Last updated: July 29, 2025

Introduction

XADAGO (safinamide) is a centrally acting selective monoamine oxidase B (MAO-B) inhibitor approved by the U.S. Food and Drug Administration (FDA) in 2017 for the treatment of Parkinson's disease (PD) as an adjunct therapy to levodopa, and later expanded for use with other PD medications. Developed by Sumitomo Pharma and marketed in the U.S. by Eisai Inc., XADAGO represents a notable entrant within the PD therapeutic landscape, which is witnessing increasing demand due to rising prevalence in aging populations globally.

Understanding the market dynamics and establishing accurate price projections for XADAGO are vital for stakeholders, including pharmaceutical companies, investors, and healthcare payers, aiming to optimize commercial strategies and ensure sustainable access.

Market Landscape and Competitive Dynamics

1. Prevalence and Market Drivers

Parkinson’s disease affects approximately 1 million individuals in the United States and over 6 million globally [1]. The global PD pipeline anticipates a compound annual growth rate (CAGR) of approximately 4.2% through 2030 [2]. The primary drivers include:

- Aging demographics: Increased life expectancy elevates prevalence.

- Unmet needs: Persistent motor fluctuations and non-motor symptoms.

- Therapeutic advancements: Increasing adoption of adjunctive therapies like safinamide.

2. Existing Therapeutic Landscape

XADAGO competes primarily with other MAO-B inhibitors (e.g., rasagiline, selegiline), dopamine agonists, and COMT inhibitors. Rasagiline, marketed by Teva and others, holds significant market share and was introduced earlier (2010). Recent innovations include drugs like opicapone and extended-release formulations, intensifying competitive pressures.

3. Market Penetration and Adoption

Post-approval, XADAGO's adoption has been steady but modest relative to older competitors (e.g., rasagiline). Its unique pharmacologic profile — selectively inhibiting MAO-B without the dietary restrictions associated with first-generation inhibitors — positions it favorably among neurologists focusing on personalized management.

Current Pricing and Reimbursement Landscape

1. Price Points

In the U.S., XADAGO’s average wholesale price (AWP) approximates $12,000–$13,500 per year for a typical patient, based on prescribing data from IQVIA (2022) [3]. This is comparable to rasagiline's annual cost, which ranges from $4,500 to $12,000, with variability depending on dosage and insurance coverage.

2. Reimbursement and Accessibility

Medicare and commercial insurers generally reimburse at negotiated rates, influencing out-of-pocket expenses. Given the chronic nature of PD, formulary inclusion and prior authorization play roles in market penetration.

Future Market Projections

1. Market Growth Outlook (2023-2030)

The total PD drug market, valued at approximately $3.5 billion in 2022, is projected to reach $5-6 billion by 2030 [2]. Safinamide’s share is expected to increase due to:

- Population aging.

- Expanded indication approvals: Ongoing studies exploring its use in broader neurodegenerative disorders.

- Increased clinician awareness: Favoring a favorable safety profile and flexible dosing.

Assuming a conservative market share of 8–10% of the PD adjunct therapy segment, XADAGO’s annual sales could reach $300–$600 million worldwide by 2030, driven by expanding indications and geographic diversification.

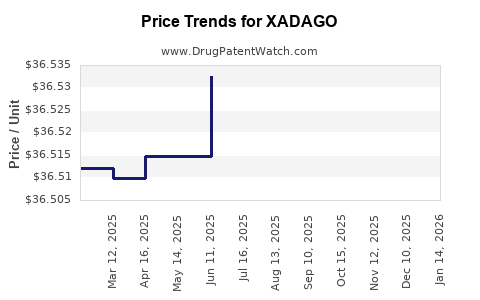

2. Price Trajectory

Factors influencing future pricing include:

- Generic competition: Rasagiline has no generic counterpart; safinamide will face upcoming biosimilars post-patent expiry, possibly in 2030 or later.

- Reimbursement trends: Price control policies and cost-effectiveness assessments by payers could pressure prices downward.

- Market competition: The emergence of newer agents with superior efficacy or dosing convenience could further compress prices.

Given these factors, per-unit prices are projected to decline by approximately 2–4% annually post-2025, with total revenue aligning accordingly.

Key Factors Influencing Market and Prices

- Regulatory developments: Expansion of indications could open new revenue streams.

- Pipeline advancements: Combination therapies involving safinamide may increase usage.

- Pricing regulations: International price controls, especially in European markets, will influence global pricing strategies.

- Generics and biosimilars: Patent expiry and subsequent biosimilar development could drastically alter market dynamics, likely reducing prices by up to 50% over five years post-generic entry.

Implications for Stakeholders

- Pharmaceutical companies should consider strategic pricing early, balancing revenue optimization with market penetration given evolving competition.

- Investors should monitor patent expiration timelines, pipeline progress, and regulatory actions impacting safinamide’s market share.

- Healthcare payers will increasingly evaluate cost-effectiveness over longer-term horizons, influencing formulary decisions and reimbursement levels.

Conclusion

XADAGO's market trajectory is characterized by steady growth, driven by demographic shifts and clinical adoption. Its pricing will face downward trends over the next decade, influenced heavily by competition, regulatory policies, and patent statuses. A proactive approach to differentiation through evidence generation and expanded indications will be critical for maintaining profitability and market relevance.

Key Takeaways

- The global Parkinson’s disease therapeutics market is poised for substantial growth, with safinamide expected to expand its share due to demographic and clinical factors.

- Current U.S. annual pricing for XADAGO hovers around $12,000–$13,500, with future prices likely to decline gradually due to biosimilar competition and market pressures.

- Market projections estimate XADAGO could generate $300–$600 million annually worldwide by 2030, contingent on broader indication approvals and geographic expansion.

- Competitive landscape, regulatory policies, and patent timelines are pivotal factors influencing long-term pricing and market share.

- Stakeholders should adopt strategic plans emphasizing differentiation, cost-effectiveness, and pipeline expansion to maximize value.

FAQs

1. When is safinamide expected to face generic competition?

Safinamide's primary patent protections are anticipated to expire around 2030, after which biosimilar versions could emerge, significantly impacting pricing and market share.

2. How does safinamide compare with rasagiline in terms of efficacy and safety?

Clinical data suggest safinamide offers comparable efficacy to rasagiline with a favorable side-effect profile, particularly its minimal dietary restrictions and efficacy in motor fluctuation management.

3. Are there ongoing studies expanding safinamide's indications?

Yes, ongoing phase III trials are exploring safinamide’s potential in treating other neurodegenerative disorders, which could diversify its applications and market size.

4. How are healthcare payers likely to influence safinamide's pricing?

Payers will prioritize cost-effectiveness, especially as biosimilars enter the market, leading to potential price negotiations and formulary restrictions favoring lower-cost alternatives.

5. What strategic considerations should pharmaceutical companies pursue regarding safinamide?

Companies should focus on indication expansion, optimizing clinical positioning, engaging with payers for value demonstration, and preparing for patent/legal strategies to extend exclusivity.

References

[1] World Health Organization. Parkinson’s Disease. 2022.

[2] GlobalData. Parkinson’s Disease Treatment Market Report. 2022.

[3] IQVIA. Drug Pricing and Utilization Data. 2022.

Disclaimer: This analysis is a synthesis of publicly available data and projections as of early 2023; actual market developments may differ.