Last updated: July 31, 2025

Introduction

Wellbutrin SR (Extended Release Bupropion), marketed primarily by GlaxoSmithKline (GSK), is a well-established antidepressant approved for major depressive disorder (MDD), smoking cessation, and seasonal affective disorder (SAD). Its unique mechanism as a norepinephrine-dopamine reuptake inhibitor has positioned it as a preferred choice for patients with treatment-resistant depression and those seeking alternatives to SSRIs.

As the pharmaceutical landscape evolves amid increasing demand for mental health treatments, understanding the current market dynamics and forecasting future pricing for Wellbutrin SR is essential for stakeholders including pharmaceutical companies, investors, and healthcare providers.

Market Landscape Overview

Historical Performance and Market Penetration

Since its approval in the late 1980s and subsequent SR formulation approval in 1996, Wellbutrin SR experienced robust growth, driven by its distinctive efficacy and tolerability profile. According to IQVIA data, the drug maintained high prescription volumes in North America, which remains its primary revenue driver, owing to the favorable regulatory and reimbursement environment.

The drug's positioning as an alternative to SSRIs and its off-label uses (e.g., weight management, ADHD) contributed to its sustained demand. However, patent expirations, notably the original patent expiring around 2006-2008, led to increased generics entering the market, impacting pricing and profitability for branded formulations.

Competitive Landscape

Post-patent, multiple generic versions of bupropion SR entered the market, intensifying price competition. Third-party manufacturers such as Mylan, Teva, and Sun Pharma have gained significant market share, offering bioequivalent, lower-cost options.

The emergence of new antidepressants (e.g., esketamine, brexanolone) and generic combination products also influence market dynamics, with clinicians increasingly adopting a tailored approach based on efficacy, side effect profile, and cost.

Regulatory and Reimbursement Trends

The pharmaceutical industry faces increasing pressure to contain costs, with payers favoring generics. As a result, the price gap between branded Wellbutrin SR and its generics has narrowed substantially. In several countries, formulary restrictions also limit the branded drug's use, favoring lower-cost alternatives.

Current Market Trends and Challenges

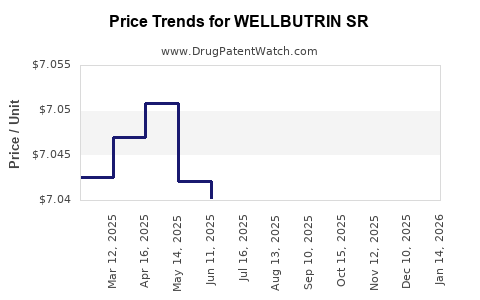

Pricing Trends

-

Patent Expiry Impact: The phase-out of exclusivity saw the branded Wellbutrin SR's wholesale acquisition cost (WAC) decline substantially, aligning closer to generic prices.

-

Generic Competition: The proliferation of multiple generic manufacturers has led to aggressive price erosion. According to the FDA’s Orange Book, over a dozen generics have received approval, fostering direct price competition.

-

Market Segmentation: Branded Wellbutrin SR has been repositioned as a premium product, often reserved for specific patient populations or clinicians preferring brand consistency, mitigating some loss of volume.

Demand Drivers

-

Mental Health Awareness: Rising global awareness of depression and anxiety disorders sustains demand, particularly in North America and Europe.

-

Off-label Use and Smoking Cessation: Continuation of use in off-label indications offers incremental revenue streams.

-

Reimbursement Policies: Expansion of insurance coverage for mental health medications sustains prescription volumes.

Supply Chain and Manufacturing Considerations

Manufacturers face challenges related to availability, quality control, and production costs, especially amid global supply chain disruptions. These factors can influence pricing margins, especially for branded formulations.

Future Price Projections

Methodology

Forecasting future prices for Wellbutrin SR involves analyzing historical data, patent and regulatory exclusivity timelines, generic market entry trends, and macroeconomic healthcare indicators. A combination of quantitative modeling and qualitative market assessment informs the projections.

Short-term (1-2 years)

-

Branded Wellbutrin SR: Expect a continued decline in WAC prices by approximately 10-15%, consistent with saturation of generic competition and minimal new demand for branded formulations.

-

Generics: Prices are projected to stabilize at 20-30% below the original branded levels, with some minor fluctuations due to manufacturing costs and inventory adjustments.

Medium-term (3-5 years)

-

Market Share Stabilization: Given the predominance of generics, the market share for branded Wellbutrin SR is unlikely to recover significantly. Price margins for branded formulations will likely remain under pressure.

-

Innovator Strategies: GSK may explore niche marketing or value-added formulations, potentially maintaining a premium price for specialized populations.

Long-term (5+ years)

-

Innovative Therapies: The advent of next-generation antidepressants and personalized medicine approaches could diminish demand for existing formulations.

-

Market Maturity: The market will be mature, with prices stabilized at generically competitive levels, barring regulatory changes or novel indication approvals that could rekindle interest in the branded product.

Impact of Regulatory and Legislation Changes

Payer policies promoting biosimilars, increased litigation, and patent challenges could further influence pricing strategies and availability, accelerating or decelerating price erosion.

Implications for Stakeholders

-

Manufacturers: Focus on differentiating through formulation innovations, patient adherence programs, or targeted marketing to sustain margins.

-

Investors: Expect diminished revenues for branded Wellbutrin SR but potentially stable or increased margins for generic suppliers.

-

Healthcare Providers: Should consider cost-effectiveness and formulary preferences when prescribing, with generics offering comparable efficacy at reduced prices.

-

Policymakers: Must balance cost containment with access, potentially fostering policies that promote biosimilars and generic utilization.

Key Takeaways

- The patent expiry and proliferation of generics have substantially reduced the price of Wellbutrin SR, with further declines anticipated over the next 3-5 years.

- Market dynamics favor cost-effective generics, relegating the branded product to niche segments unless differentiated by unique formulations or indications.

- Rising mental health awareness sustains demand, but competitive pressures and regulatory trends threaten sustained premium pricing.

- Stakeholders should strategically invest in innovation and market positioning to mitigate margin compression.

- Long-term outlook suggests stagnation in branded Wellbutrin SR pricing, with generic versions dominating the market landscape.

FAQs

1. Will the price of Wellbutrin SR ever rise again?

While unlikely in the short to medium term, price increases could occur if new formulations or indications are approved that significantly differentiate the branded product, or if supply chain disruptions limit generic availability.

2. How does generic competition affect the affordability of Wellbutrin SR?

Generic competition has driven prices down by approximately 80-90%, increasing affordability and access but reducing the profit margins for the branded version.

3. Are there any upcoming regulatory changes that could impact Wellbutrin SR pricing?

Potential changes include policies promoting biosimilar and generic drug adoption, which could further pressure prices. Legislation that extends exclusivity or broadens indications might temporarily bolster brand value.

4. What are alternative treatments for depression that may impact Wellbutrin SR sales?

Newer therapies like esketamine, brexanolone, and digital therapeutics are gaining traction, potentially diverting some market share from traditional antidepressants.

5. How should pharmaceutical companies position themselves in this market?

Focusing on value-added features, personalized medicine, or combination therapies can preserve margins. Emphasizing brand loyalty and differentiated formulations may also mitigate generic price erosion.

References

[1] IQVIA. (2022). National Prescription Audit.

[2] FDA Orange Book. (2023). Drug Approvals and Patent Data.

[3] GSK. (2023). Wellbutrin SR Product Information.

[4] Deloitte. (2022). Pharmaceutical Industry Outlook.

[5] MarketsandMarkets. (2023). Mental Health Market Forecast.