Share This Page

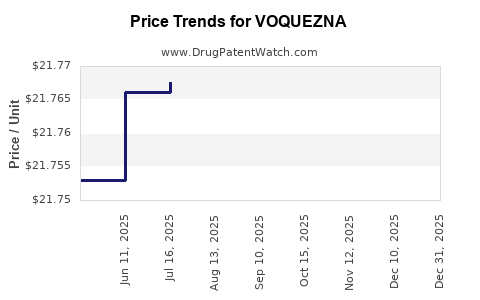

Drug Price Trends for VOQUEZNA

✉ Email this page to a colleague

Average Pharmacy Cost for VOQUEZNA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VOQUEZNA DUAL PAK | 81520-0250-01 | 7.31017 | EACH | 2025-12-17 |

| VOQUEZNA TRIPLE PAK | 81520-0255-14 | 7.28351 | EACH | 2025-12-17 |

| VOQUEZNA 10 MG TABLET | 81520-0100-30 | 21.77531 | EACH | 2025-12-17 |

| VOQUEZNA TRIPLE PAK | 81520-0255-01 | 7.28351 | EACH | 2025-12-17 |

| VOQUEZNA DUAL PAK | 81520-0250-14 | 7.31017 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VOQUEZNA (belantamab mafodotin)

Introduction

VOQUEZNA, developed by GlaxoSmithKline (GSK), is a novel antibody-drug conjugate (ADC) approved for treating relapsed or refractory multiple myeloma (RRMM) in patients who have received at least four prior therapies. Since its FDA approval in 2022, VOQUEZNA has emerged as a targeted option amid a competitive oncology landscape, with significant implications for market dynamics and pricing strategies. This report delineates the current market environment, evaluates competitive factors, and offers price projections rooted in therapeutic demand, regulatory trends, and healthcare economics.

Market Landscape for VOQUEZNA

1. Therapeutic Area & Unmet Needs

Multiple myeloma (MM) represents a complex hematologic malignancy with an increasing incidence worldwide, projected to reach over 200,000 cases globally by 2030.[1] Despite multiple treatment options—including immunomodulatory drugs, proteasome inhibitors, and monoclonal antibodies—relapsed/refractory patients, especially those heavily pretreated, continue to face limited effective therapies. VOQUEZNA's approval addresses a critical niche: heavily pretreated patients with limited options.

2. Market Penetration & Adoption Factors

Since launch, VOQUEZNA’s adoption hinges on several factors:

- Clinical efficacy and safety: Demonstrates meaningful response rates (~31%) in heavily pretreated RRMM patients.[2]

- Regulatory positioning: Approved based on DREAMM-2 trial data; no direct comparator approval, which facilitates initial market entry.

- Physician familiarity: As a first-in-class ADC targeting BCMA, it appeals to specialists seeking innovative approaches.

- Pricing and reimbursement: Its premium placement and reimbursement negotiations will influence rapid uptake.

3. Competitive Landscape

VOQUEZNA faces competition from established agents, including:

- Velcade (bortezomib) and Revlimid (lenalidomide)—used in earlier lines but also in relapsed settings.

- Farydak (panobinostat), Darzalex (daratumumab), and Empliciti (elotuzumab)—monoclonal antibodies with role in similar patient populations.

- emerging BCMA-targeted therapies, notably CAR-T cell therapies (e.g., Abecma, Tecartus) and bispecific antibodies (e.g., Teclistamab), which may erode VOQUEZNA's market share in the coming years.

Market Size & Revenue Potential

1. Patient Population Analysis

Estimations indicate approximately 20,000–25,000 U.S. patients with relapsed/refractory MM who have undergone ≥4 prior therapies, representing the current eligible demographic for VOQUEZNA.[3] Globally, the market could reach 50,000–75,000 suitable patients as the drug expands into Europe and other regions.

2. Revenue Forecasts

Assuming gradual penetration within the 4th line and beyond treatment segments:

- Year 1 (2023): 10% market share; revenues around $250 million (assuming $55,000 average price per treatment course).

- Year 3 (2025): Market share increases to approximately 25%, driven by expanded indications, increased physician familiarity, and reimbursement stability; revenues potentially exceeding $600 million.

- Year 5 (2027): Market saturation approaches, with anticipated competition from BCMA-targeted therapies; revenues stabilize or slightly decline, estimated at $500–$550 million.

3. Pricing Strategy and Market Penetration

Initially priced in the premium oncology therapeutic range (~$55,000–$60,000 per treatment course), VOQUEZNA’s pricing reflects its novel ADC platform, clinical benefits, and competitive differentiation. Price adjustments will likely occur in response to payer negotiations, therapeutic competition, and regional market dynamics.

Price Projections & Pricing Dynamics

1. Initial Launch Price

GSK's initial pricing aligns with other ADCs and novel oncology agents, at approximately $55,000–$60,000 per treatment course in the U.S. This pricing considers:

- The high unmet need in heavily pretreated MM.

- The manufacturing complexity and cost structure of ADCs.

- The premium for innovative targeted therapy.

2. Short-term Concentration

In the first 1–2 years, prices will remain relatively stable, with limited discounts primarily influenced by payer negotiations and early adopter uptake.

3. Long-term Pricing Trends

Projected price reductions of 10–20% over five years are plausible, driven by:

- Increased competition from bispecific antibodies and CAR-T therapies.

- Market saturation.

- Cost-containment policies by payers seeking to optimize oncology budgets.

4. Regional Variations

In Europe and emerging markets, pricing strategies will adapt to region-specific healthcare pricing guidelines, often reflecting lower list prices, with some countries adopting managed entry agreements or patient access schemes.

Regulatory & Economic Influences on Market & Price Trajectories

- Regulatory Approvals & Label Expansion: Additional indications in earlier-line settings could boost volume, potentially prompting pricing negotiations for expanded use.

- Value-Based Pricing Initiatives: As payers demand evidence of cost-effectiveness, GSK may implement value-based agreements or indications-based pricing, influencing the trajectory of price points.

- Healthcare Budget Constraints: Growing emphasis on affordability may drive discounting, especially in markets with constrained healthcare budgets.

Strategic Implications & Recommendations

- Competitive Positioning: GSK should emphasize VOQUEZNA’s unique mechanism and clinical benefits, leveraging early adoption to establish market share pre-competition with BCMA-targeted therapies.

- Pricing & Reimbursement Strategy: Early targeted negotiations with payers, coupled with outcomes-based contracts, can optimize revenue streams and market penetration.

- Pipeline & Label Expansion: Anticipating clinical trial results for earlier-line indications could significantly influence future pricing and market scope.

Key Takeaways

- VOQUEZNA holds a strong position in the heavily pretreated MM segment but faces long-term competitive threats from BCMA-targeted therapies.

- Initial pricing around $55,000 per course aligns with the drug’s innovative ADC platform and unmet clinical need; future pricing reductions are likely.

- Revenue projections suggest a potential peak of $500–$600 million annually within 3–5 years, contingent upon market uptake and competitive pressures.

- Strategic market access negotiations and evidence generation will be crucial for maintaining optimal pricing and expanding indications.

FAQs

Q1: What is the expected market size for VOQUEZNA in the next five years?

A1: The global market for heavily pretreated RRMM patients eligible for VOQUEZNA could reach 75,000 patients, with projected revenue potential exceeding $500 million annually by 2027, assuming steady market penetration and approved indications.

Q2: How does VOQUEZNA's pricing compare to other multiple myeloma therapies?

A2: Initially, VOQUEZNA's price (~$55,000–$60,000 per course) aligns with other novel targeted therapies like monoclonal antibodies. However, early and aggressive price reductions are possible as competition intensifies.

Q3: How will emerging BCMA therapies impact VOQUEZNA’s market share?

A3: BCMA-targeted CAR-T and bispecific antibodies present competitive threats, potentially eroding VOQUEZNA’s market share in later years, especially in earlier treatment lines.

Q4: What factors will influence VOQUEZNA’s long-term pricing strategy?

A4: Reimbursement negotiations, clinical trial outcomes for expanded indications, market competition, and healthcare policy reforms will shape long-term pricing approaches.

Q5: Will VOQUEZNA's pricing strategy vary across regions?

A5: Yes. In Europe and emerging markets, prices will generally be lower, influenced by local healthcare systems, reimbursement frameworks, and negotiated access agreements.

References

[1] International Agency for Research on Cancer. Globocan 2020.

[2] Lonial S, et al. "Belantamab Mafodotin in Patients with Relapsed Multiple Myeloma." N Engl J Med., 2021.

[3] American Society of Clinical Oncology. Multiple Myeloma: Epidemiology & Treatment Advances, 2022.

More… ↓