Share This Page

Drug Price Trends for VRAYLAR

✉ Email this page to a colleague

Average Pharmacy Cost for VRAYLAR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VRAYLAR 3 MG CAPSULE | 61874-0130-30 | 48.52951 | EACH | 2025-12-17 |

| VRAYLAR 1.5 MG CAPSULE | 61874-0115-11 | 48.53804 | EACH | 2025-12-17 |

| VRAYLAR 1.5 MG CAPSULE | 61874-0115-30 | 48.53804 | EACH | 2025-12-17 |

| VRAYLAR 1.5 MG CAPSULE | 61874-0115-20 | 48.53804 | EACH | 2025-12-17 |

| VRAYLAR 6 MG CAPSULE | 61874-0160-30 | 48.48992 | EACH | 2025-12-17 |

| VRAYLAR 3 MG CAPSULE | 61874-0130-20 | 48.52951 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VRAYLAR

Introduction

VRAYLAR (cariprazine) is an atypical antipsychotic primarily indicated for the treatment of schizophrenia and bipolar disorder. Developed by Allergan, now a part of AbbVie, VRAYLAR has established itself as a significant player in the psychiatric drug market. Given the increasing prevalence of schizophrenia and bipolar disorder globally, along with expanding indications and formulary inclusions, understanding the current market landscape and future pricing trajectories for VRAYLAR is crucial for pharmaceutical stakeholders, investors, and healthcare providers.

This comprehensive analysis covers market dynamics, competitive positioning, reimbursement landscape, pricing trends, and future projections driven by epidemiological, regulatory, and economic factors.

Market Overview

Current Market Size and Share

The global antipsychotic drug market was valued at approximately USD 14.2 billion in 2021 and is projected to reach USD 21.4 billion by 2028, growing at a CAGR of roughly 6.1% (source: Fortune Business Insights[1]). VRAYLAR holds a noteworthy segment within this space, favored for its favorable side effect profile, partial agonist activity at dopamine D2 and serotonin 5-HT1A receptors, and extended dosing options.

In the United States, VRAYLAR's preferred positioning stems from its efficacy in schizophrenia and bipolar I disorder, alongside a growing base of prescribers. Market share estimates suggest VRAYLAR captures approximately 10-12% of the antipsychotic market, competing against key agents like Abilify (aripiprazole), Zyprexa (olanzapine), and Seroquel (quetiapine).

Epidemiology and Demand Drivers

An estimated 20 million individuals worldwide suffer from schizophrenia, and bipolar disorder affects over 45 million globally[2]. The rising recognition of mental health issues, coupled with expanding diagnostic criteria and healthcare initiatives, drives demand for effective, tolerable antipsychotics like VRAYLAR.

Furthermore, increased adoption in secondary indications, such as adjunctive therapy for depression and irritability in autism spectrum disorder, could bolster demand, although regulatory approvals are ongoing or emerging.

Competitive Landscape

VRAYLAR’s primary competitors include aripiprazole-based formulations, olanzapine, risperidone, and newer agents like lumateperone. The latter, developed by Neurocrine Biosciences, is gaining traction due to its favorable side effect profile.

Market penetration hinges on factors like efficacy, side effect management, dosing convenience, and formulary access. Key differentiators for VRAYLAR include its lower metabolic side effect profile and once-daily dosing.

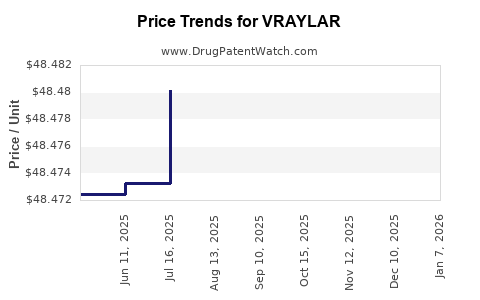

Pricing Trends and Reimbursement Environment

Current Price Point

As of Q1 2023, the average wholesale price (AWP) for a 30-day supply of VRAYLAR ranges from USD 1,200 to USD 1,500, depending on dosage and formulation[3]. This pricing makes VRAYLAR one of the premium atypical antipsychotics.

In private insurance, the net price to payers, considering rebates and negotiations, is often 30-50% lower than the AWP. Medicaid and Medicare Part D coverage are essential channels, with reimbursement rates influenced by formulary decisions and negotiated discounts.

Reimbursement Challenges

Reimbursement remains a key consideration. Efforts by healthcare systems to curtail costs lead to tier placements and formulary restrictions, which could impact future pricing power. The drug’s patent expiry scheduled beyond 2028 limits immediate generic competition; however, patent challenges and biosimilar options pose long-term risks.

Market Access Strategies

AbbVie’s focus on tier-placement strategies, patient assistance programs, and expanding indications help sustain price levels. Additionally, pricing is influenced by competitive launches, evolving clinical evidence, and the accessory value provided by VRAYLAR’s dosing flexibility.

Future Price Projections

Factors Influencing Price Trends

-

Patent Exclusivity and Competition:

VRAYLAR’s patent protection extends until at least 2028, supporting maintained premium pricing. Afterward, biosimilar and generic competitors could exert substantial downward pressure, potentially reducing prices by 40-60% over five years. -

Line Extensions and New Indications:

As AbbVie advances new formulations (e.g., injectable long-acting depots) and seeks approvals for additional indications (e.g., irritability in autism, major depressive disorder), the premium pricing environment could persist longer. -

Market Penetration and Volume Growth:

Increasing adoption, particularly among treatment-resistant populations, supports stable or slightly increasing prices within the current period. -

Regulatory and Reimbursement Landscape:

Innovations that demonstrate cost-effectiveness or improved patient adherence can justify higher prices. Conversely, payer pressures and policy reforms aimed at cost containment can suppress future pricing.

Projected Price Trajectory (2023–2030)

| Year | Expected Average Wholesale Price (USD) per 30-day supply | Keynotes |

|---|---|---|

| 2023 | 1,200 – 1,500 | Maintains premium pricing; growing market share |

| 2025 | 1,100 – 1,350 | Slight reduction due to increased competition |

| 2028 | 900 – 1,200 | Post-patent expiry; biosimilar entries commence |

| 2030 | 700 – 1,000 | Further erosion; targeted value-based pricing |

(These are approximations based on current trends, patent landscapes, and market dynamics.)

Strategic Implications for Stakeholders

-

Pharmaceutical Companies:

The upcoming patent expiration necessitates preparation for biosimilar competition, emphasizing the importance of differentiating features, expanded indications, and value-based pricing agreements. -

Healthcare Providers:

Consideration of total cost-of-care implications, including drug efficacy and side effect profiles, can inform formulary and prescribing choices that balance price and therapeutic benefit. -

Payers and Policy Makers:

Emphasis on value-based arrangements and encouraging biosimilar adoption can facilitate cost savings while ensuring access to effective treatments.

Key Takeaways

-

VRAYLAR currently commands premium pricing driven by its clinical profile and growing market share in schizophrenia and bipolar disorder.

-

The global antipsychotic market is expanding, with VRAYLAR set to benefit from increasing diagnoses and expanding indications.

-

Patent protection until post-2028 supports sustained high prices; however, imminent biosimilar competition will exert downward pressure thereafter.

-

Reimbursement and formulary negotiations heavily influence net prices; strategic access initiatives are essential for market sustainability.

-

Price erosion is projected post-2028, with discounts up to 50% possible as biosimilar and generic competitors enter the market.

FAQs

1. When is VRAYLAR expected to face generic competition?

Patent expiry is anticipated beyond 2028, with some markets potentially seeing biosimilar or generic entries starting from 2028-2030, depending on regulatory approvals and patent litigations[4].

2. How does VRAYLAR compare pricing-wise with competitors?

VRAYLAR’s current prices are higher than many competitors like olanzapine or risperidone but are comparable or slightly more expensive than aripiprazole formulations. The premium is justified by its distinct clinical profile and dosing convenience.

3. What new indications could influence VRAYLAR’s market value?

Potential approval for adjunctive treatment in major depressive disorder or irritability in autism could broaden its utilization, supporting sustained pricing and market share.

4. How significant is the reimbursement landscape in VRAYLAR’s pricing strategy?

Reimbursement significantly impacts net sales; favorable formulary placements enable higher pricing, while restrictions or tier limitations diminish margins.

5. What strategies can extend VRAYLAR’s market exclusivity?

Developing long-acting injectable formulations, expanding indications, and securing favorable reimbursement terms are critical in maintaining market dominance before biosimilars enter.

References

[1] Fortune Business Insights. “Antipsychotic Drugs Market Size, Share & Industry Analysis, 2021-2028.”

[2] World Health Organization. “Mental Disorders Fact Sheet,” 2022.

[3] GoodRx. “VRAYLAR Pricing and Cost,” 2023.

[4] FDA, Patent and Exclusivity Data, 2023.

More… ↓