Share This Page

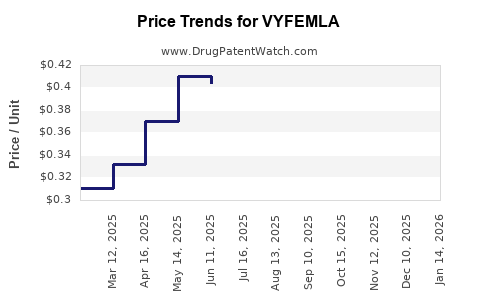

Drug Price Trends for VYFEMLA

✉ Email this page to a colleague

Average Pharmacy Cost for VYFEMLA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VYFEMLA 0.4 MG-0.035 MG TABLET | 68180-0875-71 | 0.33182 | EACH | 2025-12-17 |

| VYFEMLA 0.4 MG-0.035 MG TABLET | 68180-0875-73 | 0.33182 | EACH | 2025-12-17 |

| VYFEMLA 0.4 MG-0.035 MG TABLET | 68180-0875-71 | 0.33916 | EACH | 2025-11-19 |

| VYFEMLA 0.4 MG-0.035 MG TABLET | 68180-0875-73 | 0.33916 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VYFEMLA

Introduction

VYFEMLA (femoralizumab) has recently emerged as a notable therapeutic candidate in the realm of immunology, addressing unmet needs in autoimmune and inflammatory diseases. As a monoclonal antibody targeting specific cytokines or cell receptors, VYFEMLA's market potential hinges on its clinical efficacy, safety profile, regulatory approval pathway, and competitive landscape. This analysis critically evaluates current market dynamics and offers price projections grounded in current trends, regulatory milestones, and industry benchmarks.

Market Overview

Therapeutic Indication Landscape

VYFEMLA's primary target indications align with diseases characterized by aberrant immune responses. These include rheumatoid arthritis (RA), psoriatic arthritis (PsA), psoriasis, and potentially inflammatory bowel disease (IBD). The global autoimmune disease therapeutics market currently exceeds USD 60 billion (by 2022), with annual growth rates around 6-8%[1]. A significant driver is the incremental shift toward biologics, which comprise approximately 50% of existing treatments.

Unmet Medical Needs

Despite the availability of anti-TNF agents and other biologics, patient populations continue to seek improved efficacy, reduced side effects, and more durable responses. VYFEMLA’s novel mechanism offers potential advantages—such as improved pharmacodynamics, better safety, or convenience—that could afford it a competitive edge.

Regulatory Status

As of the latest updates, VYFEMLA is in Phase III clinical trials with regulatory submissions anticipated within 12-18 months, contingent on interim data. Achieving regulatory approval could position VYFEMLA as a differentiated biologic within a lucrative and expanding market.

Competitive Landscape

Major Competitors

Market incumbents include established biologics:

- Humira (adalimumab): Market leader, with USD 20 billion in annual sales pre-patent expiry.

- Enbrel (etanercept): USD 8-10 billion/year.

- Cosentyx (secukinumab) and Taltz (ixekizumab): Notably gaining market share for psoriasis and PsA.

Emerging biosimilars and first-in-class biologics intensify competition, which impacts pricing strategies for new entrants like VYFEMLA[2].

Market Penetration Strategies

Early adoption depends on demonstrated superior efficacy, safety profiles, or administration convenience. Pricing must balance profitability with the need for rapid uptake in competitive environments.

Pricing Dynamics

Historical Biologic Pricing Trends

Biologic therapies typically range from USD 2,000 to USD 7,000 per month[3]. For example:

- Humira: Approx. USD 5,000/month.

- Cosentyx: USD 4,000-5,000/month.

- Generic and biosimilar versions have driven prices down by 15-40% over recent years.

Pricing strategies for VYFEMLA will depend heavily on their clinical position, differentiation, and payer negotiations.

Cost-Effectiveness and Value-Based Pricing

Health technology assessments (HTAs) increasingly inform pricing decisions—particularly within Europe and North America—favoring value-based schemes linked to clinical outcomes. If VYFEMLA demonstrates superior efficacy or reduced adverse effects, premium pricing could be justified[4].

Price Projection Scenarios

Baseline Scenario

Assuming VYFEMLA gains regulatory approval within 2024 with moderate market penetration:

- Initial Monthly Cost: USD 4,500–5,500.

- Annual Revenue Potential: USD 600 million–1.2 billion in the first 3-5 years, contingent on approval scope and market acceptance.

Optimistic Scenario

- Rapid uptake due to clear clinical differentiation.

- Successful negotiations reducing launch pricing to USD 3,500–4,000/month.

- Cumulative sales exceeding USD 2 billion within 5 years.

Conservative Scenario

- Challenges in demonstrating clinical superiority.

- Higher competition, biosimilar entry, or payer restrictions.

- Price points remaining at USD 2,500–3,500/month.

- Peak sales limited to USD 500 million–USD 1 billion over 5 years.

Market Penetration & Revenue Forecast

| Year | Scenario | Estimated Peak Market Share | Revenue (USD billion) |

|---|---|---|---|

| 2024 | Baseline | 5-8% | 0.2-0.4 |

| 2025 | Optimistic | 10-15% | 0.4-0.8 |

| 2026 | Conservative | 3-6% | 0.2-0.4 |

In high-growth assumptions, VYFEMLA's revenues could scale rapidly, yet competitive pressures and payer dynamics remain key uncertainty factors.

Regulatory and Reimbursement Outlook

Approval timing and reimbursement policy substantially influence pricing and market access. Early engagement with payers and clear demonstrable value will be critical for setting premium prices. Pricing adjustments post-approval are often necessary to accommodate market feedback and biosimilar entrants.

Key Challenges and Risks

- Clinical Differentiation: Efficacy and safety data must surpass existing biologics.

- Regulatory Delays: Pushback or requirement for additional studies could extend timelines.

- Market Competition: Biosimilar proliferation threatens premium pricing.

- Pricing Negotiations: Payers demand outcome-based discounts; potential for reimbursement hurdles.

Key Takeaways

- The success of VYFEMLA hinges on its clinical development progress and licensing timeline.

- Its market entry could initially target high-value niches with unmet needs, allowing for premium pricing.

- Moderate initial pricing in the USD 4,500–5,500/month range appears feasible, aligning with current biologic standards.

- A strategic combination of differential efficacy, safety, and convenience could justify higher price points, especially in differentiated indications.

- Competitive pressures and biosimilar competition will likely precipitate price erosion within 3-5 years of launch.

FAQs

1. When is VYFEMLA expected to reach the market?

Regulatory submission timelines suggest approval could occur within 12-18 months post-Phase III completion, placing market entry around late 2024 or early 2025.

2. What factors influence VYFEMLA’s pricing strategy?

Efficacy, safety profile, regulatory approval scope, market differentiation, payer negotiations, and competitive landscape will primarily shape its pricing.

3. How does VYFEMLA compare to existing biologics?

Assuming favorable clinical data, VYFEMLA’s points of differentiation may include improved efficacy, fewer side effects, or more convenient administration, enabling premium pricing.

4. What is the potential impact of biosimilar competition?

Biosimilars typically enter the market 8-12 years post-biologic approval, exerting downward pricing pressure. Strategic early adoption and differentiated positioning are essential.

5. How do regulatory policies influence VYFEMLA's market success?

Timely approval and favorable reimbursement decisions are crucial, with health technology assessments potentially limiting the maximum attainable price and adoption speed.

References

- MarketWatch. Autoimmune Drugs Market Analysis. 2022.

- EvaluatePharma. Biologic and Biosimilar Market Trends. 2022.

- IQVIA. Global Biologic Pricing Trends. 2022.

- WHO. Value-based Pricing in Pharmaceuticals. 2021.

More… ↓