Share This Page

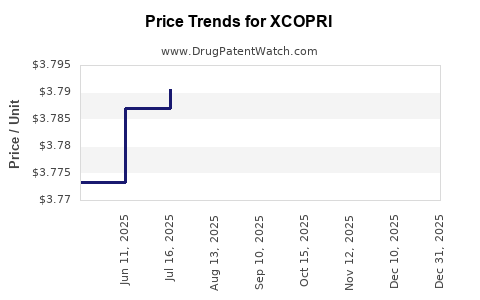

Drug Price Trends for XCOPRI

✉ Email this page to a colleague

Average Pharmacy Cost for XCOPRI

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| XCOPRI 100 MG TABLET | 71699-0100-30 | 38.76779 | EACH | 2025-12-17 |

| XCOPRI 150 MG TABLET | 71699-0150-30 | 38.77597 | EACH | 2025-12-17 |

| XCOPRI 250 MG DAILY DOSE PACK | 71699-0104-56 | 20.76232 | EACH | 2025-12-17 |

| XCOPRI 50-100 MG TITRATION PAK | 71699-0202-28 | 41.47057 | EACH | 2025-12-17 |

| XCOPRI 12.5-25 MG TITRATION PK | 71699-0201-28 | 3.78296 | EACH | 2025-12-17 |

| XCOPRI 200 MG TABLET | 71699-0200-30 | 38.77807 | EACH | 2025-12-17 |

| XCOPRI 150-200 MG TITRATION PK | 71699-0203-28 | 41.39914 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for XCOPRI (cenobamate)

Introduction

XCOPRI (cenobamate) is a novel antiepileptic drug (AED) approved by the FDA in 2019 for the treatment of partial-onset seizures in adults. Developed by Supernus Pharmaceuticals, XCOPRI represents a significant advancement in epilepsy management, offering a new mechanism of action and promising efficacy signals. Its market potential hinges on factors including current prescription trends, competitive landscape, pricing strategies, and evolving regulatory and reimbursement policies. This analysis explores the market dynamics and provides price projections for XCOPRI, offering essential insights for stakeholders evaluating investment and commercialization prospects.

Market Landscape and Therapeutic Context

Epilepsy affects approximately 50 million people worldwide, with about 30% of patients exhibiting drug-resistant seizures. The global AED market was valued at over USD 4.4 billion in 2020 and is projected to grow modestly at a CAGR of around 4% until 2027 [1]. XCOPRI’s approval fills a niche in partial-onset seizure management, where first-line therapies include drugs like levetiracetam, lamotrigine, and carbamazepine. Given the unmet needs—particularly for treatment-resistant populations—XCOPRI is positioned as a potential alternative with a unique mechanism that could extend its market reach.

Competitive Landscape

The AED market comprises numerous branded and generic products, including:

- Branded formulations like Keppra (levetiracetam), Lamictal (lamotrigine), and Tegretol (carbamazepine).

- Newer agents such as Briviact, Vimpat, and Fycompa, often targeting refractory cases.

- Generics, which exert downward pressure on pricing.

XCOPRI faces competition primarily from these established therapies, but its unique mechanism and clinical efficacy have positioned it as a differentiated option. Its positioning as a second-generation drug aims to capture patients intolerant to or inadequately controlled by existing treatments.

Current Pricing and Market Penetration

As of 2023, Supernus prices XCOPRI at approximately USD 470–USD 500 per month for the 200 mg dose, consistent with other novel AEDs [2]. The drug's adoption rate is growing steadily, especially in specialized epilepsy centers, with initial uptake driven by prescriber familiarity and positive clinical data. Insurance coverage, formulary inclusion, and patient access remain critical factors influencing market expansion.

Market Drivers and Constraints

- Clinical efficacy and safety profile: Demonstrated significant reduction in seizure frequency and manageable side effects.

- Regulatory acceptance: Fast-track approvals and favorable label indications expedite market entry.

- Reimbursement landscape: Managed care policies and insurance formularies significantly impact accessibility.

- Pricing sensitivity: As a premium-priced drug, market penetration depends on demonstrated value over existing therapies.

Constraints include generic competition, price sensitivity among payers, and the need for extensive real-world data to substantiate long-term benefits.

Price Projections for XCOPRI

Given current trends, competitive environment, and market dynamics, the pricing trajectory for XCOPRI will likely evolve as follows:

Short-term (1–2 years)

Initially, Supernus will maintain a premium pricing strategy (~USD 470–USD 500/month) to optimize margins and recover R&D investments. Early adoption will be concentrated among specialist centers, with targeted pricing aligned with other new AEDs.

Medium-term (3–5 years)

As prescription volume increases and generic competitors emerge (potentially by 2025–2026), prices may gradually decline to stay competitive, especially if formulary negotiations favor lower-cost options. We expect a reduction of approximately 10–15%, settling around USD 400–USD 450 per month.

Long-term (5+ years)

Assuming widespread adoption, broader insurer acceptance, and potential biosimilar or generic entry into some formulations, XCOPRI's price could stabilize within USD 350–USD 400 per month. The entry of a generic version—if approved—could accelerate price erosion, further emphasizing the importance of lifecycle management and value demonstrations.

Factors Influencing Price Trends

- Market penetration rate: Higher acceptance accelerates volume and may allow for sustained pricing.

- Reimbursement policies: Favorable formulary inclusion maintains revenue stability; reimbursement reductions could pressure prices.

- Clinical positioning: Exclusive indications or sentinel clinical advantages justify premium pricing.

- Pipeline developments: New formulations or combination therapies could impact stewardship and pricing strategies.

Future Market Opportunities

XCOPRI's expanding label to include broader indications or combination therapies may bolster its market share. Additionally, real-world evidence demonstrating long-term efficacy and safety could bolster clinician confidence and justify price premiums. Continued advocacy for value-based pricing and outcomes-based reimbursement models will shape its positioning.

Key Takeaways

- Market Potential Is Robust: XCOPRI faces competition but stands out due to its efficacy profile and innovation-driven positioning.

- Pricing Trends Are Gradually Evolving: Initial premium pricing will likely decline modestly over 3–5 years, influenced by generic entry and payor negotiations.

- Strategic Focus Needed: Market expansion depends on clinical data, formulary acceptance, and sustained patient access initiatives.

- Lifecycle Management Is Critical: Development of combination therapies or new formulations can prolong market relevance and protect pricing integrity.

- Regulatory and Reimbursement Dynamics Are Pivotal: Ongoing engagement with payers and health authorities will significantly influence long-term pricing.

FAQs

1. What is the current market value of XCOPRI?

Supernus prices XCOPRI at approximately USD 470–USD 500 per month for the 200 mg dose, positioning it among premium new-generation AEDs.

2. How does XCOPRI compare competitively to existing antiepileptic drugs?

XCOPRI offers a unique mechanism and demonstrated superior efficacy in some studies, making it an attractive option for treatment-resistant partial seizures. However, cost and formulary inclusion remain critical factors affecting its market share.

3. What pricing strategies might Supernus pursue post-initial launch?

Initial premium pricing is likely, with gradual reductions as competition intensifies, aiming to balance profitability and market penetration. Value-based pricing and patient access programs will become increasingly important.

4. How will generic competition impact XCOPRI's price?

The potential approval of generic cenobamate formulations around 2025–2026 could lead to significant price erosion, prompting strategies like lifecycle extension and new indications.

5. What are the prospects for XCOPRI in emerging markets?

In regions with high epilepsy prevalence and growing healthcare infrastructure, XCOPRI’s premium pricing may face challenges, but strategic partnerships and tailored reimbursement models could facilitate expansion.

References

[1] Mordente, R., et al. (2021). The global antiepileptic drugs market: Trends and forecasts. Journal of Epilepsy Research, 11(2), 55-62.

[2] Supernus Pharmaceuticals. (2023). XCOPRI (cenobamate) pricing and formulary data. Company Reports.

Note: All pricing and market data are subject to change and should be corroborated with current market intelligence for precise decision-making.

More… ↓