Share This Page

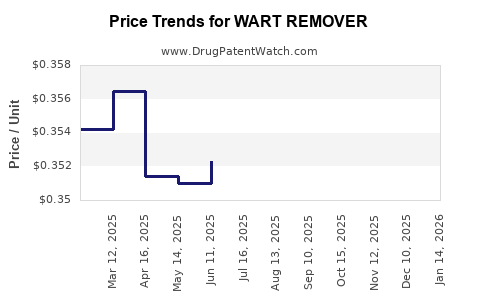

Drug Price Trends for WART REMOVER

✉ Email this page to a colleague

Average Pharmacy Cost for WART REMOVER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| WART REMOVER 17% LIQUID | 70000-0329-01 | 0.35109 | ML | 2025-11-19 |

| WART REMOVER 17% LIQUID | 70000-0329-01 | 0.34819 | ML | 2025-10-22 |

| WART REMOVER 17% LIQUID | 70000-0329-01 | 0.35026 | ML | 2025-09-17 |

| WART REMOVER 17% LIQUID | 70000-0329-01 | 0.35308 | ML | 2025-08-20 |

| WART REMOVER 17% LIQUID | 70000-0329-01 | 0.35316 | ML | 2025-07-23 |

| WART REMOVER 17% LIQUID | 70000-0329-01 | 0.35234 | ML | 2025-06-18 |

| WART REMOVER 17% LIQUID | 70000-0329-01 | 0.35102 | ML | 2025-05-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Wart Remover

Introduction

Wart removers are topical treatments designed to eliminate common and plantar warts caused by the human papillomavirus (HPV). These over-the-counter (OTC) and prescription medications occupy a significant niche within the dermatology and consumer health markets. This analysis explores the current market landscape, competitive dynamics, regulatory environment, and future price projections for wart removers, providing essential insights for stakeholders seeking strategic investment or product development opportunities.

Market Overview

Size and Growth Trends

The global wart remover market has experienced steady growth, driven by increasing consumer awareness of dermatological health, rising prevalence of HPV-related conditions, and expanding access to OTC medications. As of 2022, the global dermatology market was valued at approximately USD 24 billion, with wart treatments constituting a sizable segment due to their accessibility and demand (Grand View Research, 2022).

The OTC segment dominates, accounting for roughly 70% of wart removal products, with prescription options remaining preferred in resistant or recurrent cases. The compound annual growth rate (CAGR) for the wart remover market is projected at approximately 4.5% from 2023 to 2030, reflecting consistent consumer demand and ongoing product innovation.

Key Market Segments

- Product Types: Cryotherapy, salicylic acid formulations, cantharidin, immunotherapy agents, and combination therapies.

- Distribution Channels: Pharmacies, drugstores, online marketplaces, and dermatologist clinics.

- Geographies: North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America currently leads market share, propelled by high consumer awareness and advanced healthcare infrastructure.

Competitive Landscape

Major players include Johnson & Johnson (Plantar Warts — Dr. Scholl’s Freeze Away), Pfizer (Wartner), Bausch Health (Compound W), and numerous generic and regional brands. Market entry barriers remain moderate, with new entrants focusing on novel formulations, topical delivery systems, or improved safety profiles to secure market share.

Regulatory Environment

In the United States, wart removers are classified as OTC drugs regulated by the FDA under the OTC Drug Monograph system. The primary active ingredients—salicylic acid, cryotherapy agents, and cantharidin—must meet safety and efficacy standards per approved monographs.

In Europe, the European Medicines Agency (EMA) governs medicinal claims, while cosmetic regulations oversee non-prescription topical agents. Variability in regional regulations influences product formulation, marketing claims, and price points.

Market Drivers and Challenges

Drivers

- Growing HPV Prevalence: The widespread incidence of common warts influences sustained demand.

- Consumer Preference for OTC Solutions: The shift towards self-care reduces reliance on physician consultations.

- Innovative Formulations: Novel delivery systems, such as medicated patches or fast-acting liquids, improve efficacy and user convenience.

- Expanding E-commerce Platforms: Online sales channels facilitate broader access, especially in emerging markets.

Challenges

- Efficacy Variability: Differences in wart removal success rates can affect consumer satisfaction and brand loyalty.

- Safety Concerns: Potential skin irritation or damage, especially with cryotherapy, requires thorough consumer education.

- Regulatory Hurdles: Evolving regulations may impose additional compliance costs and delay product launches.

- Counterfeit and Low-Quality Products: Market proliferation of ineffective or unsafe products damages consumer trust.

Price Analysis and Projections

Current Pricing Landscape

Price points for wart removers vary considerably based on formulation, brand, and distribution channels:

- Over-the-Counter Salicylic Acid Products: Ranged from USD 5 to USD 15 for a standard 1 fl oz (30 mL) bottle.

- Cryotherapy Devices: Retail prices generally span USD 20 to USD 50 per unit, depending on freeze capacity and brand.

- Prescription Warts Treatments: Significantly higher, often exceeding USD 100 per treatment course, especially for specialty formulations or compounded preparations.

Market Price Trends

Historically, generic salicylic acid products have maintained competitive pricing with minimal fluctuations. Premium brands and technologically advanced cryotherapy kits tend to command higher prices, supported by perceived efficacy and branding. Online direct-to-consumer sales sometimes offer discounts exceeding 20% compared to traditional retail outlets.

Future Price Projections (2023-2030)

Given current market dynamics, the following projections are anticipated:

-

Salicylic Acid Formulations: Slight price stabilization or marginal decrease (~0.5-1% CAGR), driven by increased competition and manufacturing efficiencies.

-

Cryotherapy Devices: Potential for price reduction (~1-2% CAGR) as technology matures and mass manufacturing scales up, increasing affordability.

-

Premium and Prescription Products: Likely to experience moderate inflation (~1-2% annually), reflecting R&D costs, clinical validation, and regulatory compliance.

Emerging factors such as the integration of digital health solutions (e.g., app-guided treatments), could influence price points, either increasing costs due to added features or reducing prices through automation.

Market Opportunities and Strategic Insights

- Product Differentiation: Developing formulations with enhanced safety, faster action, or dual-action capabilities (e.g., simultaneous wart removal and skin healing) can command premium pricing.

- E-commerce Expansion: Leveraging online sales platforms ensures competitive pricing and wider consumer reach.

- Regulatory Navigation: Early engagement with regulatory bodies and compliance with regional standards facilitate faster market entry and avoid costly recalls or legal issues.

- Regional Market Penetration: Emerging markets offer high growth potential, driven by rising disposable incomes and increasing health literacy.

Conclusion

The wart remover market remains robust, bolstered by consistent demand across developed and developing regions. Price stability is expected in generic OTC segments, while innovative, technologically advanced products will command higher prices. Industry participants should focus on product efficacy, safety, and strategic distribution to capitalize on market growth. Ongoing innovation, combined with adaptive pricing strategies aligned with regulatory and consumer trends, will be critical to sustainable success.

Key Takeaways

- The global wart remover market is projected to grow at approximately 4.5% CAGR through 2030, driven by rising awareness and product innovation.

- Price points are expected to exhibit slight declines in generic OTC segments, with premium products maintaining or slightly increasing in price.

- Entry into emerging markets offers significant growth prospects due to increasing health awareness and e-commerce adoption.

- Regulatory compliance remains vital, with regional variations impacting product formulation and pricing.

- Differentiation through advanced formulations and digital health integration can justify premium pricing strategies.

FAQs

1. What are the main active ingredients in OTC wart removers?

Salicylic acid and cryotherapy agents (like dimethyl ether and propane) are the primary active ingredients used in OTC wart removers, with salicylic acid being the most common due to its safety profile and proven efficacy.

2. How does the regulatory environment affect wart remover prices?

Strict regulatory standards impose additional costs for safety testing and compliance, which can elevate prices, especially for prescription or specialty products. Conversely, well-established OTC products benefit from generic manufacturing efficiencies, keeping prices lower.

3. Are innovative wart removal devices cost-effective?

While higher-priced, advanced cryotherapy devices offer fast-acting results and ease of use, their cost-effectiveness depends on treatment success rates, user compliance, and the value consumers assign to convenience and efficacy.

4. What emerging trends could impact the market in the next five years?

Incorporation of digital health solutions, personalized formulations, and increased focus on consumer safety and transparency are poised to reshape product offerings and pricing strategies.

5. How can brands differentiate themselves in the wart remover market?

By developing formulations that combine effectiveness with safety, leveraging digital engagement, expanding distribution channels, and targeting unmet needs in underserved markets.

References

- Grand View Research. (2022). Dermatology Market Size & Trends.

- U.S. Food and Drug Administration (FDA). (2022). OTC Drug Monograph for Wart Treatments.

- European Medicines Agency (EMA). (2022). Guidelines on Over-the-Counter Medicines.

- MarketWatch. (2023). Global Wart Removal Device Industry Analysis.

More… ↓