Last updated: July 28, 2025

Introduction

Vytorin, a combined lipid-lowering medication containing ezetimibe and simvastatin, has been a significant player in the cardiovascular treatment landscape. Used primarily for managing cholesterol levels and reducing the risk of cardiovascular events, Vytorin occupies a niche in the statin and adjunct lipid-lowering therapy markets. As patents expire and generics proliferate, analyzing its market dynamics and projecting future pricing trajectories are vital for pharmaceutical stakeholders, healthcare providers, and investors. This report offers a comprehensive assessment of Vytorin's current market status and provides detailed price forecast models based on prevailing trends, competitive pressures, regulatory influences, and healthcare policies.

Market Overview

Product Profile

Vytorin combines ezetimibe, a cholesterol absorption inhibitor, with simvastatin, a widely used statin. Approved by the FDA in 2004, Vytorin became an essential therapy for patients with hyperlipidemia, particularly those requiring dual mechanisms for lipid reduction. Its efficacy in lowering LDL cholesterol and preventing cardiovascular events has authorized its widespread adoption.

Market Penetration and Usage

According to IQVIA data, Vytorin generated approximately $600 million in U.S. sales in 2022. Though it has maintained a solid market share since its launch, recent shifts towards generic alternatives have impacted revenue streams. Its primary prescribers include cardiologists and primary care physicians, with utilization heavily influenced by evolving guidelines and lipid management strategies[1].

Competitive Landscape

The advent of generic formulations following patent expiration has led to increased competition. Major generic manufacturers such as Teva, Mylan, and others have entered the market. Alternatives like atorvastatin, rosuvastatin, and newer agents such as PCSK9 inhibitors threaten Vytorin’s market dominance. Furthermore, non-pharmacological interventions and lifestyle modifications influence prescribing patterns.

Regulatory Environment

The expiration of Vytorin’s patent in the U.S. in 2018[2] facilitated biosimilar and generic entry, exerting downward pressure on prices. Regulatory agencies continue to monitor safety signals and efficacy data, influencing market stability.

Market Drivers and Restraints

Drivers

- Cardiovascular Prevention: The persistent burden of cardiovascular disease drives demand for effective lipid-lowering therapies.

- Combination Therapy Preference: Clinicians often prefer combinations like Vytorin for patient adherence due to simplified regimens.

- Reimbursement Policies: Favorable insurance coverage sustains high utilization rates.

Restraints

- Generic Competition: Entry of generics decreases prices and compresses profit margins.

- Evolving Guidelines: Escalating emphasis on lifestyle and alternative therapies diminishes reliance on medications like Vytorin.

- Price Sensitivity: Increasing shifts toward cost-effective generic options limit brand-name drug margins.

Pricing Analysis

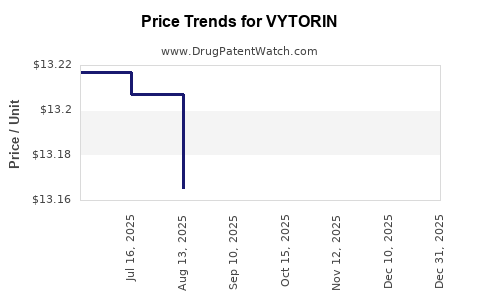

Current Pricing Landscape

In the U.S., the average wholesale price (AWP) for brand-name Vytorin ranges between $300-$350 per month for a typical prescription (30 tablets), whereas generic ezetimibe and simvastatin prescriptions can cost as little as $10-$20 monthly. The contrast underscores the impact of patent expiry and generic proliferation.

Factors Influencing Price Declines

- Patent Expiry: Led to immediate price reductions in the generic market.

- Market Saturation: Increased availability of generics drives down prices further.

- Negotiations: Payer negotiations, formulary placements, and discounts affect net prices.

- Regulatory Developments: Any future patent extensions or legal challenges could impact pricing trajectories.

Price Projection Models

Short-term Outlook (Next 1-2 Years)

Given existing generic competition, the retail price for Vytorin is expected to decline further, with an estimated average reduction of 20-30% from current brand-name pricing, mainly driven by patient and payer preferences for lower-cost generics. The brand’s price is likely to stabilize around $120-$180 per month, reflecting persistent brand recognition but limited incremental value over generics.

Medium-term Outlook (3-5 Years)

Over the next five years, several factors could influence Vytorin’s pricing:

- Patent and Exclusivity Status: Since patents expired in 2018[2], future exclusivity extensions are unlikely unless new formulations or delivery mechanisms are introduced.

- Market Share Trends: A continued shift toward generic ezetimibe and simvastatin, further diminishing the brand’s premium pricing capacity.

Projections suggest that the brand price could decline to approximately $80-$100, while generic versions may sustain prices around $10-$20.

Long-term Outlook (5+ Years)

Finally, considering technological advances and competitive pressures, Vytorin's brand price could stabilize at $50-$70 in scenarios where consumer preference for branded drugs persists due to perceived quality or physician loyalty. Alternatively, the market may favor completely generic options, rendering Vytorin's brand price insignificant relative to generics.

Influence of New Therapies

Emerging lipid-lowering therapies, notably PCSK9 inhibitors (e.g., alirocumab, evolocumab), may impact Vytorin’s market share and pricing, particularly in high-risk populations. Their high cost (~$5,850/month) positions them as adjuncts rather than replacements but exerts upward pressure on overall market pricing.

Strategic Considerations

Pharmaceutical companies aiming to sustain or grow Vytorin’s value should consider:

- Lifecycle Strategy: Innovate with new formulations or delivery methods to extend patent life.

- Market Differentiation: Emphasize clinical benefits and safety profiles over cheaper generics.

- Pricing Flexibility: Adopt tiered pricing models aligned with payer negotiation outcomes.

Healthcare providers and payers should prioritize cost-effective therapies, considering the availability of options that deliver similar or superior efficacy at lower prices.

Key Takeaways

- Patent expiry of Vytorin has significantly depreciated its price, leading to increased generic competition.

- Current estimates project Vytorin's brand price to decline by approximately 20-30% in the short term and stabilize around $50-$70 over the long term.

- Generics dominate the market, available at 10-20% of the brand price, impacting brand profitability.

- Market dynamics are increasingly influenced by alternative lipid-lowering therapies, especially PCSK9 inhibitors.

- Strategic innovation and differentiation are essential for the brand’s future valuation and market relevance.

FAQs

1. How has patent expiration affected Vytorin’s market price?

Patent expiration in 2018 led to an influx of generic ezetimibe and simvastatin products, dramatically reducing Vytorin’s retail price due to increased competition and formulary preferences favoring generic options.

2. What are the primary factors expected to influence Vytorin’s future price?

Key factors include continued generic market penetration, evolving clinical guidelines prioritizing cost-effective therapies, potential formulation innovations, and competition from emerging lipid-lowering agents like PCSK9 inhibitors.

3. Are there any regulatory developments that could impact Vytorin’s pricing?

Future patent extensions or approval of new formulations could temporarily bolster Vytorin’s pricing power. Conversely, legal challenges to patent validity may further depress prices.

4. How do Vytorin’s prices compare with other lipid-lowering medications?

Brand-name Vytorin costs approximately $300-$350 monthly, significantly higher than generic ezetimibe and simvastatin (~$10-$20), and much higher than newer agents such as PCSK9 inhibitors, which can cost over $5,000 monthly.

5. What strategies should stakeholders adopt to optimize returns from Vytorin?

Manufacturers should consider lifecycle management through innovation and differentiation, whereas payers should negotiate favorable formulary terms. Clinicians should base therapy choices on efficacy, safety, and cost-effectiveness.

References

[1] IQVIA. "U.S. Prescription Drug Trends." 2022.

[2] U.S. Food & Drug Administration. "Vytorin (ezetimibe/simvastatin) Patent and Market Exclusivity Data." 2018.