Last updated: July 27, 2025

Introduction

XOPENEX HFA (Levalbuterol HFA) is a bronchodilator classified as a short-acting beta-2 adrenergic receptor agonist (SABA), primarily prescribed for relief and prevention of bronchospasm in patients with asthma and chronic obstructive pulmonary disease (COPD). Its unique positioning as a selective beta-2 agonist aims to mitigate adverse cardiovascular effects associated with racemic albuterol, driving its adoption particularly among sensitive populations. This analysis appraises the current market landscape, competitive dynamics, regulatory influences, and projects future pricing trends for XOPENEX HFA.

Market Landscape Overview

Global and U.S. Market Size

The global respiratory inhaler market was valued at approximately USD 35 billion in 2022, with inhaled bronchodilators representing a substantial segment due to the high prevalence of asthma and COPD. North America, particularly the United States, holds the dominant market share owing to high disease prevalence, extensive healthcare infrastructure, and advanced treatment paradigms [1].

In the U.S., the asthma prevalence among adults is roughly 7.5%, whereas COPD affects approximately 6.2% of adults aged 40 and above [2]. Given these epidemiological factors, XOPENEX HFA’s target patient population remains sizable. However, its market penetration is influences by formulary preferences, generic availability, and prescribing trends.

Competitive Landscape

XOPENEX HFA faces competition primarily from:

- Albuterol/Metered-Dose Inhalers (MDIs): Both generic and branded versions, e.g., ProAir, Ventolin.

- Other Selective Beta-2 Agonists: Such as levalbuterol nebulizations.

- Combination Therapies: Incorporating corticosteroids and long-acting agents (ICS/LABA inhalers).

While generics have eroded branded inhaler market shares, XOPENEX’s clinical profile, especially in pediatric and cardiac-sensitive patients, sustains demand. Notably, Teva Pharmaceuticals markets XOPENEX HFA, with its ability to offer consistent formulations and regulatory compliance.

Regulatory Dynamics

The FDA approved XOPENEX HFA in 2004, with subsequent extensions and exclusivity periods. Patent protections and exclusivity effects influence pricing strategies and market competition, especially against cheaper generics. The recent expiration of the primary patent and the entry of generic alternatives in recent years have heightened pricing competition.

Pricing Dynamics and Trends

Current Pricing Context

As of early 2023, the average retail price for a 200-dose inhaler of XOPENEX HFA ranges between USD 180-220, depending on pharmacy and insurance coverage. The price variance is driven by:

- Insurance reimbursements: Negotiated agreements, co-pay structures.

- Generic competition: Price reductions typically follow generic launches, leading to a decrease of 20-40% compared to branded prices.

- Distribution channels: Pharmacies, mail-order services, and hospital formularies.

Impact of Patent Expiry and Generics

The expiry of key patents for XOPENEX HFA has introduced generic competition, exerting downward pressure on prices. Generic levalbuterol inhalers are priced approximately 30-50% lower than the branded version, with some market sharing already observed in several regions.

Reimbursement and Insurance Impact

Reimbursement rates significantly influence patient out-of-pocket expenses, affecting access and utilization. Insurers increasingly favor generics, further constraining prices for branded XOPENEX HFA.

Future Price Projections

Factors Influencing Price Trends

- Market Penetration of Generics: As generics capture an increasing share, prices are projected to decline further.

- Emergence of Biosimilars and New Formulations: Although less relevant for inhalers currently, future biospecific inhaled therapies could impact pricing strategies.

- Regulatory Pricing Policies: Policy shifts towards drug pricing transparency and negotiation can limit price increases.

- Patent and Exclusivity Landscape: Potential patent extensions or exclusivities could temporarily stabilize or increase prices.

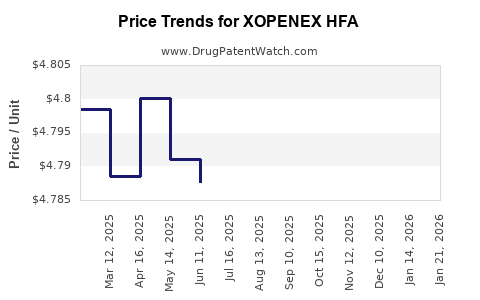

Projected Price Trajectory (2023-2028)

- Short-term (1-2 years): Expectation of a 10-15% decline in branded XOPENEX HFA prices, driven by generic absorption.

- Medium-term (3-5 years): Potential stabilization with minor increases tied to inflation and manufacturing costs, or further reductions if additional generics enter the market.

- Long-term (5+ years): Prices may plateau near generic-equivalent levels, approximately USD 100-150 per inhaler, contingent upon market dynamics and regulatory policies.

Market Opportunities and Challenges

-

Opportunities:

- Targeting niche segments such as pediatric use and patients with cardiac sensitivities.

- Expansion in emerging markets with rising respiratory disease prevalence.

- Developing combination inhalers with other agents for broader therapeutic claims.

-

Challenges:

- Competition from low-cost generics.

- Public and payer emphasis on cost containment.

- Evolving treatment guidelines favoring long-acting and combination therapies.

Conclusion

XOPENEX HFA remains a clinically valuable inhaler in respiratory therapeutics, notably for specific patient populations. However, the expiration of patent protections and robust generic competition exert persistent downward pressure on prices. While the branded drug's price will likely decline over the coming years, steady demand driven by physician preferences and patient needs sustains its market relevance. Stakeholders should monitor regulatory developments, reimbursement policies, and formulary decisions to adapt pricing and marketing strategies effectively.

Key Takeaways

- Market dominance is diminishing: Patent expiries and generic alternatives have eroded XOPENEX HFA's pricing power, leading to significant price declines.

- Pricing will stabilize at lower levels: Expect a gradual decrease of 10-15% in the short-term, with prices stabilizing near generic equivalents over time.

- Reimbursement dynamics are crucial: Insurance coverage favors generics, influencing patient access and branded drug utilization.

- Segment-specific opportunities persist: Niche patient groups and emerging markets offer growth and premium pricing prospects.

- Regulatory and policy shifts could further impact future pricing trajectories, emphasizing the importance of ongoing market intelligence.

FAQs

Q1: How does the patent status affect the pricing of XOPENEX HFA?

A: Patent expirations open the market to generic manufacturers, increasing competition and often leading to significant price reductions for the branded drug.

Q2: Are there effective alternatives to XOPENEX HFA?

A: Yes. Generic levalbuterol inhalers and other SABAs like albuterol inhalers are common competitors, often at lower prices.

Q3: What factors could reverse the downward price trend?

A: Potential factors include regulatory reforms restricting generics, supply chain disruptions, or new formulation innovations that command premium pricing.

Q4: How does insurance coverage influence XOPENEX HFA’s pricing and access?

A: Insurers favor cost-effective generics, which reduces co-pays for patients and puts pressure on branded drug prices.

Q5: What strategic moves should pharmaceutical companies consider to maintain profitability?

A: Focus on niche markets, develop combination therapies, or innovate delivery systems to differentiate their products and justify premium pricing.

References

- Market Research Future. "Respiratory Inhalers Market Analysis." 2022.

- CDC. "Asthma and COPD Prevalence Data," 2022.