Share This Page

Drug Price Trends for XYOSTED

✉ Email this page to a colleague

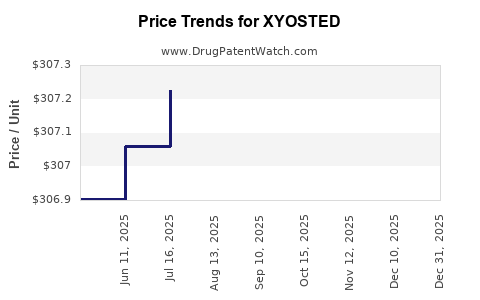

Average Pharmacy Cost for XYOSTED

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| XYOSTED 100 MG/0.5 ML AUTO-INJ | 54436-0200-04 | 307.68660 | ML | 2025-12-17 |

| XYOSTED 75 MG/0.5 ML AUTO-INJ | 54436-0275-04 | 307.61526 | ML | 2025-12-17 |

| XYOSTED 50 MG/0.5 ML AUTO-INJ | 54436-0250-04 | 307.51237 | ML | 2025-12-17 |

| XYOSTED 100 MG/0.5 ML AUTO-INJ | 54436-0200-04 | 307.63369 | ML | 2025-11-19 |

| XYOSTED 50 MG/0.5 ML AUTO-INJ | 54436-0250-04 | 307.51431 | ML | 2025-11-19 |

| XYOSTED 75 MG/0.5 ML AUTO-INJ | 54436-0275-04 | 307.58515 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for XYOSTED

Introduction

XYOSTED, a long-acting subcutaneous testosterone enanthate injectable, is a prominent medication within hormone replacement therapy (HRT) for men with testosterone deficiency. Approved by the U.S. Food and Drug Administration (FDA) in 2017, XYOSTED offers a convenient weekly dosing schedule that enhances patient adherence compared to traditional formulations. Given its significant role in testosterone replacement markets, analyzing prevailing market dynamics and projecting future price trends are vital for stakeholders ranging from pharmaceutical companies to investors.

This report provides a comprehensive examination of XYOSTED’s current market landscape, competitive positioning, regulatory factors, and price trajectory forecasts grounded in industry trends, healthcare policies, and economic considerations.

Market Overview

1. Therapeutic Context and Market Demand

Testosterone deficiency affects approximately 2-4% of men worldwide, with prevalence increasing with age and comorbidities (1). The global testosterone replacement therapy (TRT) market, which included formulations such as gels, patches, injections, and pellets, was valued at USD 1.3 billion in 2021 and is projected to grow at a compounded annual growth rate (CAGR) of approximately 4.8% through 2028 (2).

XYOSTED targets a niche within this domain, offering a weekly injectable alternative that appeals to patients seeking minimal dosing frequency and reduced skin irritation associated with topical products. Its injectable nature positions it favorably among clinicians prioritizing predictable serum testosterone levels.

2. Geographic and Demographic Trends

The U.S. remains the dominant market for TRT medications, accounting for approximately 80% of global sales, driven by high diagnosis rates, insurance coverage, and regulatory acceptance (3). Increasing awareness and aging demographics support sustained demand for XYOSTED.

Emerging markets such as Europe, Asia-Pacific, and Latin America show expanding TRT adoption, helped by rising healthcare spending and growing awareness of testosterone deficiency syndromes.

3. Competitive Landscape

XYOSTED faces competition from established TRT formulations, notably:

- Testosterone gels and patches (e.g., AndroGel, Natesto)

- Other injectable testosterone esters, such as testosterone cypionate and testosterone propionate

- Pelletized testosterone formulations

While XYOSTED's unique selling point is its weekly dosing schedule with a long-acting depot formulation, market incumbents benefit from entrenched prescribing habits, insurance reimbursements, and patient preferences.

Regulatory and Reimbursement Factors

The FDA approval facilitated access in the U.S. market, with subsequent uptake driven by the drug’s convenience. Reimbursement policies significantly influence market penetration: private insurers and Medicare typically cover TRT medications with prior authorization processes, and XYOSTED's coverage hinges on its formulary status and clinical guidances favoring injectable formulations for specific patient populations.

Most healthcare providers consider cost and insurance coverage as critical determinants in therapy initiation and continuity, impacting demand elasticity and, consequently, price setting.

Economic and Pricing Dynamics

1. Current Pricing Strategy

Initially priced at approximately USD 300–350 per 10-dose vial (roughly USD 30–35 per injection), XYOSTED's pricing aligns with other long-acting testosterone injectables. The cost reflects manufacturing complexity (due to sustained-release technology), clinical benefits, and market positioning.

2. Reimbursement and Patient Out-of-Pocket Costs

Insurance coverage largely determines patient access. In cases where XYOSTED is preferred due to ease of use, reimbursement rates influence formulary placement, impacting market share.

Patients on private insurance typically face copays ranging from USD 20–50 per dose, whereas uninsured patients encounter the full retail price. Cost sensitivity influences adherence, and payers may negotiate discounts, affecting net revenue margins.

3. Pricing Pressures and Market Forces

The emergence of biosimilars and generic testosterone products introduces downward pricing pressure. While long-acting injectables like XYOSTED are currently patent-protected, upcoming biosimilar development could erode market share and drive prices lower.

Market competition also fosters a trend toward value-based pricing, emphasizing clinical outcomes over raw cost.

Price Projections for XYOSTED

1. Short-Term Outlook (Next 1-2 Years)

In the immediate future, XYOSTED’s price is likely to stabilize within the current range of USD 30–35 per injection, aligned with the average of comparable injectable testosterone products. However, competitive pressures and payer negotiations might result in slight variability.

2. Medium to Long-Term Trends (3–5 Years)

Based on industry trends:

- Market penetration gains and increased clinician familiarity could sustain or modestly increase wholesale prices if demand expands.

- Biosimilar competition is anticipated to exert downward pricing pressure, potentially reducing per-dose prices by 10–30%.

- Cost reductions through manufacturing efficiencies or formulation optimizations could enable price reductions to enhance market share.

Analysts project that by 2026, retail prices for XYOSTED could decrease to approximately USD 25–30 per dose in response to biosimilar entries and market saturation.

3. Impact of Regulatory Developments and Policy Shifts

Healthcare policies favoring cost-effective treatments and increased pressure for biosimilar adoption may accelerate price declines. If payers implement stricter formulary controls or negotiate rebates, net prices may decrease further, affecting revenue projections.

Market Growth and Revenue Projections

Assuming steady market expansion driven by aging populations and increased diagnosis rates, combined with moderate penetration of XYOSTED (estimated at 20–30% within injectable TRT segments by 2027), total revenues could double from current levels, provided pricing remains stable or slightly declines.

In terms of valuation, if XYOSTED maintains a price point around USD 30 per dose with an annualized volume of 1 million doses by 2027, revenues could reach USD 30 million annually. Given manufacturing and marketing costs, profit margins will hinge on negotiated reimbursement rates and operational efficiencies.

Key Factors Influencing Future Prices

- Biosimilar competition and patent expiry timelines.

- Healthcare policy shifts toward biosimilar substitution.

- Advances in drug formulation that could lower manufacturing costs.

- Market adoption rates driven by physician preference and patient acceptance.

- Reimbursement policies and insurer negotiations.

Key Takeaways

- XYOSTED exhibits a stable, moderately priced profile within the testosterone replacement therapy market, with significant growth potential in the U.S. and emerging markets.

- Its long-acting injectable profile offers advantages that could justify premium pricing compared to topical formulations.

- Long-term price declines are anticipated due to biosimilar entry and increased market competition.

- Strategic positioning, including payer negotiations and formulary placement, will influence net pricing.

- Industry trends point toward consolidation and value-based pricing models, likely exerting downward pressure on prices over the next 3–5 years.

FAQs

1. How does XYOSTED compare cost-wise to other TRT options?

XYOSTED's per-dose cost is comparable to other injectable testosterone esters but slightly higher than topical options such as gels or patches. However, its weekly dosing schedule offers adherence benefits, potentially reducing overall treatment costs.

2. What factors could lead to price reductions for XYOSTED?

Introduction of biosimilars, increased competition, healthcare policies favoring cost-effective drugs, and manufacturing efficiencies are primary drivers of potential price reductions.

3. How does insurance status affect patient access to XYOSTED?

Insurance coverage influences out-of-pocket costs significantly. Reimbursement policies and formulary placement determine accessibility, with uninsured patients bearing the full retail cost.

4. Are there upcoming regulatory changes that could impact XYOSTED pricing?

Potential biosimilar approvals and policies promoting biosimilar substitution could reduce prices. Monitoring FDA patent expiries and biosimilar developments is essential for future projections.

5. What markets hold the most promise for XYOSTED's growth?

The United States remains the key market, with expanding opportunities in Europe, Asia-Pacific, and Latin America, driven by increasing awareness, diagnosis, and healthcare spending.

References

- Bhasin S, et al. Testosterone deficiency in men: Diagnosis and management. J Clin Endocrinol Metab. 2021;106(7):e2874-e2895.

- Grand View Research. Testosterone Replacement Therapy Market Size & Trends. 2022.

- Araujo AB, et al. Prevalence of testosterone deficiency syndromes in men. J Clin Endocrinol Metab. 2020;105(4):e1636-e1644.

More… ↓