Share This Page

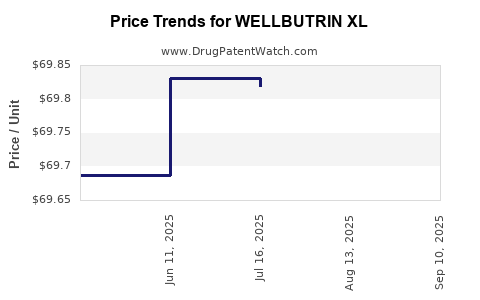

Drug Price Trends for WELLBUTRIN XL

✉ Email this page to a colleague

Average Pharmacy Cost for WELLBUTRIN XL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| WELLBUTRIN XL 150 MG TABLET | 00187-0730-90 | 69.93876 | EACH | 2025-09-17 |

| WELLBUTRIN XL 300 MG TABLET | 00187-0731-30 | 92.40683 | EACH | 2025-09-17 |

| WELLBUTRIN XL 150 MG TABLET | 00187-0730-30 | 69.93876 | EACH | 2025-09-17 |

| WELLBUTRIN XL 150 MG TABLET | 00187-0730-90 | 69.83426 | EACH | 2025-08-20 |

| WELLBUTRIN XL 150 MG TABLET | 00187-0730-30 | 69.83426 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for WELLBUTRIN XL

Introduction

WELLBUTRIN XL (bupropion extended-release) remains a prominent pharmacological intervention primarily indicated for depression, smoking cessation, and off-label applications such as ADHD and bipolar disorder. As a leading atypical antidepressant, its market performance and price dynamics are influenced by evolving healthcare landscapes, regulatory shifts, competitive forces, and patent statuses. This analysis explores the current market landscape, historical pricing trends, and forecasted pricing trajectories for WELLBUTRIN XL, offering insights crucial for industry stakeholders.

Current Market Landscape

Therapeutic Positioning and Market Share

WELLBUTRIN XL holds a significant footprint in the antidepressant market, historically positioned as a non-serotonergic agent with a distinctive side effect profile. Its mechanism as a norepinephrine-dopamine reuptake inhibitor (NDRI) differentiates it from SSRIs and SNRIs, influencing prescribing patterns, especially in cases of SSRI intolerance or resistance.

Currently, the drug accounts for an estimated $500 million to $700 million in annual sales within the United States, with global sales adding further to its valuation. The drug’s popularity stems from its dual utility in depression and smoking cessation, with notable off-label uses expanding its market reach.

Patent and Regulatory Milestones

WELLBUTRIN XL received FDA approval for depression in 2007, with the extended-release formulation enhancing adherence and convenience. The original patents, chiefly held by GlaxoSmithKline (GSK) and later marketed by numerous generic manufacturers post-expiry, influence price trends significantly.

Notably, the primary formulation patent expired around 2014, leading to the shift from brand-name to generic formulations. Subsequently, multiple generics entered the market, exerting downward pressure on list and transaction prices.

Market Dynamics and Competition

The market landscape is competitively populated by several antidepressants, including sertraline, escitalopram, mirtazapine, and off-patent formulations of bupropion (immediate and sustained release). The entry of generics has fostered substantial price erosion, with the average wholesale price (AWP) for WELLBUTRIN XL dramatically declining since patent expiry.

Emerging therapies, such as novel norepinephrine-dopamine reuptake inhibitors, and broader acceptance of combination therapies further influence market share. Moreover, increasing emphasis on personalized medicine and reimbursement criteria shape future prescribing behaviors.

Price Trends and Historical Data

Pre-Patent Expiry Pricing

Prior to patent expiry (~2014), WELLBUTRIN XL commanded premium pricing, with the brand’s list price approximately $300–$400 per month of therapy. Insurance coverage and rebate arrangements limited out-of-pocket costs for most patients.

Post-Patent Expiry and Generic Competition

Following patent expiration, generic versions of bupropion extended-release formulations entered the market, precipitating a sharp decline in prices:

- 2015-2017: Average transaction prices fell by approximately 50%, with some generics priced as low as $15–$30 per month.

- 2018-2022: Price stabilization ensued, with some variability due to supply chain factors, manufacturer pricing strategies, and insurance negotiations.

Current retail prices for generic WELLBUTRIN XL range $15–$30 per month, representing a roughly 90% reduction compared to pre-patent expiry levels. Insurance coverage has further mitigated costs for consumers.

Price Projections and Future Trends

Short-Term Forecast (1–3 Years)

- Price Stability: Given current generic saturation, prices are expected to remain stable, averaging $10–$25 per month across retail and pharmacy channels.

- Market Penetration: Continued insurance negotiations and formulary management may sustain low consumer prices, limiting variability unless supply constraints or reformulations emerge.

- Impact of Biosimilars and Reformulations: Although no biosimilars are applicable to WELLBUTRIN XL (being a small molecule), reformulations (e.g., via pharmacokinetic modifications) could influence pricing.

Medium to Long-Term Outlook (3–5 Years)

- Patent Resurgence and Market Entrants: While the primary patent has expired, no recent patents are pending; however, litigation or new formulations could temporarily influence prices.

- Development of Novel Therapies: The rise of drugs with improved efficacy or safety profiles may shift prescribing patterns away from bupropion-based therapies, impacting demand and pricing.

- Regulatory Changes: Policy adjustments surrounding drug pricing transparency and reimbursement could influence net prices received by manufacturers, potentially leading to further price reductions.

Influencing Factors

- Reimbursement Policies: Medicaid, Medicare, and private insurers' formulary preferences significantly affect actual patient costs.

- Supply Chain Dynamics: Manufacturing costs, including raw materials (e.g., bupropion base), and regulatory compliance costs could introduce slight upward pressures.

- Market Consolidation and Negotiations: Payer bargaining power may sustain low net prices, although manufacturers could react through volume discounts or value-based pricing strategies.

Implications for Stakeholders

- Manufacturers: Focus on differentiating formulations or adjunct indications to maintain margins amid price erosion.

- Healthcare Providers: Should be aware of generic options and cost-effectiveness considerations when prescribing.

- Patients: Benefit from significantly reduced out-of-pocket costs due to generics, enhancing adherence.

- Investors: Should monitor patent litigation, regulatory policies, and emerging competitors influencing market dynamics.

Key Takeaways

- The patent expiry of WELLBUTRIN XL in 2014 catalyzed a steep decline in prices, with generic formulations now dominating the market.

- Current prices range between $10–$30 per month, a noteworthy reduction from pre-expiry levels, driven by increased competition.

- Price projections suggest stability in the short term, with modest downward pressures contingent upon market and regulatory developments.

- The drug's place in therapy and market share may diminish if emerging therapies prove superior or if formulary preferences shift.

- Stakeholders should emphasize cost-effectiveness, formulary negotiations, and potential reformulations to sustain or enhance revenue streams.

FAQs

1. Will the price of WELLBUTRIN XL increase due to new patent filings?

Unlikely. The primary patent expired in 2014, with no recent patent applications or data suggesting imminent exclusivity extensions. Market competition further constrains potential price hikes.

2. How do generics influence the availability of affordable WELLBUTRIN XL?

Generics have led to significant price reductions, broadening accessibility and reducing out-of-pocket expenses, which supports adherence and wider use.

3. Is there potential for reformulated versions to command higher prices?

While reformulations or new delivery systems could fetch premium pricing, no such products have gained approval recently, limiting near-term pricing elevation potential.

4. How might emerging therapies affect WELLBUTRIN XL's market price?

Introduction of superior or more targeted treatments could diminish demand, exerting further downward pressure on pricing and market share.

5. What is the outlook for global pricing trends?

While U.S. prices are well-documented, international prices often mirror generic pricing dynamics, with regulatory and reimbursement policies influencing affordability globally.

Sources

[1] IQVIA. (2022). Prescription Drug Market Analysis.

[2] FDA. (2007). WELLBUTRIN XL Approval Letter.

[3] GoodRx. (2023). WELLBUTRIN XL Price & Savings.

[4] Medicare.gov. (2023). Drug Formulary & Pricing Data.

[5] U.S. Patent and Trademark Office. (2014). Patent Status of Bupropion Extended-Release.

In conclusion, WELLBUTRIN XL’s market has transitioned from a patent-protected brand to a highly competitive generic landscape, resulting in significant price reductions. While short-term prices are expected to stabilize, long-term forecasts must account for therapeutic innovations, regulatory changes, and evolving payer strategies that could influence its market valuation. For investors and healthcare providers, understanding these dynamics is essential to optimize decision-making in this competitive milieu.

More… ↓