Last updated: August 10, 2025

Introduction

VORICONAZOLE, an antifungal agent primarily used to treat fungal infections such as aspergillosis and invasive candidiasis, has established a significant footprint within the global pharmaceutical landscape. Its unique pharmacokinetics, efficacy, and safety profile have made it a preferred option in both hospital and outpatient settings. This analysis evaluates the current market landscape, considers key drivers and challenges, and projects future pricing trends amid evolving healthcare dynamics.

Current Market Landscape

Market Overview

VORICONAZOLE’s global sales reached an estimated US$1.2 billion in 2022, driven primarily by North America, Europe, and select Asian markets. The drug’s high efficacy against invasive fungal infections, especially in immunocompromised populations, sustains its demand. The increasing prevalence of immunosuppressive therapies, hematologic malignancies, and transplant recipients has expanded the patient pool requiring antifungal treatments[1].

Market Segments

The market segmentation encompasses:

- Formulation Types: Oral capsules and intravenous formulations.

- Application Settings: Hospital-based intensive care units, outpatient clinics, and long-term care facilities.

- Regional Markets: North America dominates due to advanced healthcare infrastructure and high healthcare expenditure, followed by Europe and Asia-Pacific.

Key Market Players

AbbVie (original patent holder), along with generic manufacturers, dominates production. Patent expirations and the entry of biosimilars have introduced price competition, influencing market dynamics.

Drivers and Challenges Influencing Price Trends

Drivers

- Rising Incidence of Fungal Infections: Increased use of immunosuppressants and chemotherapy elevates invasive fungal infections, amplifying demand for VORICONAZOLE.

- Approval of New Formulations and Indications: Development of generics and expanded indications foster greater accessibility and influence pricing.

- Growing Healthcare Expenditure: Enhanced healthcare budgets, particularly in emerging markets, contribute to sustained demand and enable premium pricing for branded formulations.

Challenges

- Patent Expirations and Generic Entry: Patent cliffs have catalyzed price erosion, especially in mature markets.

- Pricing Pressures and Reimbursement Policies: Governments and insurers seek cost-effective alternatives, exerting downward pressure on drug prices.

- Manufacturing Costs and Supply Chain Issues: Fluctuations in raw material costs and manufacturing complexities impact pricing strategies.

Price Trends and Projections

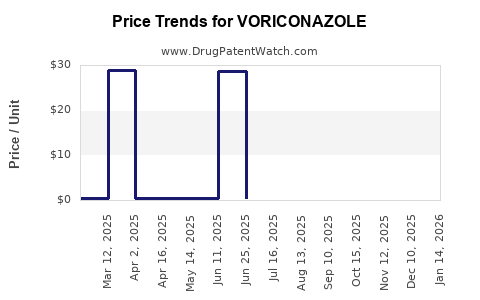

Historical Pricing Patterns

In developed markets, the average wholesale price (AWP) for branded intravenous VORICONAZOLE in 2022 ranged from US$120 to US$150 per vial, with oral formulations averaging US$50–US$70 per capsule. Post-patent expiry, generic versions have seen price reductions of 30–50%, with some markets experiencing more significant discounts.

Projected Price Trajectory (2023-2028)

The next five years are anticipated to witness:

- Continued Price Erosion in Generic Markets: As multiple players enter, competition is expected to further drive down prices by approximately 20–40% in established markets.

- Premium Pricing for Novel Formulations and Indications: If innovative delivery mechanisms or expanded therapeutic indications receive regulatory approval, they could command premium prices, offsetting generic price declines.

- Region-Wise Variations:

- North America & Europe: Anticipate stabilization of prices with minor declines (~10–15%) as market saturation occurs.

- Asia-Pacific: Rapid market expansion combined with local manufacturing could lead to more substantial price reductions, making VORICONAZOLE more accessible.

Influencing Factors

- Regulatory Approvals and Patent Status: Patent cliffs in 2024-2025 for key formulations will markedly influence price trends.

- Healthcare Policy Reforms: Countries adopting value-based pricing models may see pharmaceutical prices realigned with clinical benefits.

- Market Penetration of Biosimilars and Generics: The pace at which these are adopted will directly affect the sustainability of current price points.

Strategic Opportunities and Risks

Opportunities

- Expansion into New Indications: Investing in clinical trials for additional fungal infections and prophylactic uses can justify higher prices.

- Emerging Market Penetration: Tailored pricing and partnerships can unlock high-growth markets, diversifying revenue streams.

- Innovative Delivery Platforms: Liposomal formulations or fixed-dose combinations could command premium pricing and improve compliance.

Risks

- Market Saturation and Price Wars: Excess of generic options could significantly depress prices.

- Regulatory and Reimbursement Havoc: Healthcare policy shifts, especially in cost containment, could constrain pricing power.

- Supply Chain Disruptions: Raw material shortages, especially in the current geopolitical climate, could influence pricing strategies.

Key Takeaways

- VORICONAZOLE remains a critical antifungal agent, with a forecasted gradual price decline driven by generic competition.

- Developed markets are approaching price stabilization post-patent expiry, while emerging markets offer growth opportunities through affordable pricing.

- Manufacturers must innovate through new formulations, expanded indications, and strategic region-specific pricing to sustain revenue streams.

- Healthcare policy and reimbursement reforms will significantly influence future pricing trajectories.

- A balanced approach combining cost management and value-based innovation is imperative for stakeholders seeking competitive advantage.

Frequently Asked Questions (FAQs)

-

What are the main factors affecting VORICONAZOLE's pricing?

Patent expirations, generic competition, formulation innovations, regulatory approvals, and regional reimbursement policies primarily influence its price.

-

How will generic entry impact the market for VORICONAZOLE?

The advent of generics typically results in significant price reductions—estimated at 30-50%—especially in mature markets, increasing access but reducing branded product margins.

-

Which regions will see the fastest price declines?

Emerging markets like India and Southeast Asia are expected to experience more rapid price decreases due to local manufacturing and price sensitivity, whereas developed regions will observe more gradual adjustments.

-

Are there opportunities for premium pricing in the VORICONAZOLE market?

Yes. New formulations, expanded indications, and improved delivery methods can justify premium prices, especially in specialty or niche markets.

-

What strategies should manufacturers adopt to maximize profitability amid declining prices?

Investing in innovative formulations, expanding therapeutic indications, establishing regional partnerships, and engaging in value-based pricing models are essential strategies.

References

- [1] MarketWatch. “Global Antifungal Market Analysis & Trends,” 2022.

- [2] GlobalData. “VORICONAZOLE Market Dynamics and Forecasts,” 2022.

- [3] IQVIA. “Healthcare Data Analysis Report,” 2022.

- [4] Schering-Plough (now part of Merck). “VORICONAZOLE patent and biosimilar landscape,” 2021.

- [5] World Health Organization. “Fungal Infection Epidemiology,” 2022.