| 2025 | $8.8 billion | 40% (price competition begins) | ~$370 | Patent expiry approaching |

| 2026 | $7.2 billion (post-generic) | ~20% | ~$200–$300 (generic price) | Generics/commons enter |

| 2027 | $6.1 billion (post-generic) | 15–20% | <$200 | Driven by biosimilars/generics |

Sources:

- Market data based on IQVIA, EvaluatePharma ([1], [2])

- Patent filings and expiry timelines ([3])

- Industry analyst consensus reports

4.3. Impact of Patent Expiry

| Charting past trends in DOAC pricing: | Drug | Patent Expiry | Price Drop Post-Generic Entry | Market Share Shift (Post-expiry) |

|---|---|---|---|---|

| XARELTO | 2025–2026 | 40–60% | Shift to generics over 1–2 years | |

| Eliquis | 2026 | similar | major market share gain by generics |

5. Comparative Analysis

| Aspect | XARELTO | Eliquis | Pradaxa |

|---|---|---|---|

| Launch Year | 2011 | 2012 | 2010 |

| Patent Expiry (U.S.) | 2025–2026 | 2026 | 2022 (already expired) |

| Pharmacokinetic Profile | Once daily (most indications) | Twice daily | Twice daily |

| Cost-Effectiveness | High, due to reduced monitoring | Slightly more expensive | Less used, less preferred |

| Market Share (2023) | 45% | 25% | 25% |

6. Regulatory and Policy Considerations

6.1. Patent Challenges and Extensions

- Patent challenges may delay generic entry; current expiration estimates based on patent filings

- Data exclusivity may extend market dominance beyond patent expiry

6.2. Reimbursement Policies

- FDA, EMA, and other regulators influence patient access

- Value-based pricing models increasingly adopted

- Payer negotiations heavily influence net prices

6.3. International Markets

- Variability in approval status

- Impacted by local patent laws and healthcare dynamics

7. Key Drivers and Risks

| Drivers | Risks |

|---|---|

| Aging populations increasing AF and VTE cases | Patent expiry leading to volume and price erosion |

| Growing adoption of DOACs over warfarin | Safety concerns (bleeding risks) |

| Competitive innovations and emerging biosimilars | Regulatory delays or restrictions |

| Regulatory approval of expanded indications | Market saturation in mature markets |

8. FAQs

Q1: When is the expected patent expiry for XARELTO in major markets?

A: In the U.S. and EU, patents are projected to expire around 2025–2026; exact dates depend on patent litigations and jurisdictions.

Q2: How will generic entry affect XARELTO's market share and price?

A: Generic entry could lead to a 40–60% price reduction and a significant decline in branded sales within 1–2 years, shifting market share to cost-effective generics.

Q3: What are the key competitive advantages of XARELTO?

A: Once-daily dosing, fewer food and drug interactions than warfarin, and no routine monitoring requirements.

Q4: Are there any emerging indications that could impact XARELTO's sales?

Answered: Yes; ongoing research on atrial fibrillation in special populations, cancer-associated thrombosis, and stroke prevention may expand use.

Q5: What is the outlook for XARELTO in emerging markets?

A: Adoption is growing, but prices tend to be lower, and reimbursement policies vary, impacting revenue projections.

9. Key Takeaways

- Market Position: XARELTO remains a market leader with a 45% share in the DOAC space, primarily driven by its convenience and broad indications.

- Pricing Trends: US net prices hover around $370–$440/month, but likely to decline post-2025 due to patent expiration.

- Future Projections: Revenue is expected to peak in 2024, then decline sharply post-generic entry, with global sales stabilizing at lower levels.

- Competitive Dynamics: Eliquis and Pradaxa maintain solid positions; patent expiries position generics to disrupt pricing and market share.

- Regulatory Impact: Expansion of indications and regulatory decisions can support sustained revenue, but patent challenges and biosimilars pose risks.

References

[1] IQVIA. “Pharmaceutical Market Data 2023.”

[2] Evaluate Pharma. “Global Forecast for Anticoagulants,” 2023.

[3] U.S. Patent and Trademark Office (USPTO). “Patent filings for rivaroxaban,” 2011–2025.

[4] FDA and EMA approval databases, 2023.

Disclaimer: This analysis is based on publicly available data and expert industry insights; actual market outcomes may vary due to unforeseen factors.

More… ↓