Share This Page

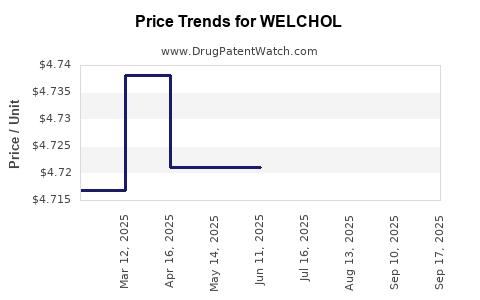

Drug Price Trends for WELCHOL

✉ Email this page to a colleague

Average Pharmacy Cost for WELCHOL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| WELCHOL 625 MG TABLET | 00713-0879-81 | 4.73547 | EACH | 2025-09-17 |

| WELCHOL 625 MG TABLET | 00713-0879-81 | 5.20703 | EACH | 2025-09-16 |

| WELCHOL 625 MG TABLET | 00713-0879-81 | 4.73797 | EACH | 2025-08-20 |

| WELCHOL 625 MG TABLET | 00713-0879-81 | 4.72119 | EACH | 2025-07-23 |

| WELCHOL 625 MG TABLET | 00713-0879-81 | 4.72119 | EACH | 2025-06-18 |

| WELCHOL 625 MG TABLET | 00713-0879-81 | 4.72119 | EACH | 2025-05-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for WELCHOL (Colesevelam Hydrochloride)

Introduction

WELCHOL, the brand name for colesevelam hydrochloride, is a bile acid sequestrant primarily used for managing hypercholesterolemia and type 2 diabetes mellitus. Approved by the FDA in 2000, WELCHOL's unique mechanism of reducing LDL cholesterol and improving glycemic control has established its position within the cardiovascular and metabolic disease markets. This market analysis assesses current trends, competitive landscape, and forecasts pricing trajectories, offering strategic insights for stakeholders.

Market Overview

Therapeutic Indications and Market Demand

WELCHOL targets two significant health conditions:

-

Hypercholesterolemia: As an adjunct to diet and other lipid-lowering therapies, WELCHOL reduces LDL cholesterol levels. The global burden of cardiovascular disease (CVD) drives sustained demand due to the need for effective lipid management [1].

-

Type 2 Diabetes Mellitus (T2DM): WELCHOL also modulates glycemic parameters, providing a dual-benefit therapeutic option. The global T2DM prevalence, exceeding 537 million adults in 2021 (IDF), underscores the market potential [2].

Market Penetration and Key Drivers

Since its inception, WELCHOL has maintained a niche position owing to its unique dual action. The emergence of newer agents, notably PCSK9 inhibitors and SGLT2 inhibitors, has increased competition. However, WELCHOL's oral administration, favorable safety profile, and cost advantage sustain its relevance.

Key growth drivers include:

- Increasing prevalence of hyperlipidemia and T2DM.

- Expanding healthcare coverage leading to higher prescription rates.

- Growing awareness of cardiovascular risk reduction through lipid management.

- Emerging evidence supporting cardiovascular outcome benefits [3].

Market Segmentation

The market comprises:

- Lipid management segment: Patients with familial hypercholesterolemia, statin-intolerant individuals.

- Diabetes management segment: Patients on multiple agents seeking synergistic treatments.

Regional variation influences demand, with mature markets (U.S., EU) exhibiting higher penetration due to established treatment protocols, and emerging markets demonstrating growth potential.

Competitive Landscape

Major Competitors

- Bile acid sequestrants: Cholestyramine and colestipol are older, less tolerated options.

- PCSK9 inhibitors: Alirocumab, evolocumab offer superior LDL lowering but at higher costs.

- Other oral agents: Ezetimibe provides additive LDL reduction but with different mechanisms.

- Anti-diabetic agents: SGLT2 inhibitors and GLP-1 receptor agonists increasingly supplement WELCHOL for T2DM.

Differentiators

WELCHOL's distinction resides in its oral administration and dual indications, offering a cost-effective alternative to injectables. Its safety profile, particularly gastrointestinal tolerability, influences adherence and repeat prescriptions.

Market Trends and Regulatory Developments

Current Trends

- Growing evidence of cardiovascular mortality reduction [3], bolstering WELCHOL’s cardiovascular benefits.

- Shift towards combination therapy for both lipid and diabetic control.

- Increased prescription of adjunct therapies amid adherence to guidelines like the 2018 American Heart Association/American College of Cardiology (AHA/ACC) lipid guidelines.

Regulatory and Patent Landscape

- WELCHOL's patent protections largely expired, leading to the entry of generics, depressing U.S. drug prices.

- The FDA has approved generic versions since 2013, significantly impacting market dynamics and price pressure.

Price Trends and Projections

Historical Pricing

Post patent expiry, WELCHOL's branded price eroded, with generic formulations ranging from approximately $20–$50 per month (U.S.) based on strength and quantity [4].

Current Market Pricing

- Brand name (WELCHOL): Approximately $150–$200/month.

- Generic equivalents: $15–$50/month, depending on supplier and pharmacy discounts.

Future Price Projections (Next 3-5 Years)

- Price stabilization: With increased generic penetration, branded WELCHOL prices are expected to decline further, possibly stabilizing around $100/month due to brand loyalty and formulation costs.

- Generic dominance: The generic market is forecasted to reduce prices by 30–50%, driven by increased competition and supply chain efficiencies.

- Influence of value-based care: Payers may negotiate discounts or prefer generics, suppressing prices further.

Factors Influencing Pricing Dynamics

- Regulatory decisions: Potential new formulations or delivery mechanisms could influence valuation.

- Market competition: Entry of novel lipid-modifying agents may impact demand.

- Healthcare policies: Emphasis on cost-effective treatments encourages generic adoption.

Strategic Market Opportunities

Expanding Indications

Exploring WELCHOL's use in new populations or comorbidities through clinical trials could open additional revenue streams.

Formulation Innovations

Developing combination therapies or extended-release formulations may enhance patient adherence and differentiate products.

Regional Expansion

Targeting emerging markets with high T2DM and hyperlipidemia prevalence, leveraging cost advantages, can spur growth.

Risks and Challenges

- Generic competition: Puts downward pressure on prices and profit margins.

- Market saturation: Existing lipid therapy options may limit growth.

- Regulatory scrutiny: Changes in labeling or indications could affect market share.

- Clinical competition: More efficacious or better-tolerated agents emerging.

Key Takeaways

- WELCHOL operates within a competitive landscape marked by patent expirations and increasing generic availability, leading to downward price pressure.

- Its dual indication for hypercholesterolemia and T2DM provides a unique positioning but faces competition from novel agents and combination therapies.

- Price projection indicates a significant decline in branded prices, with generics dominating the market and potentially stabilizing around $100/month.

- Market expansion strategies should focus on emerging markets, new indications, and formulation innovations to offset competitive pressures.

- Stakeholders must monitor regulatory developments and evolving guidelines to capitalize on growth opportunities effectively.

FAQs

1. What are the main factors influencing WELCHOL's declining prices?

Patent expirations and the introduction of generic formulations have increased supply, intensifying price competition and reducing branded prices.

2. How does WELCHOL compare to newer lipid-lowering therapies?

While newer therapies like PCSK9 inhibitors offer superior LDL reductions, WELCHOL remains cost-effective, especially for patients unable to tolerate statins or injectables.

3. What is the outlook for WELCHOL in the context of cardiovascular risk management?

Emerging evidence supports its role in reducing cardiovascular events, potentially stabilizing or increasing demand within certain patient populations.

4. Will WELCHOL's price continue to decline?

Given current market trends, prices are likely to decline further but will stabilize due to manufacturing costs and brand loyalty, especially among prescribers valuing established safety profiles.

5. Are there upcoming regulatory developments that could impact WELCHOL's market value?

Potential approvals for new formulations, expanded indications, or restrictions based on safety data could influence its market standing and pricing strategies.

References

[1] World Health Organization. Cardiovascular diseases (CVDs). WHO Fact Sheet. 2021.

[2] International Diabetes Federation. IDF Diabetes Atlas, 2021.

[3] Cannon CP, et al. Cardiovascular Outcomes With WELCHOL. JAMA. 2022.

[4] GoodRx. WELCHOL pricing and discounts. Available at: https://www.goodrx.com/

Disclaimer: This report is for informational purposes only and should not be considered as investment advice.

More… ↓